Optimism about the Bitcoin future outlook stays robust, with a crypto analyst forecasting a large $100,000 worth improve for the pioneer cryptocurrency. With expectations of an excellent better worth surge, the analyst believes {that a} $100,000 ATH for Bitcoin in 2025 is a nominal worth goal.

Why Bitcoin Will Rise To $100,000 In 2025

Luke Broyles, a distinguished crypto analyst and Bitcoin fanatic lately dived right into a dialogue concerning the relationship between Bitcoin’s price and inflation, particularly how the US (US) inflation impacts the worth of the cryptocurrency over time. The analyst argues that by 2025, Bitcoin’s nominal worth might attain $100,000 as a consequence of inflation. Nonetheless, the extent of this worth rally would barely attain ranges seen in 2021.

Associated Studying

Earlier than making his $100,000 bullish forecast, Broyles predicted that Bitcoin might rise to $65,000 quickly. He in contrast his projected worth leap to Bitcoin’s worth all-time excessive in 2021, which was above $69,000.

In keeping with the analyst, the actual worth for the 2021 ATH, adjusted for inflation, is definitely $83,000 in right now’s market. This means that even when Bitcoin’s present worth surges to new levels around $65,000, the cryptocurrency wouldn’t have the identical buying energy it did in 2021.

Broyles has projected that within the subsequent six to eight months, there’ll probably be extra money printing, doubtlessly rising inflation additional. Subsequently, he predicts that this rise in inflation may very well be a catalyst to pushing Bitcoin’s price to $95,000.

Commenting on the analyst’s predictions, a crypto neighborhood member questioned his evaluation of Bitcoin’s future trajectory, highlighting {that a} $95,000 worth improve was bearish.

One other crypto member claimed that inflation in the US is far increased than what’s reported, stating that “the actual Bitcoiners” consider that inflation is at the very least 21% per 12 months, as such Bitcoin needs to be value $210,000. Responding to the member, Broyles expressed skepticism concerning the 21% inflation declare however admitted that inflation may very well be as excessive as 12%, 14%, and 16% yearly.

In a earlier publish, Broyles analyzed the present standing of the Bitcoin bull market. In keeping with the analyst, the market cycle is midway via, with 50% of the anticipated timeline accomplished and 40% of potential returns achieved. Moreover, Bitcoin’s market sentiment has developed solely 10% and Worry Of Lacking Out (FOMO) has barely begun, at simply 5%.

Analyst Predicts Subsequent BTC High

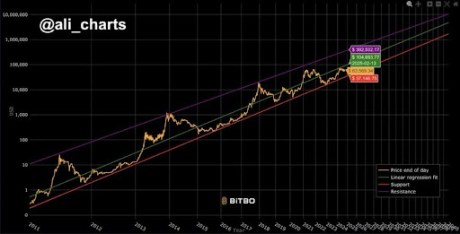

On September 24, crypto analyst Ali Martinez forecasted Bitcoin’s subsequent market top on this cycle. In keeping with Martinez, if Bitcoin’s Lengthy Time period Energy Regulation holds true, the market can anticipate the cryptocurrency’s subsequent peak to achieve $400,000.

Associated Studying

The Bitcoin Energy Regulation is an idea or idea that implies a selected mathematical relationship between the worth of Bitcoin and its market behavior or adoption. As of writing, the worth of Bitcoin is buying and selling at $63,807, reflecting an 8.76% improve over the previous week.

Featured picture created with Dall.E, chart from Tradingview.com