The US presidential elections have come and gone, and the one thing left is the results. Curiously, a snapshot of the Bitcoin worth through the elections confirmed Bitcoin buying and selling simply above $70,000. It is a notable worth to comply with, as historical past reveals this is likely to be the value assist for Bitcoin within the foreseeable future. Curiously, this phenomenon goes again to the Bitcoin worth ranges in earlier US elections.

Why Bitcoin Value Would possibly By no means Dip Under $70,000 Once more

Bitcoin has largely been on an uptrend since Monday, when it kicked off a run after it rebounded to the upside from $67,000. This run continued, permitting the Bitcoin common worth through the 2024 presidential elections to be round $70,110.

Traditionally, U.S. election cycles have typically been accompanied by shifts in Bitcoin’s worth, marking essential worth factors that have a tendency to determine longer-term assist ranges.

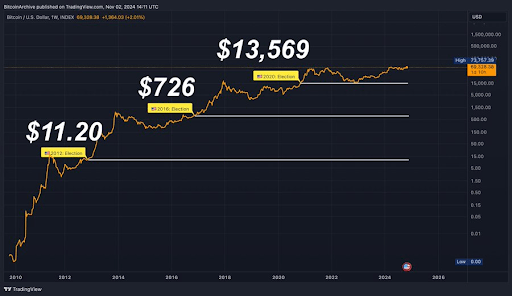

To understand this trend, we have to take a look at the previous 4 election cycles. Again in 2012, through the early days of the crypto business, the Bitcoin worth traded at a modest $10 on the US presidential election day, a worth level that now appears nearly unimaginable. By 2016, Bitcoin’s election-day worth had climbed to $710, setting a brand new baseline that it has by no means revisited since.

Essentially the most fascinating one was what occurred after the 2020 US presidential election, when the Bitcoin worth was buying and selling round $13,555. The Bitcoin worth has by no means revisited this worth level once more since then up till the time of writing. What’s extra fascinating is that this worth level even served because the lowest assist stage through the 2022 bear market worth crash.

If these historic tendencies are any indication, the 2024 election-day worth of $70,110 may change into an identical stronghold and a worth flooring for Bitcoin within the coming years. This stage would possibly even function vital assist ought to a bear market finally take maintain at any level.

What’s Subsequent For The Bitcoin Value?

As of now, Bitcoin is buying and selling above $73,200 after experiencing an intense surge over the previous 24 hours. This outstanding rally noticed Bitcoin climb almost 10% inside a single day, reaching an intraday excessive of $75,358. This milestone has now change into Bitcoin’s highest buying and selling stage, because it broke previous its earlier all-time excessive of $73,737 in March 2024.

Though the Bitcoin worth has pulled again barely doubtless as a consequence of some buyers cashing in on recent profits, the rally is predicted to resume anytime from now. Contemplating this momentum, Bitcoin stays well-positioned to problem the $80,000 mark earlier than the tip of November, particularly if shopping for curiosity continues to drive the present uptrend.

Featured picture created with Dall.E, chart from Tradingview.com