- BTC community issue has hit a report excessive and remained there.

- That is occurring as BTC makes an attempt to reclaim its ATH.

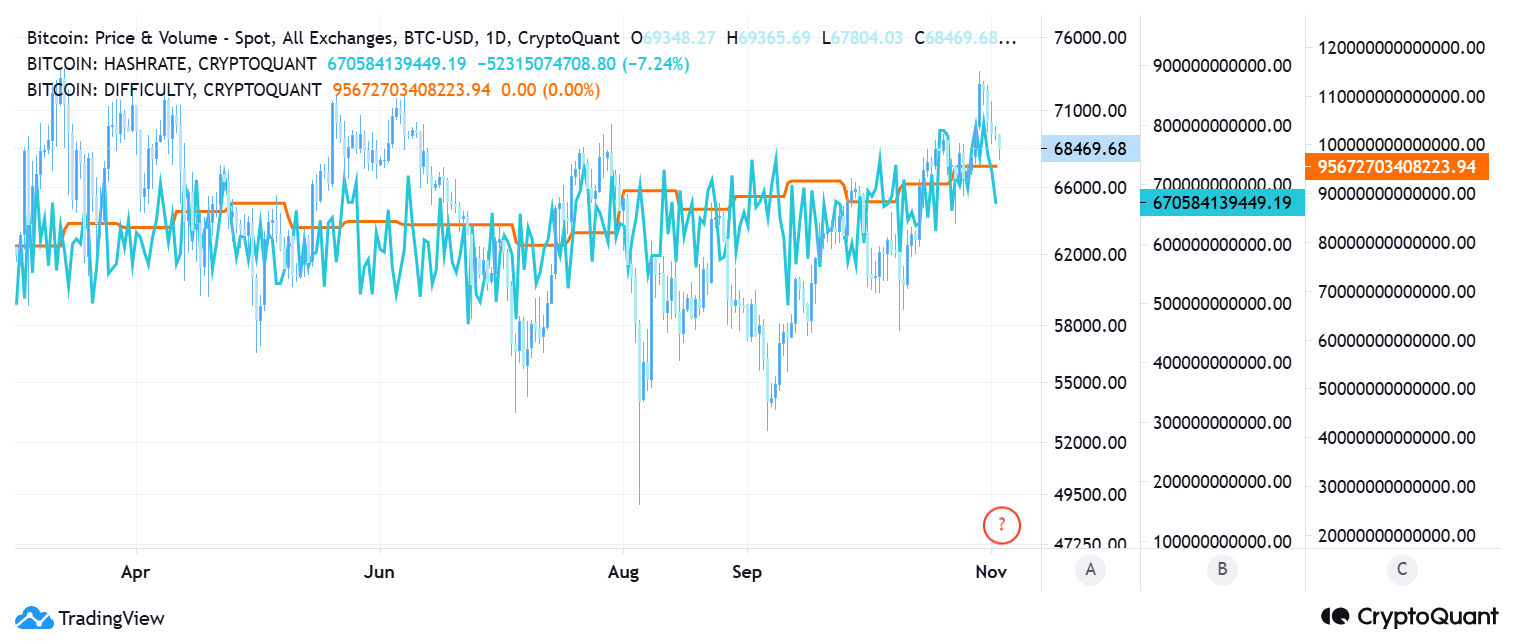

Bitcoin’s [BTC] community issue has continued its relentless ascent, hitting new highs. As this measure of mining problem grows, traders are asking whether or not worth motion will mirror this upward development or face a ceiling.

Analyzing BTC’s mining metrics, together with hashrate and issue, offers perception into potential worth impacts and the broader community’s resilience.

Rising community issue indicators Bitcoin mining curiosity

Bitcoin’s community issue, a key metric that adjusts roughly each two weeks, is reaching unprecedented ranges. Evaluation of the community issue on CryoptoQuant confirmed that it has not declined after its climb to over 95 trillion.

The problem displays how laborious it’s for miners to resolve complicated cryptographic puzzles and earn BTC rewards. As issue climbs, it implies that extra miners are competing for Bitcoin, an indication of sturdy community participation and safety.

Elevated issue typically coincides with greater hashrates, displaying confidence in Bitcoin’s long-term potential, particularly as establishments spend money on mining infrastructure. This rising curiosity and funding in mining might help Bitcoin’s worth by including stability to the community.

Bitcoin worth correlation: Historic developments and present context

Traditionally, an rising issue can correlate with bullish worth momentum, as a safe community attracts extra members and reassures traders of Bitcoin’s resilience. Nevertheless, regardless of these optimistic community fundamentals, Bitcoin’s worth has lately skilled a slight pullback.

Evaluation reveals that Bitcoin has hovered round $68,000 however has not sustained the sturdy rise many anticipated. With issue excessive and volatility remaining, the Bitcoin worth may expertise short-term resistance round $70,000.

A number of elements contribute to this potential resistance. As miners incur greater prices because of elevated issue, they could must promote extra Bitcoin to cowl bills, exerting promoting stress available on the market.

This dynamic, coupled with BTC’s sensitivity to broader financial developments, might mood instant worth features regardless of strong community well being.

Can BTC surpass resistance ranges?

BTC worth might break by way of its present resistance if it maintains sturdy institutional curiosity. Nevertheless, if the mining group continues to broaden, sustaining excessive issue ranges, miners might offset prices by holding, quite than promoting, their earnings.

Learn Bitcoin (BTC) Price Prediction 2024-25

Such conduct would cut back market provide, doubtlessly driving up costs within the medium time period.

In abstract, whereas Bitcoin’s worth stays below short-term stress, the rising community issue underscores the asset’s rising safety and attractiveness. BTC might see upward momentum if these circumstances persist, particularly if financial circumstances stabilize.