- Bitcoin’s stablecoin inflow hints at rising shopping for energy and potential worth breakout

- A 36% improve in short-term holders’ “HODL” habits strengthens Bitcoin’s upward potential

Bitcoin [BTC] has lately been buying and selling inside a slim vary, with resistance at $98,804 and help round $94,603. Nevertheless, rising on-chain indicators counsel that the main cryptocurrency may very well be gearing up for a big upward transfer.

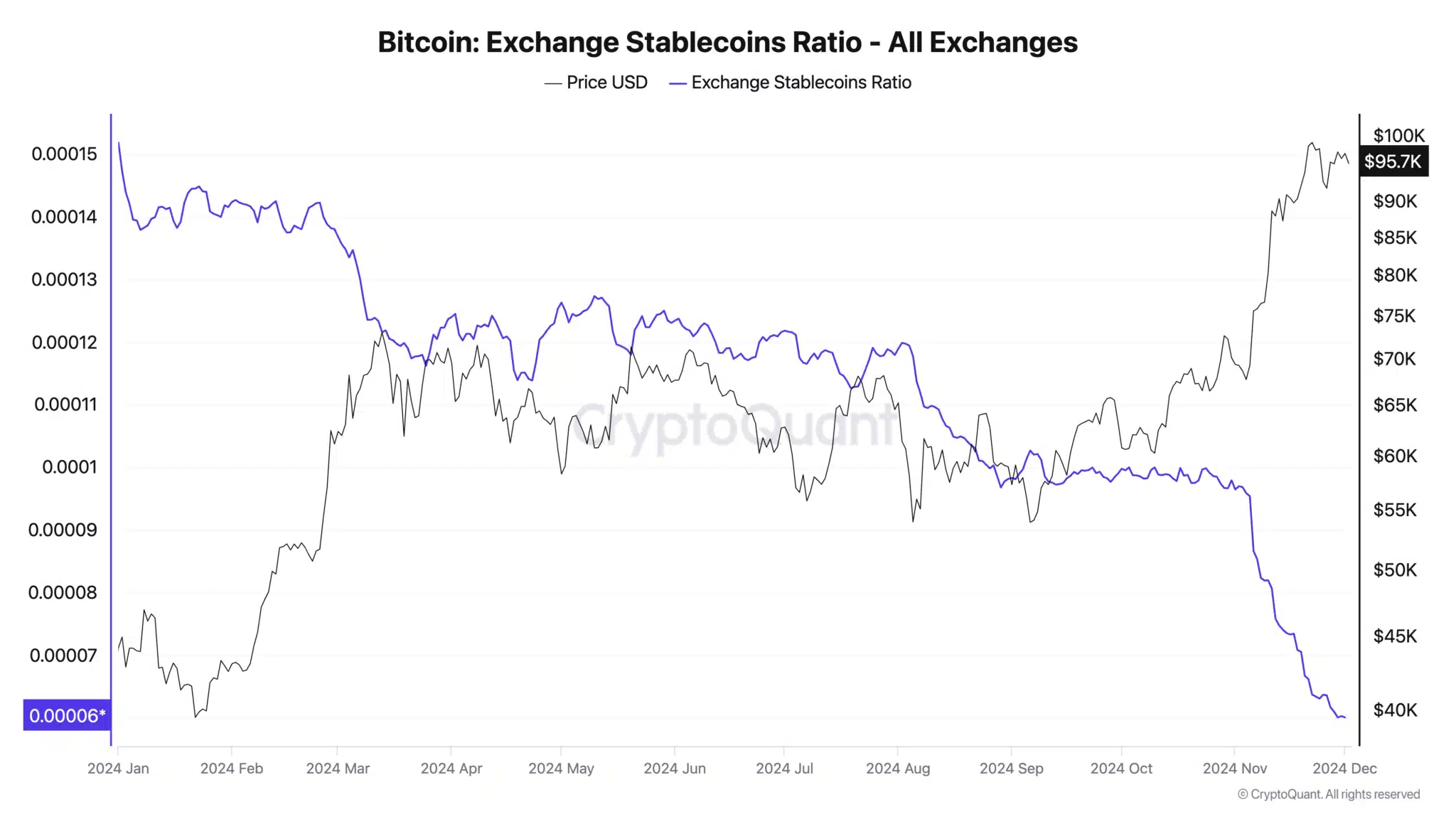

Notably, the Change Stablecoins Ratio has seen a pointy decline, pointing to a rise in shopping for energy on exchanges. This shift in market dynamics has sparked hypothesis that Bitcoin could also be poised for a rally, doubtlessly breaking by way of its present worth vary and transferring towards new highs.

Because the market braces for potential progress, investor sentiment is rising more and more optimistic.

A glance into BTC’s efficiency

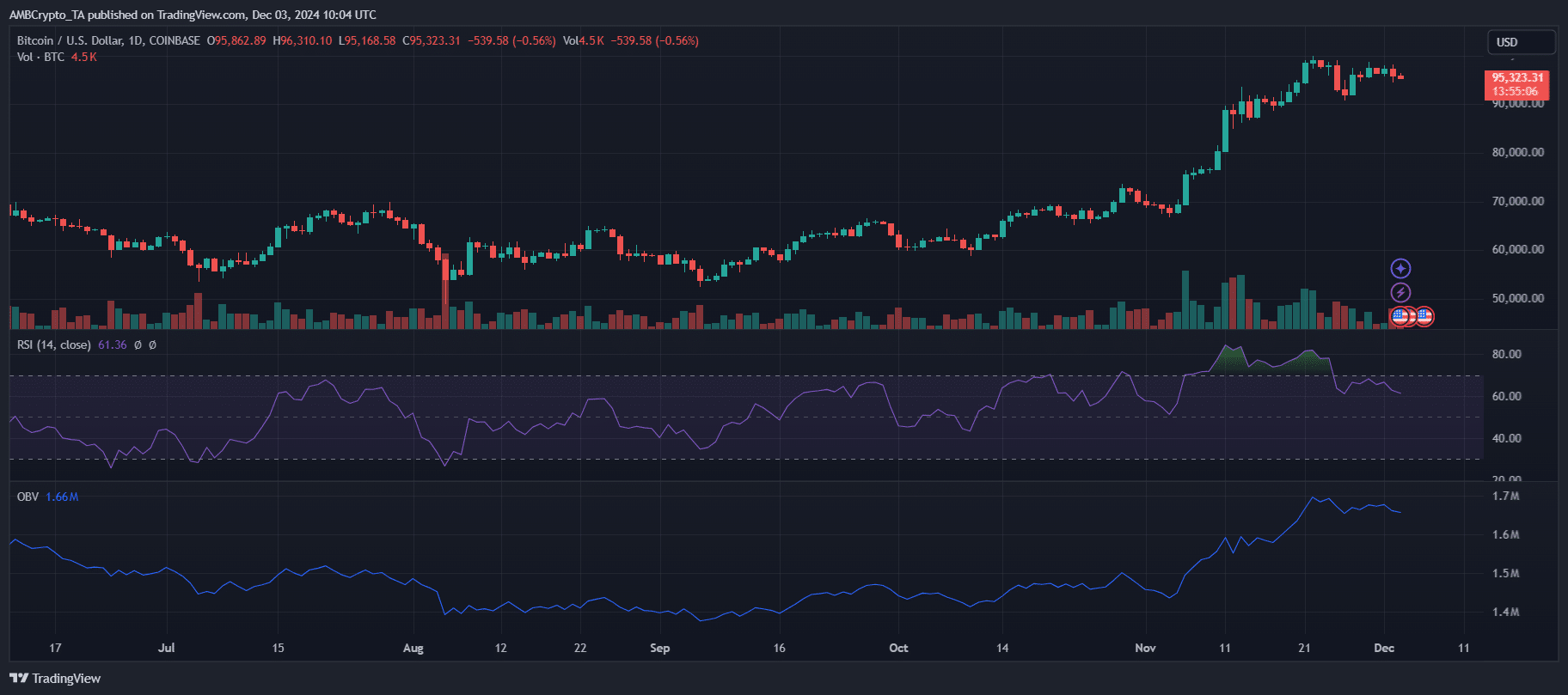

Bitcoin’s current buying and selling vary displays a consolidating market, with worth struggling to breach the $98,804 resistance stage whereas holding agency above $94,603 help.

The day by day RSI at 61.41 suggests reasonably bullish momentum, although a transparent breakout sign stays absent. Notably, buying and selling volumes have proven minor declines, indicating a cautious market awaiting a decisive transfer.

OBV maintains an upward trajectory, highlighting sustained shopping for strain regardless of worth stagnation. This divergence between worth and OBV hints at latent bullish potential.

Moreover, the Change Stablecoins Ratio’s decline reinforces this outlook, suggesting a buildup of buying energy on exchanges.

A breach of the $98,804 resistance might catalyze a push towards $100,000, however failure to take care of momentum dangers a revisit to decrease help ranges.

Change stablecoins ratio and hodling affect

The Change Stablecoins Ratio, now at 0.000060, its lowest stage in 2024, underscores important shopping for energy on exchanges. This metric displays the rising provide of stablecoins relative to Bitcoin, signaling that traders are well-positioned to accumulate BTC.

Traditionally, such situations have preceded bullish worth motion as demand outpaces provide.

Moreover, the rise in hodling habits amongst short-term Bitcoin holders is a notable issue. CryptoQuant knowledge exhibits a 36% improve of their common holding interval over the previous month.

This reduces quick promoting strain, fostering shortage out there and strengthening worth stability.

Collectively, these dynamics – low Change Stablecoins Ratio and heightened holder confidence – improve Bitcoin’s potential to interrupt previous $98,804 resistance, with $100,000 more and more inside attain.

What to anticipate from Bitcoin?

At press time, Bitcoin was buying and selling at $95,323, barely under its key resistance stage of $98,804. The inflow of stablecoins on exchanges, mirrored within the low Change Stablecoins Ratio, suggests important shopping for energy that would drive demand.

If short-term holders preserve their “HODL” technique and investor sentiment stays optimistic, Bitcoin might overcome this resistance and edge nearer to the psychological $100,000 mark.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Nevertheless, any improve in promoting strain might see BTC consolidating inside its present vary or retracing to its essential help stage of $94,603 earlier than trying one other breakout.

The market’s trajectory hinges on whether or not demand sustains its momentum within the coming classes.