- Bitcoin briefly dropped under $100K earlier than rebounding to $101,496, marking volatility post-FOMC announcement.

- Coinbase sees $1.1 billion Bitcoin outflow, signaling sturdy institutional demand and ETF-driven accumulation.

Bitcoin [BTC] has skilled vital main worth fluctuations previously day, primarily influenced by the Federal Open Market Committee (FOMC) assembly outcomes and Federal Reserve Chair Jerome Powell’s speech.

The asset noticed a steep decline, falling to as little as $98,000—a drop of over 5% in only a day. Nonetheless, the cryptocurrency seems to have shortly rebounded, reclaiming the $100,000 mark and briefly reaching a excessive of $105,000 earlier at present.

On the time of writing, Bitcoin was buying and selling at $101,496, reflecting a 2.6% lower over the previous day and a 6.1% drop from its all-time excessive (ATH).

This dramatic worth motion highlights Bitcoin’s continued volatility, however it additionally highlights the resilience of investor sentiment. Analysts appear to have been intently monitoring these fluctuations, with consideration turning to institutional exercise and its influence on market tendencies.

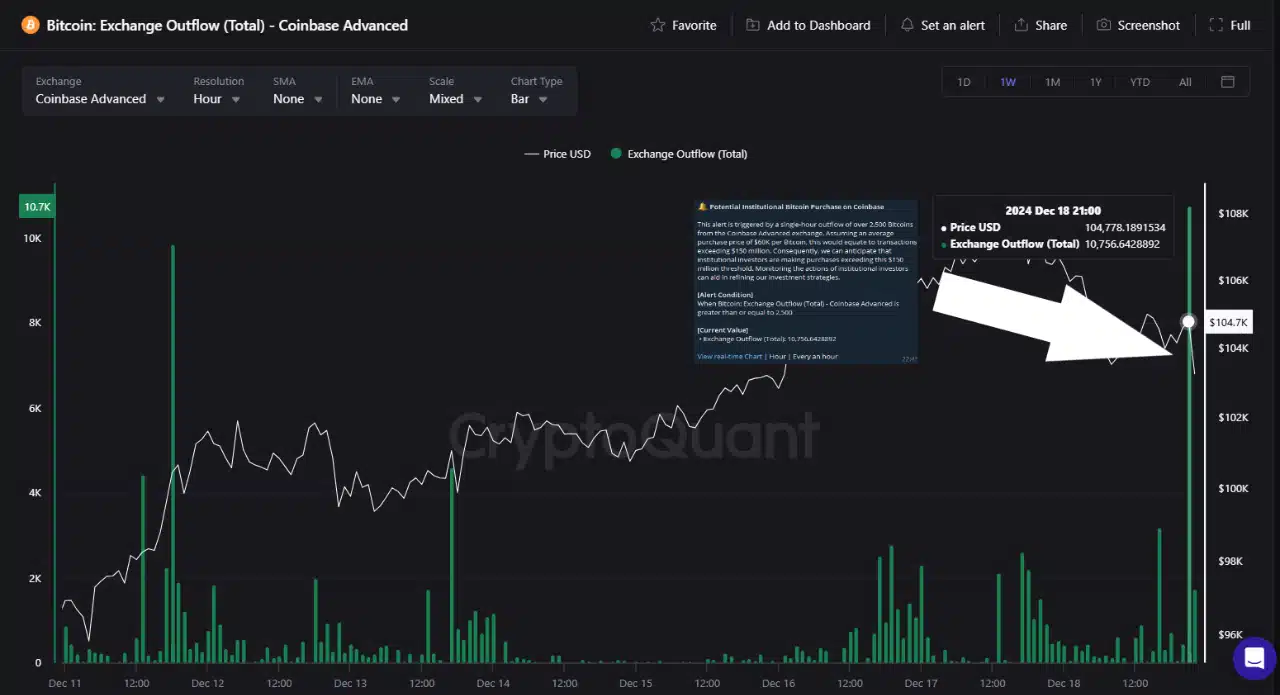

A brand new report from CryptoQuant analyst Burak Kesmeci sheds mild on a big growth in Bitcoin’s market dynamics.

Large Coinbase outflow indicators institutional curiosity

In response to Kesmeci, a record-breaking Bitcoin outflow was noticed on Coinbase in the course of the FOMC announcement. Inside only one hour, roughly 10,756 BTC, valued at $1.1 billion, had been withdrawn from the change.

The transaction occurred in two main blocks: one involving 8,093 BTC and the opposite 2,557 BTC. This substantial outflow strongly suggests institutional buying or middleman purchases possible linked to Spot ETF demand—a sample that aligns with related institutional exercise over the previous yr.

Kesmeci emphasised the rising position of institutional buyers in Bitcoin’s market construction.

He famous,

“U.S. buyers proceed to build up Bitcoin relentlessly, undeterred by worth fluctuations or market downturns.”

The analyst talked about that these vital transactions underscore the affect of establishments like RIOT and MARA in driving market momentum, notably throughout crucial occasions like rate of interest bulletins.

Bitcoin metrics sign combined short-term outlook

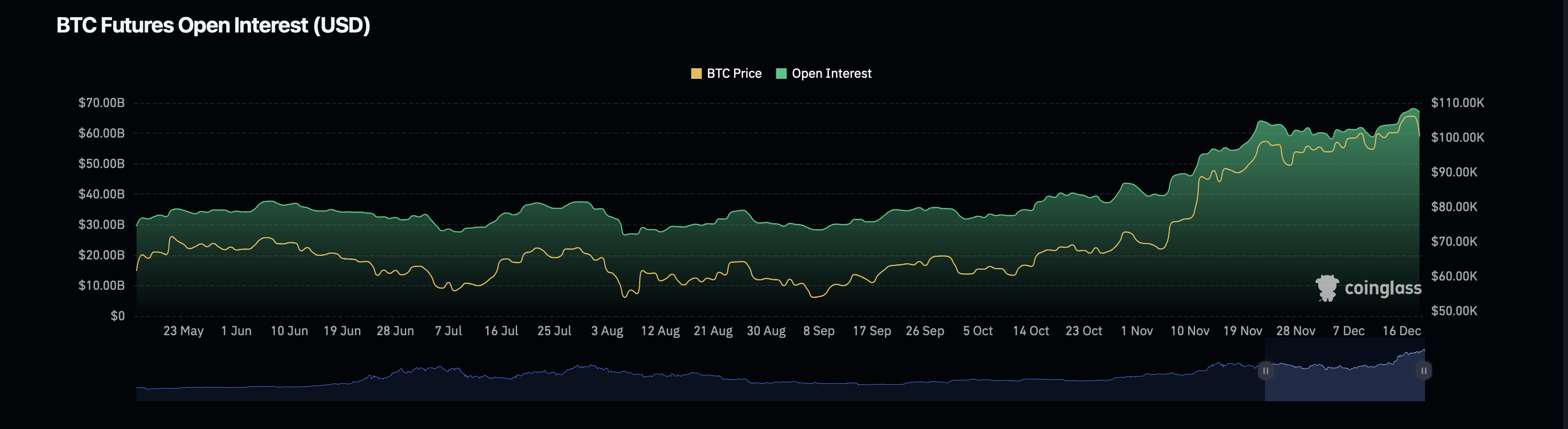

Whereas institutional exercise factors to long-term bullish sentiment, different key metrics reveal a combined outlook for Bitcoin’s fast future.

Data from Coinglass reveals a 0.90% lower in Bitcoin’s open curiosity, now valued at $68.14 billion. Conversely, Bitcoin’s open curiosity quantity has surged by 36%, reaching $148.57 billion—an indication of heightened buying and selling exercise.

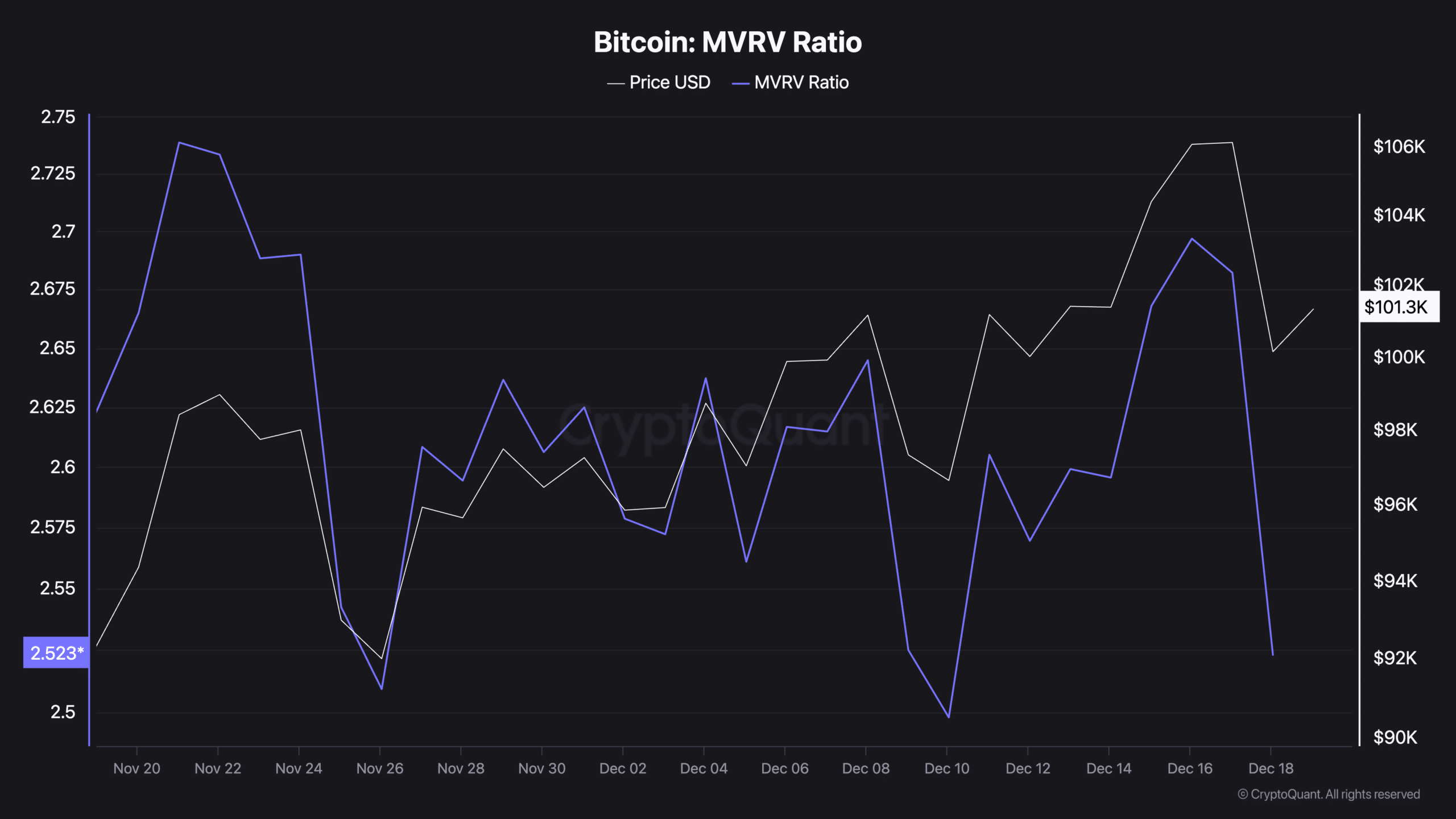

One other vital metric, the MVRV (Market Worth to Realized Worth) ratio, has additionally seen notable modifications. The MVRV ratio measures whether or not Bitcoin is overvalued or undervalued primarily based on its present market worth relative to its realized worth.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

A ratio above 1 usually signifies profitability for holders, whereas increased values recommend potential overvaluation. Bitcoin’s MVRV ratio lately climbed to 2.69 however has since fallen to 2.52 following the value drop.

This decline suggests a cooling market sentiment, with merchants doubtlessly reassessing their positions within the quick time period.