- A current report has revealed an fascinating connection between world inflation and the crypto market cap.

- Is the current ‘dip’ within the crypto market cap only a false alarm, or is volatility looming?

A yr in the past, the crypto market cap was a strong $1.72 trillion. Quick-forward to in the present day, and it’s soared to $3.27 trillion—a staggering 90.11% leap year-to-date.

Curiously, half of that progress got here in This fall alone.

Clearly, the “Trump pump” was the important thing catalyst, fueling a large inflow of recent capital into the crypto market.

Nevertheless, 2024 closed with the market nonetheless 11% off its peak from mid-December.

May this widening hole be an indication of issues to return as we head into what’s shaping as much as be probably the most unstable Q1 but?

The crypto market have to be ready for a unstable 2025

Curiously, a current Grayscale report uncovered a putting hyperlink between the crypto and bond markets.

The market cap of digital belongings has now surpassed that of the U.S. high-yield bond market, greater than doubling its dimension. Clearly, buyers are turning to crypto in the hunt for higher returns.

Regardless of this huge progress, the crypto market’s current double-digit dip is not only a fluke.

The Fed’s sign for fewer fee cuts in 2025 has sparked some uncertainty, creating a difficult dynamic for each markets.

Right here’s the deal: Sometimes, when rates of interest rise, bonds turn out to be extra enticing. Why? As a result of the yield will increase, providing a greater deal for buyers.

So, because the Fed leans towards fewer fee cuts, it’s no shock that buyers are flocking to bonds for his or her regular returns. This might set the stage for a possible rebound within the bond market in 2025.

In response, the crypto market, which regularly strikes inversely to bonds, has taken successful. Nonetheless, this dip could be extra about “speculation” on fee hikes than precise modifications in borrowing prices.

So, is the crypto market poised for a turnaround, or are we an extended dip?

The U.S. bond market below scrutiny

Technically, bonds play a important position in how the U.S. authorities raises funds.

Nonetheless, when rates of interest rise, they arrive with a hefty price ticket—no marvel the president-elect, Donald Trump, has been outspoken concerning the Fed’s reluctance to chop borrowing prices.

This could possibly be a pivotal second for the crypto market. Whereas many anticipate inflation to rise with Trump’s hardline insurance policies, November’s modest core PCE inflation progress instructed much less value stress than anticipated.

Including to the combination, mid-December data revealed persevering with unemployment claims hitting a three-year excessive, signaling potential financial pressure.

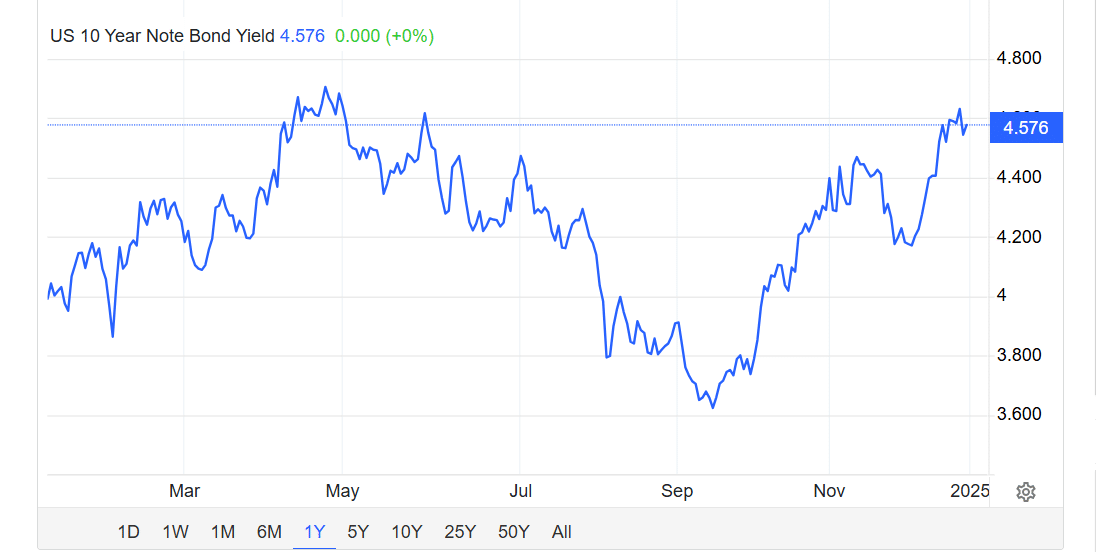

In the meantime, the yield on the 10-year U.S. Treasury observe dropped to 4.576%, dipping farther from its current peak of 4.6%, the best it’s been since early Could.

These shifting dynamics might result in the federal government reconsidering its method to borrowing prices, particularly given the immense debt load it’s dealing with.

So, what does this imply for buyers? It could possibly be time to refocus on crypto. Furthermore, with a attainable financial downturn looming, the thought of Bitcoin [BTC] as a strategic reserve, as suggested by Trump, is gaining traction.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

2025 guarantees to be a pivotal yr for each the bond and crypto markets. With bonds dealing with mounting challenges, the crypto market presents a worthwhile alternative.

However, how the federal government responds to the macroeconomic tendencies, notably round rates of interest, stays the important thing issue to look at within the coming months.