- Ethereum just lately noticed a spike in constructive netflow, with about 82,000 netflow to by-product exchanges.

- ETH has spiked by over 8% within the final 24 hours.

The current surge in Ethereum’s [ETH] trade netflow, alongside Bitcoin’s climb to a brand new all-time excessive (ATH), has generated renewed curiosity within the crypto market.

Ethereum has proven a notable improve in netflow on by-product exchanges, a shift which will trace at altering investor sentiment. In the meantime, Bitcoin’s breakthrough previous $75,000 has fueled optimism throughout the board.

Let’s take a more in-depth take a look at what these developments imply for ETH and when it’d observe BTC’s lead.

Ethereum’s netflow spike displays rising curiosity

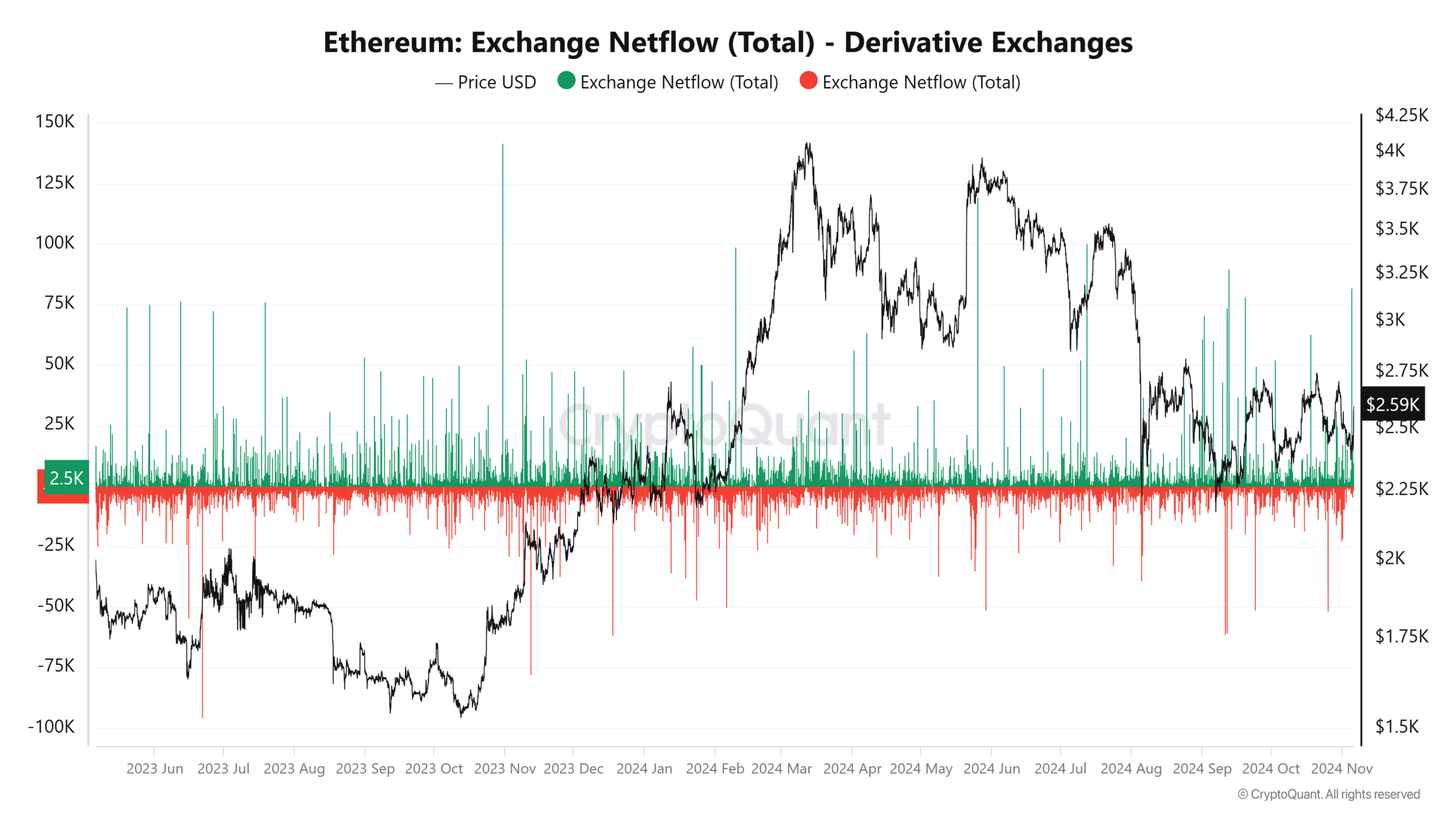

In current days, Ethereum’s netflow on by-product exchanges has skilled a major spike. Netflow, which measures the stability of property flowing into versus out of exchanges, serves as a key gauge of investor sentiment.

A constructive netflow often factors to accumulation, suggesting that buyers are shifting property to exchanges with an eye fixed on buying and selling or leveraging positions.

However, a destructive netflow typically signifies long-term holding, with property being transferred off exchanges.

The netflow just lately noticed a spike, with round 82,000 constructive netflow recorded, per information from CryptoQuant. The current spike coincides with heightened value volatility.

Traditionally, such spikes have led to short-term value adjustments, as elevated trade deposits typically sign that merchants are getting ready for giant strikes.

This habits means that buyers are positioning themselves for potential shifts in Ethereum’s value, probably bracing for extra vital fluctuations.

Ethereum’s value response to previous netflow surges

A glance again at Ethereum’s netflow patterns reveals an attention-grabbing development: spikes in trade inflows typically accompany substantial value shifts.

For instance, throughout earlier rallies this yr, durations of elevated netflow aligned with sharp value will increase as merchants positioned themselves to seize positive factors or mitigate threat.

Nonetheless, netflow spikes don’t at all times sign bullish sentiment—they’ll additionally carry volatility as merchants put together for value swings in both course.

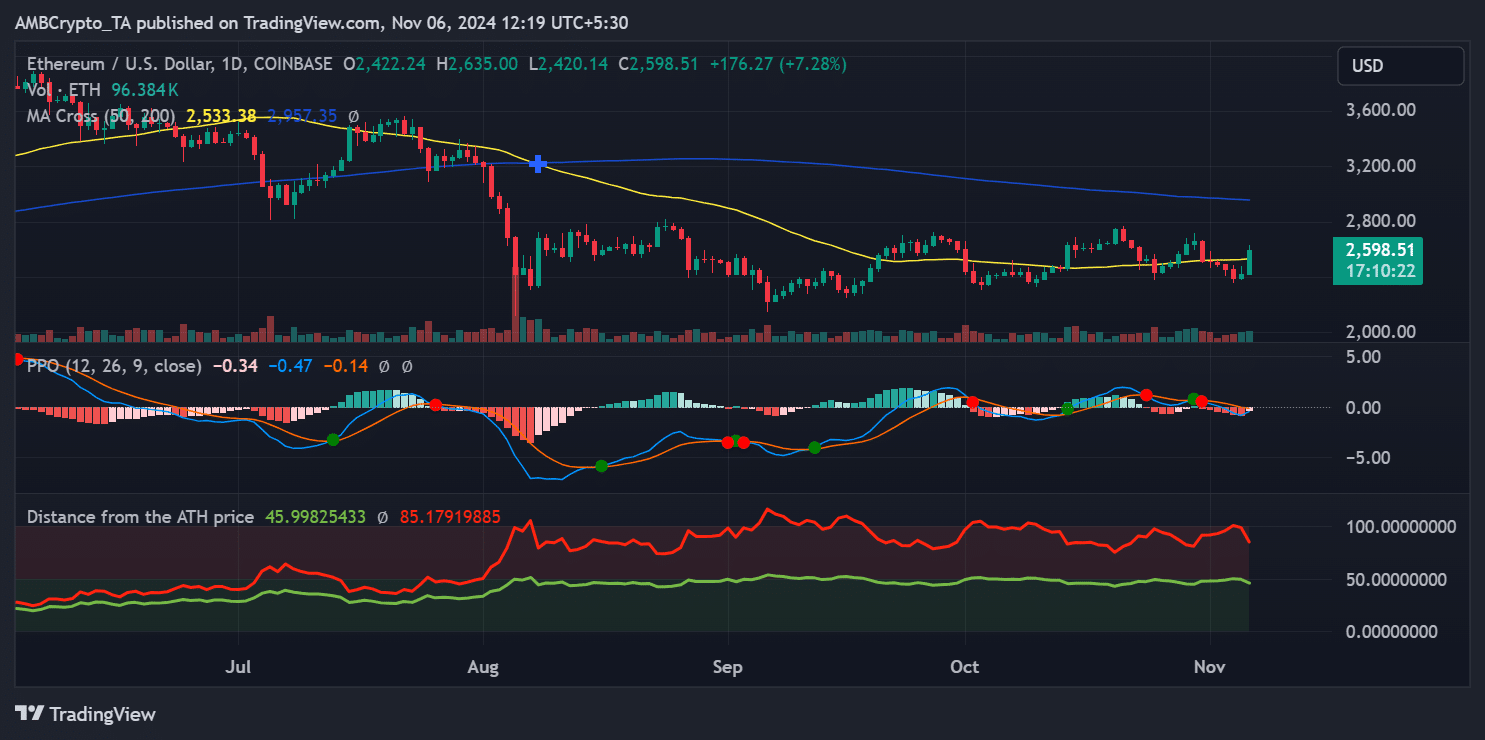

Presently, Ethereum is buying and selling close to $2,600, nicely under its ATH of round $4,800. Regardless of Bitcoin’s current rally, Ethereum has but to revisit its report highs.

Nonetheless, the constructive netflow could point out a rising optimism amongst buyers who count on a broader market rally. Whether or not ETH can preserve purchaser curiosity amidst present situations will likely be essential to its near-term trajectory.

Bitcoin’s ATH and implications for Ethereum

Bitcoin’s current surge previous $75,000 has set a brand new ATH, igniting enthusiasm throughout the market. This accomplishment has sparked a ripple impact with potential implications for Ethereum’s value course.

Though ETH stays at $2,600, nicely under its ATH, technical indicators counsel paths that might assist an upward development.

To higher perceive ETH’s place, the Distance from ATH indicator reveals that ETH continues to be roughly 45% under its peak. This sizable hole means that ETH has room for development if market sentiment stays constructive.

Traditionally, BTC’s ATH has typically paved the way in which for altcoin rallies as buyers look to diversify their positive factors from BTC into different main property like ETH. Given ETH’s tendency to observe Bitcoin’s lead, it might shut this hole if favorable situations proceed.

Moreover, the Share Worth Oscillator (PPO) additionally offers insights into Ethereum’s momentum relative to its historic value.

The PPO is at present just under zero, indicating a discount in bearish momentum. Ought to the PPO cross into constructive territory, it will bolster the case for a bullish development, suggesting ETH could regain energy and face upward value stress.

Ethereum/BTC pair stability and impartial energy

The Ethereum/Bitcoin (ETH/BTC) pair is one other useful metric for assessing ETH’s efficiency. Presently, the ETH/BTC ratio is holding regular, implying that ETH is retaining its worth relative to BTC, at the same time as BTC achieves new highs.

If the ETH/BTC pair strengthens, it might point out that ETH is attracting buyers independently of BTC’s actions, probably setting the stage for a extra sustained rally.

Real looking or not, right here’s ETH market cap in BTC’s phrases

A broader resurgence in Altcoin curiosity?

The mixture of accelerating Ethereum netflow on derivatives exchanges and Bitcoin’s ATH suggests renewed curiosity in altcoins. Given the historic correlation between BTC and ETH, ETH could observe BTC’s upward momentum if BTC’s rally continues.

Whereas Ethereum continues to be a ways from its ATH, current netflow information factors to rising market curiosity and attainable volatility forward.