- Bitcoin’s worth corrected beneath $100K, declining practically 8% from its current all-time excessive.

- Analysts famous that long-term holders confirmed no indicators of promoting, signaling new market cycles forward.

Bitcoin [BTC] is at the moment dealing with a notable correction, after its worth fell from as excessive as above $109,000 final week to now buying and selling as soon as once more beneath the $100,000 worth mark as of as we speak.

Notably, on the time of writing, BTC has dropped by practically 5% prior to now week to its press time buying and selling worth of $99,986—bringing the worth to 7.9% lower any from its all—time excessive achieved final week.

Main market gamers present restraint

Amid the continuing correction, a CryptoQuant analyst has highlighted an intriguing pattern in long-term holder (LTH) conduct.

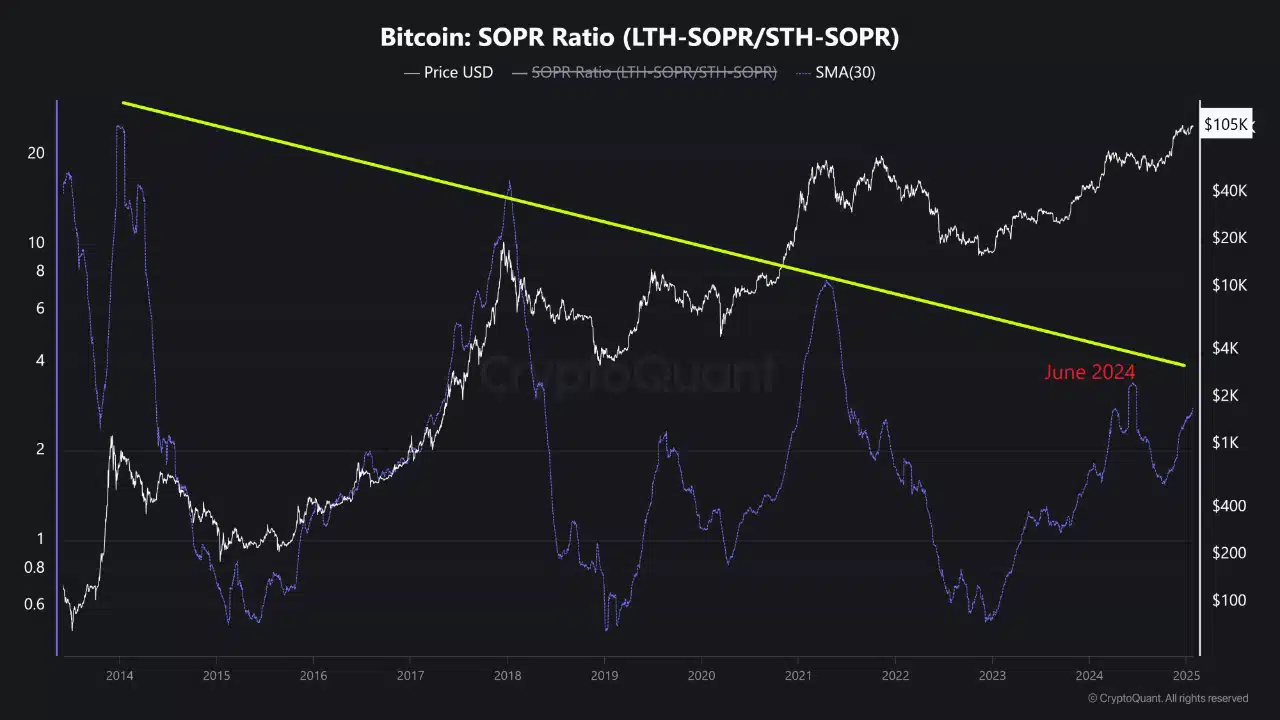

In a put up on the CryptoQuant QuickTake platform titled “Main Market Gamers are Reluctant to Promote,” the analyst famous that the SOPR Ratio (LTH SOPR/STH SOPR), was exhibiting slower progress within the present bull run in comparison with earlier cycles.

This ratio, which measures long-term holders’ realized earnings relative to short-term holders, stays decrease than ranges seen throughout Bitcoin’s worth run-up in mid-2024.

The analyst additionally advised that as Bitcoin matures, long-term holders have more and more adopted a extra measured strategy, distancing themselves from speculative actions.

Institutional participation additionally seems to have reshaped market dynamics.

With extra traders viewing Bitcoin as a long-term retailer of worth somewhat than a buying and selling instrument, the capital flowing into exchanges has decreased.

In consequence, many long-term holders are opting to maintain their Bitcoin in portfolios somewhat than cashing out.

The implication is that, whereas the market might expertise corrections, new cycles will seemingly emerge during which Bitcoin is held for prolonged intervals, decreasing speculative promoting and doubtlessly stabilizing the market.

On-chain knowledge gives extra insights

Along with inspecting long-term holder conduct, it’s vital to think about different key metrics to get the entire image of what’s ongoing behind the scenes of BTC and the place the asset is probably going headed within the short-term.

Notably, data from CryptoQuant on BTC’s MVRV ratio revealed that this metric has to date been on a rise together with BTC’s current worth motion.

This improve introduced BTC’s MVRV ratio from 2.2 as of January 9 to as excessive as 2.52 on the twenty first of January.

Though, as of the twenty sixth of January, there was a slight lower to 2.4, the general pattern of this metric remains to be fairly in an uptrend.

It’s value noting that the continued improve in MVRV ratio factors to a optimistic sentiment amongst holders and traders.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

The next ratio sometimes signifies that the market remains to be keen to worth Bitcoin at ranges above its realized worth, which may sign resilience and potential for restoration.

Nevertheless, the slight pullback in MVRV is also a cautionary signal, suggesting that the market may be approaching a interval of consolidation.