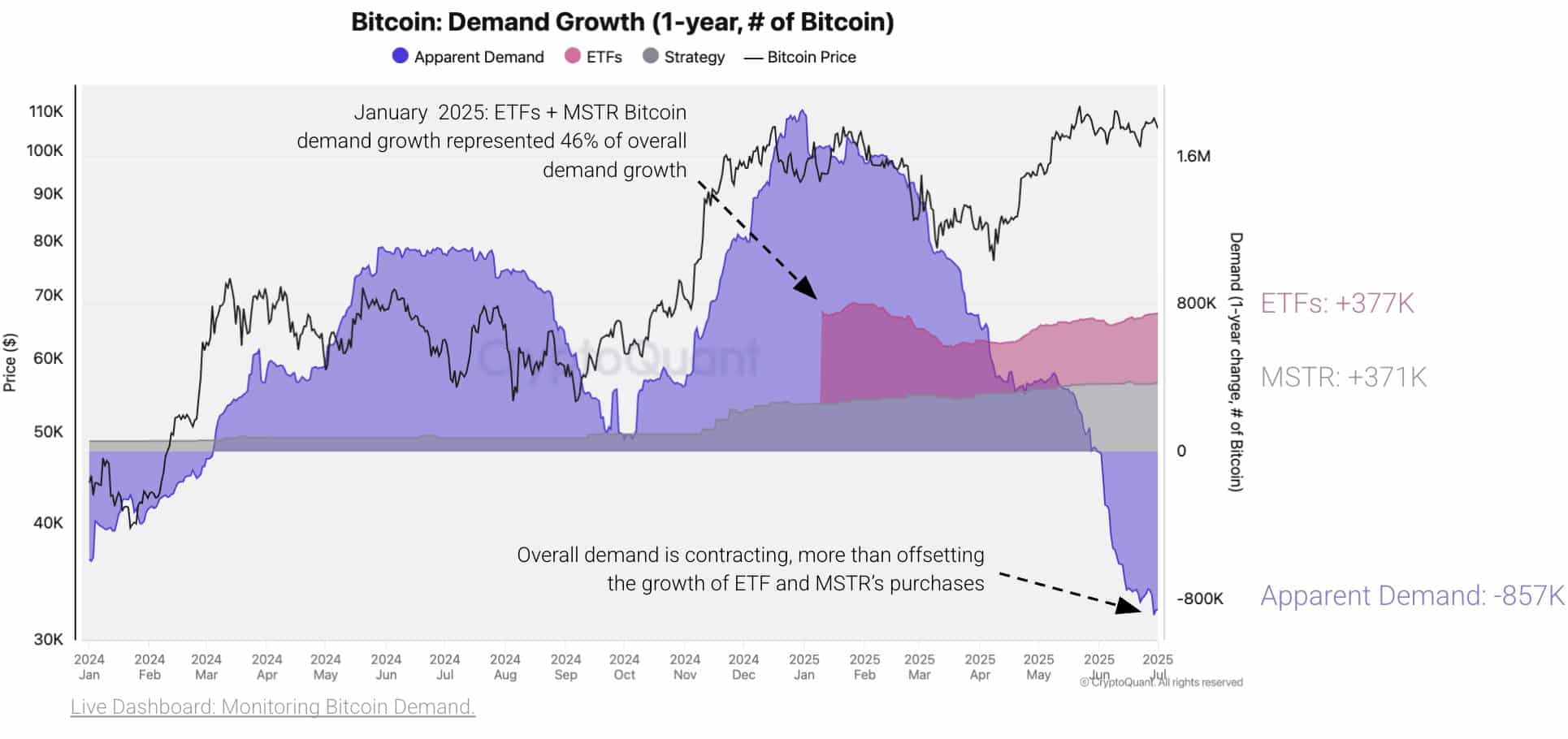

- Internet demand dropped 857K BTC regardless of institutional shopping for, weakening Bitcoin’s progress basis.

- Whale outflows, rising CDD, and falling transactions sign fading market conviction.

Bitcoin [BTC]’s web demand has dropped by 857K BTC regardless of ETFs and MicroStrategy accumulating 748K BTC mixed—highlighting weakening natural curiosity from broader market individuals.

At press time, Bitcoin traded at $109,011, but this rally seems hole because it lacks the transaction quantity and retail engagement seen throughout previous bull runs.

The failure of institutional accumulation to offset falling demand creates fragility beneath the floor, elevating considerations concerning the sustainability of additional upside.

Are whales shedding religion as netflows plunge into the crimson?

Giant holders have sharply decreased their publicity, with netflows displaying a 7-day drop of over 1300%. This mass withdrawal displays vital bearish sentiment amongst whales, which undermines the bullish narrative.

Notably, even temporary value spikes did not reverse the outflow development, implying structural hesitation throughout this investor class.

Subsequently, regardless of a comparatively regular value ground close to $96K–$97K, the sustained damaging flows from giant addresses level to deeper doubts about BTC’s short-term upside potential.

Why are long-term holders beginning to transfer their cash?

On the time of writing, Coin Days Destroyed (CDD) elevated by 7.06%, indicating that older BTC had been moved extra ceaselessly.

CDD tracks the lifespan of cash being spent and helps gauge long-term holder sentiment. Rising CDD usually alerts that seasoned holders are getting ready to exit positions, which introduces overhead provide stress.

Since long-term holders usually promote throughout unsure or overheated circumstances, this shift could replicate rising warning. If sustained, it might put additional pressure on any try and reclaim all-time highs.

Will falling transactions cripple BTC’s momentum?

BTC on-chain transaction exercise has plummeted, falling to simply 97.1K, its lowest studying in months. This alerts fading retail and community engagement.

Whereas institutional involvement has elevated, the broader community reveals indicators of stagnation. A decline in energetic utilization reduces natural demand and hinders elementary power.

Therefore, with out renewed transaction quantity and participation, Bitcoin’s bullish case weakens structurally, even when costs quickly stay supported by giant patrons.

Can constructive funding charges maintain up in a weak demand local weather?

Notably, Funding Charges remained marginally constructive at +0.008%, indicating mildly bullish positioning amongst derivatives merchants.

Nonetheless, the shallow worth suggests an absence of conviction, with little proof of aggressive lengthy publicity. This subdued funding sample aligns with low web demand and fading engagement.

Consequently, the by-product market will not be offering significant momentum, reflecting uncertainty throughout each retail and leveraged individuals within the present cycle.

Are leveraged merchants in danger across the $110K zone?

Binance’s liquidation heatmap reveals densely packed liquidation clusters simply above $110K. These zones point out the place many merchants have open lengthy positions with excessive leverage.

If value exams these areas, a liquidation cascade might happen, including volatility as a substitute of sustained breakout power. Subsequently, this cluster creates each psychological and technical resistance.

Breaking by means of this stage with out stronger demand and quantity might end in exaggerated draw back threat for overleveraged positions.

Can BTC rally with out actual demand behind it?

Regardless of regular institutional inflows, BTC faces mounting stress from falling transaction counts, declining large-holder help, and weak by-product conviction.

Lengthy-term holders are starting to reposition, and liquidation threat stays excessive round key value zones. Except these demand-side metrics reverse meaningfully, BTC’s probabilities of breaking all-time highs stay slim within the close to time period.