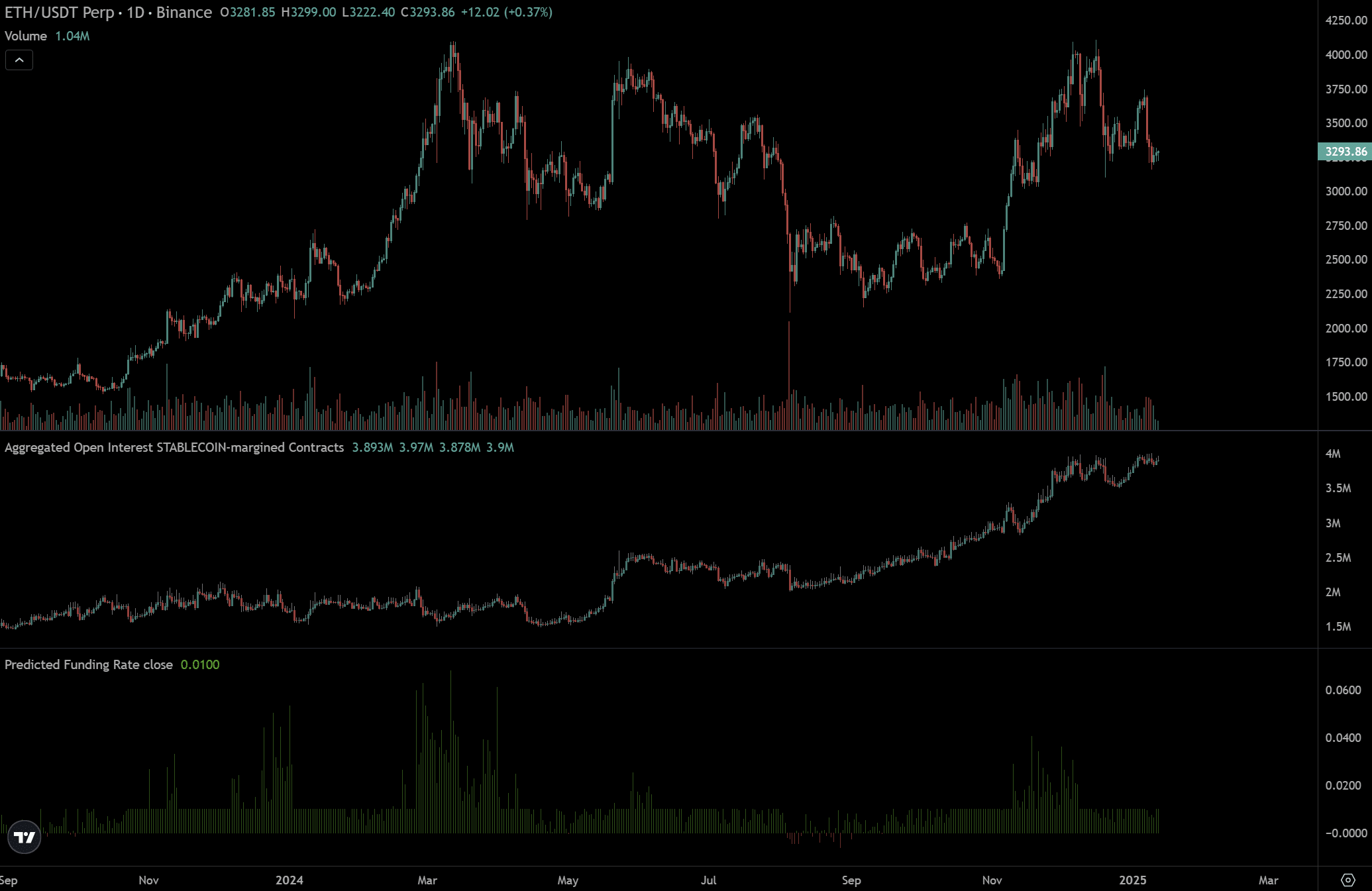

- ETH’s leverage has surged to $10B in two months.

- Historic developments indicated excessive leverage may negatively impression ETH’s worth.

Regardless of Q1 being traditionally bullish for Ethereum [ETH], the altcoin’s large $10B leverage may expose it to liquidation dangers and cap upside potential.

Andrew Kang, Co-Founding father of crypto VC agency Mechanism Capital, projected ETH may stay range-bound ($2K-$4K) on account of this leverage danger. He stated,

“$ETH has added $10b+ in leverage because the election. This unwind shall be painful, however $ETH received’t go to zero. It would merely vary from $2k to $4k for a really very long time”

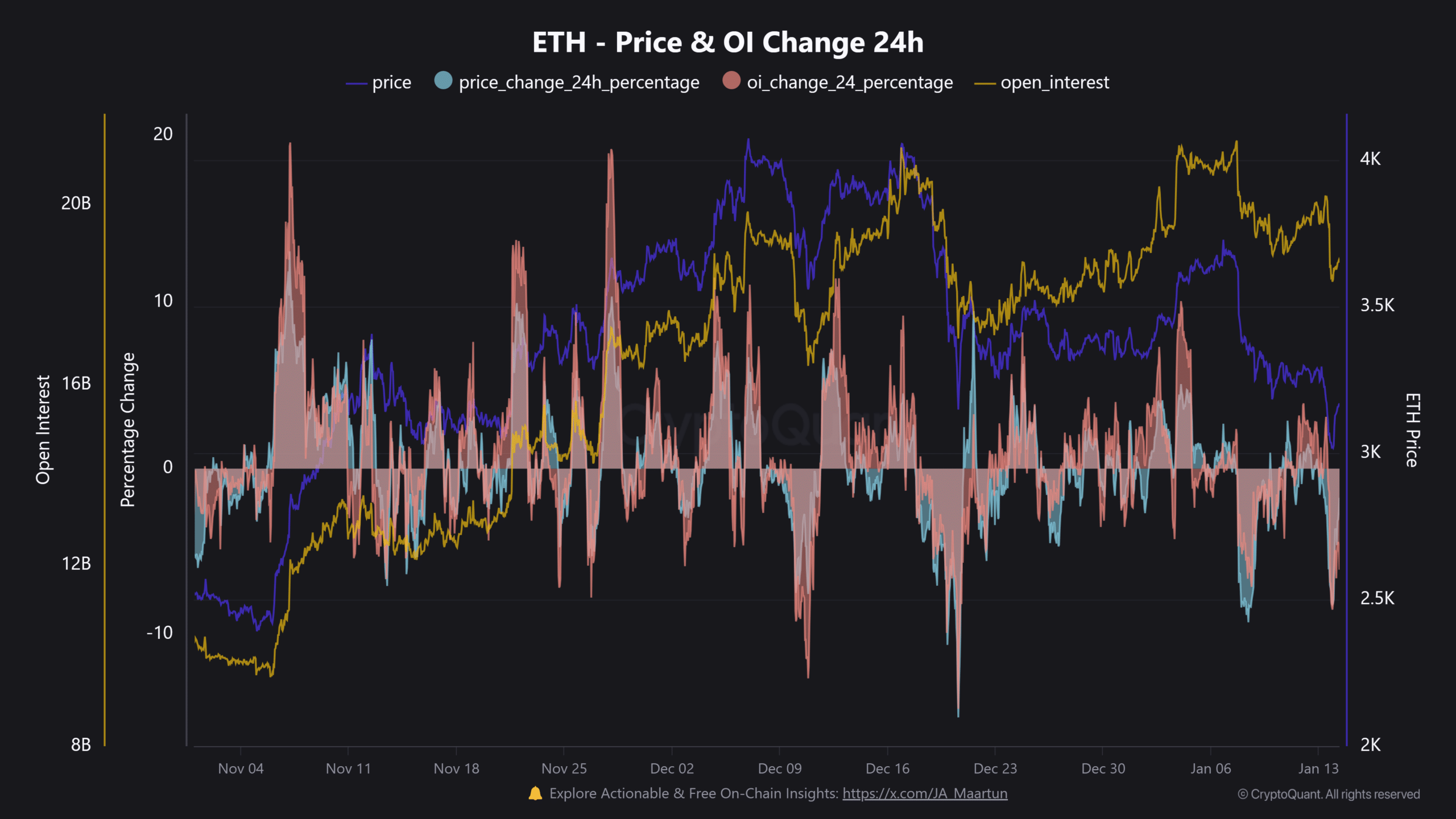

Earlier than the US elections, ETH leverage (borrowed asset for speculative buying and selling) stood at $9B. It shot as much as over $19B in December.

Afterward, the sharp value decline liquidated a number of positions and dragged ETH to round $3.1K.

Will leverage derail ETH’s upside?

Kang added that the ETH ‘foundation commerce’ pushed by CME Futures had little impression on the huge leverage because it was ‘delta-neutral’—each ETH purchased within the spot market is shorted within the Futures market. As a substitute, he blamed speculative merchants for the extreme leverage.

The historic ETH-leverage-driven pump confirmed Kang’s considerations. Usually, at any time when leverage Open Curiosity elevated greater than value through the rally, a pullback and native prime adopted.

This was evident in early November and late December. They each escalated ETH liquidations.

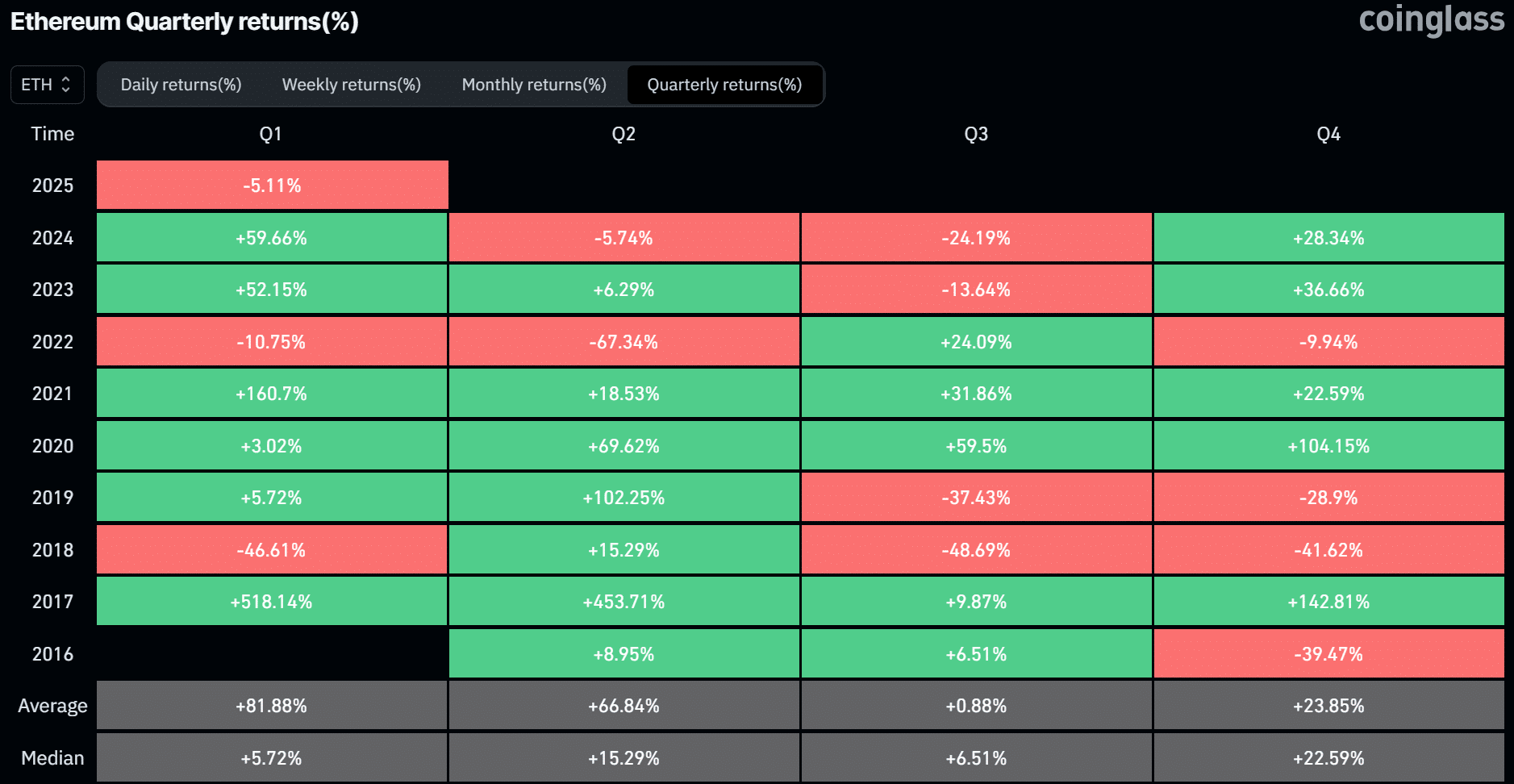

The truth is, on the twentieth of December, ETH recorded over $300M of liquidations, and lengthy positions dominated the losses. That stated, Coinglass knowledge revealed that Q1 has at all times been ETH’s strongest performer, with a mean of 81% achieve.

Out of the previous seven years, ETH closed solely two quarters (Q1s) within the crimson. Merely put, if historic developments repeat, ETH may document important beneficial properties in Q1 2025.

Nevertheless, the lurking liquidation danger may cap the upside expectation. At press time, ETH was again above $3K after a pointy drop to $2.9K following Monday’s bearish transfer.