Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

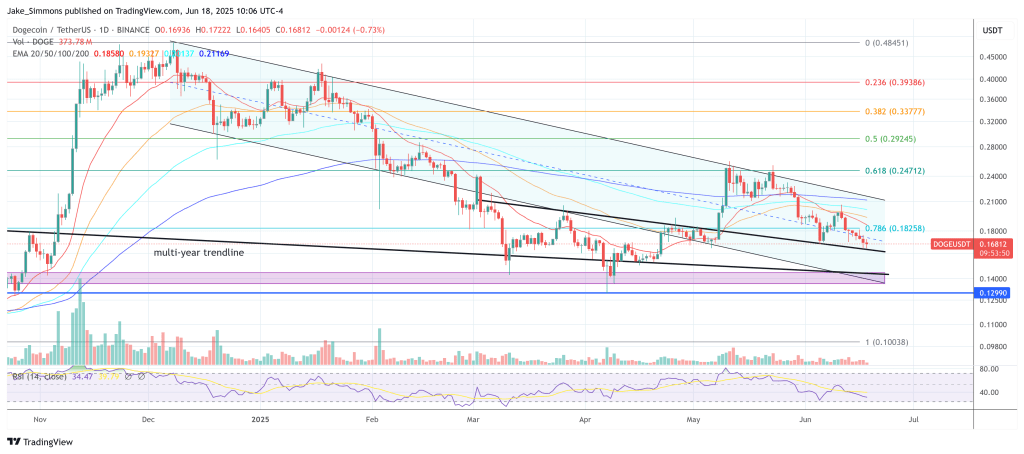

Within the late-cycle quiet of mid-June, veteran market technician Tony “The Bull” Severino, CMT, posted a month-to-month Dogecoin (DOGE) chart that means the meme-coin’s exuberant bark could be fading right into a drained whimper. The 1-month candle view, revealed on TradingView at 22:43 UTC+2 on 17 June 2025, fixes DOGE at $0.1694 — down roughly 2.3% on the session — and locations three stark black arrows the place prior macro-momentum crested, rolled, and in the end bled into extended draw back.

Is Dogecoin Simply Taking part in Lifeless?

On the value pane, the primary arrow sits on the January 2018 peak, when DOGE briefly tagged the 2 cent space earlier than relinquishing almost all of its positive factors. The second arrow marks the euphoric blow-off in Might 2021, when the token spiked to simply below seventy cents after which started an two 12 months descent. The third arrow lands on the latest cluster of decrease month-to-month highs that capped out slightly below $0.26 final month and has since slipped again beneath the psychological twenty-cent threshold.

Beneath the candles, Severino overlays his most popular long-term MACD (labelled “LMACD”) with default histogram. The indicator — blue for the quick line, orange for the sign line — information an virtually metronomic rhythm: steep optimistic crossovers throughout parabolic advances, adopted by equally dramatic bearish flips as patrons are exhausted. The histogram’s tallest inexperienced bars in early 2017 and early 2021 coincide with these value spikes; in every occasion, as soon as the histogram light to impartial and turned purple, DOGE entered a multi-year drawdown.

Associated Studying

At the moment, that sample seems to be repeating. The blue LMACD line has simply crossed under the orange sign line, printing a modestly unfavourable histogram worth of -0.0263 whereas the sign rests at 0.1704 and the LMACD itself at 0.1440. The configuration mirrors the early levels of the 2018 and 2022 downturns, the 2 earlier rollover factors Severino emphasizes along with his arrows. In his personal phrases, the month-to-month oscillator “seems prefer it needs to roll over and play useless,” hinting that the crossover might herald a deeper retracement towards historic assist zones.

From a structural perspective, DOGE is now trapped between the previous cycle’s flooring close to the five-cent mark and overhead resistance on the late-202 swing excessive round $0.48. The waning momentum on the LMACD suggests bears preserve the higher hand except recent demand arrives shortly sufficient to invalidate the incipient bearish crossover. A decisive shut under the April low close to $0.13 would open the chart to vacuum-like territory, as little as the cycle bottom at $0.0491.

Associated Studying

Severino’s evaluation, whereas strictly technical, lands at a second when broader crypto liquidity is thinning forward of the summer time doldrums and as danger urge for food reveals indicators of fatigue throughout digital property attributable to postponed hopes for the next rate cut by the US Federal Reserve and geopolitical tensions between Israel and Iran.

For long-term merchants who monitor momentum greater than memes, the month-to-month crossover carries extra weight than any viral tweet. Historical past doesn’t repeat precisely, however for Dogecoin holders it has rhymed with unsettling precision each time the LMACD has curled over from an elevated crest.

Whether or not the canine-themed coin has really curled up for an extended nap, or merely paused earlier than one other spherical of tail-wagging hypothesis, will depend upon how value reacts ought to the histogram develop extra unfavourable in coming months. For now, the chart’s message is unambiguous: Dogecoin’s dominant trend has misplaced its pulse, and momentum merchants might need to maintain a detailed ear to the canine’s respiratory earlier than assuming it’s only enjoying.

At press time, DOGE traded at $0.168.

Featured picture created with DALL.E, chart from TradingView.com