- Bitcoin is now battling an impediment round $95k amid the hike in retail sell-offs

- Key worth and validation fashions projected BTC may hit $150k-$200k in 2025

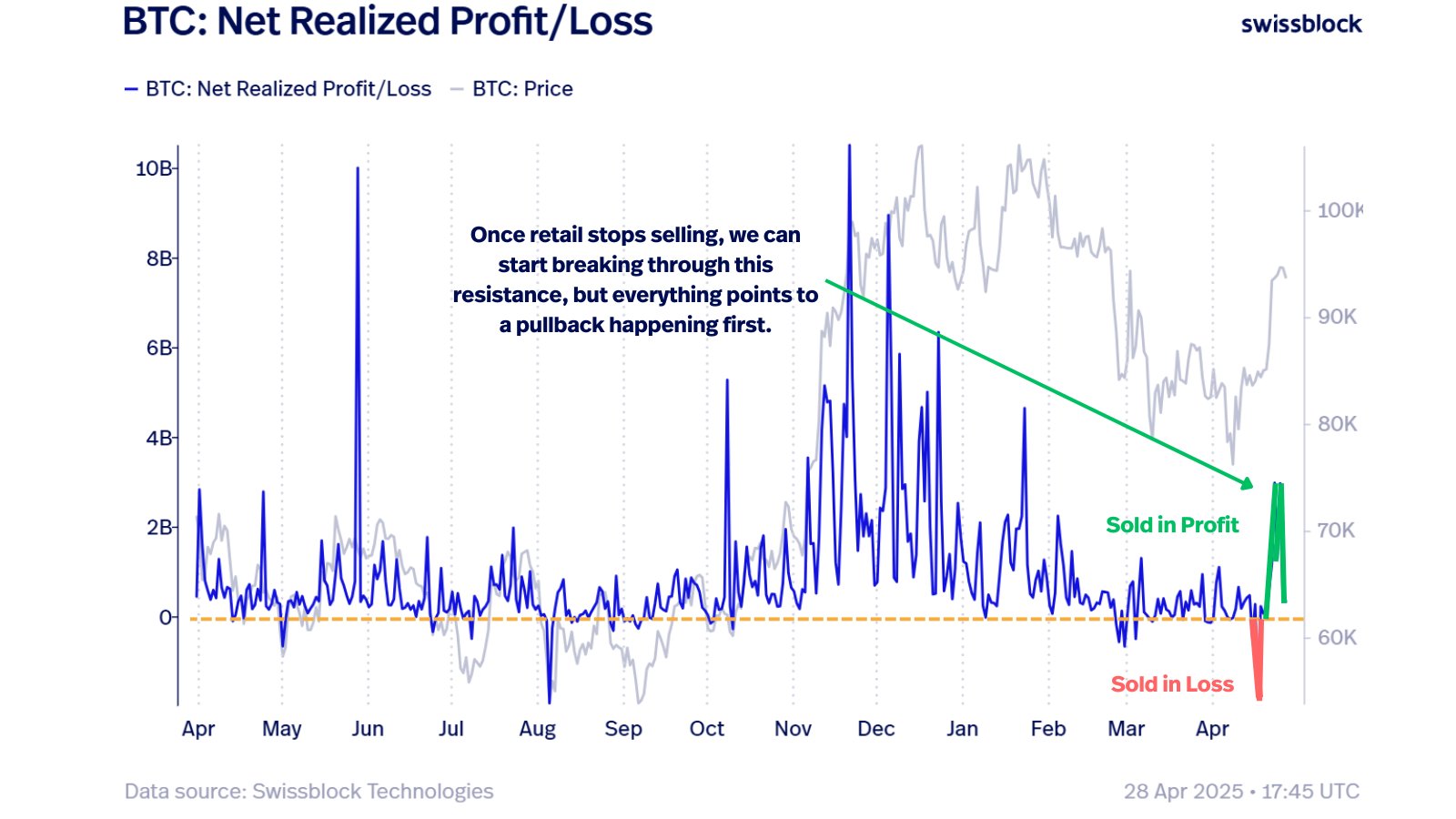

Bitcoin [BTC] has prolonged its worth consolidation round $95k for almost every week to date. In actual fact, in line with Swissblock analysts, the $95k roadblock is a break-even degree for many retail, they usually may simply be cashing out too.

“The $94K–$95K wall holds $BTC again. A pullback looms, however as soon as retail stops, we’ll break by”

Quite the opposite, most analysts like Mathew Hyland believe that Bitcoin’s bulls have extra market leverage. He cited the weekly candlestick shut on the day by day worth chart, which was above the earlier range-low of $92k.

Now, assuming they’re proper, how far can BTC climb in 2025?

Charting BTC’s subsequent peak

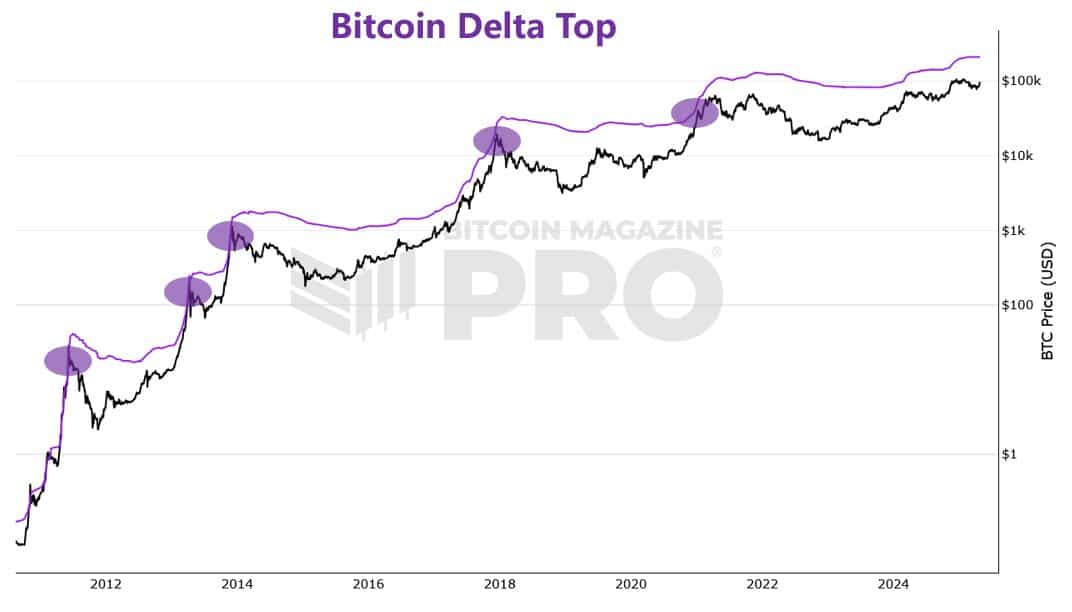

In line with a pseudonymous analyst Onchain Faculty, BTC’s rally may extend to above $200k per Bitcoin Delta Cap. This metric makes use of historic, on-chain, and technical knowledge to undertaking seemingly market tops on the charts.

It has marked previous cycle tops with honest accuracy. If historical past repeats itself, the subsequent cycle peak could possibly be round $210k.

Different valuation fashions, together with the Bitcoin Quantile, projected an identical situation of a +$200k worth goal.

Nonetheless, for the Pi Cycle High indicator, the potential market high could possibly be round $150k-$180k if the present cycle peaks in the direction of the top of 2025.

Regardless of the distinction in targets, the fashions leaned in the direction of potential development for BTC. The same perception was seen on one other valuation metric – BTC True MVRV.

The metric retreated after hitting an area peak round 2, which coincided with BTC’s worth stalling at $109k. The identical degree marked the early 2024 native high.

Apparently, Bitcoin’s current restoration adopted the metric’s rebound at 1.4, much like final September’s transfer.

Nonetheless, cycle peaks have at all times been flagged by a True MVRV worth of three and above. The press time MVRV studying was 1.6, which means BTC has extra room to broaden based mostly on previous developments.

Price noting although that some analysts nonetheless consider that BTC’s four-year cycle is perhaps distorted, given the tempo of institutional adoption out there. In that case, the projections shared by the aforementioned fashions ought to be taken with a grain of salt.