Following the steep corrections seen in late July, the Bitcoin market made a modest recovery previously week, rising by 2.73% based on data from CoinMarketCap. Nevertheless, one other rejection amidst this worth resurgence forces the premier cryptocurrency to now commerce inside the $116,000 worth area. Whereas the crypto market awaits the token’s subsequent transfer, cumulative buying and selling exercise alerts potential for a serious worth surge to a brand new all-time excessive.

Golden Ratio In Sight: Bitcoin Targets $131K After Quantity Shelf Maintain

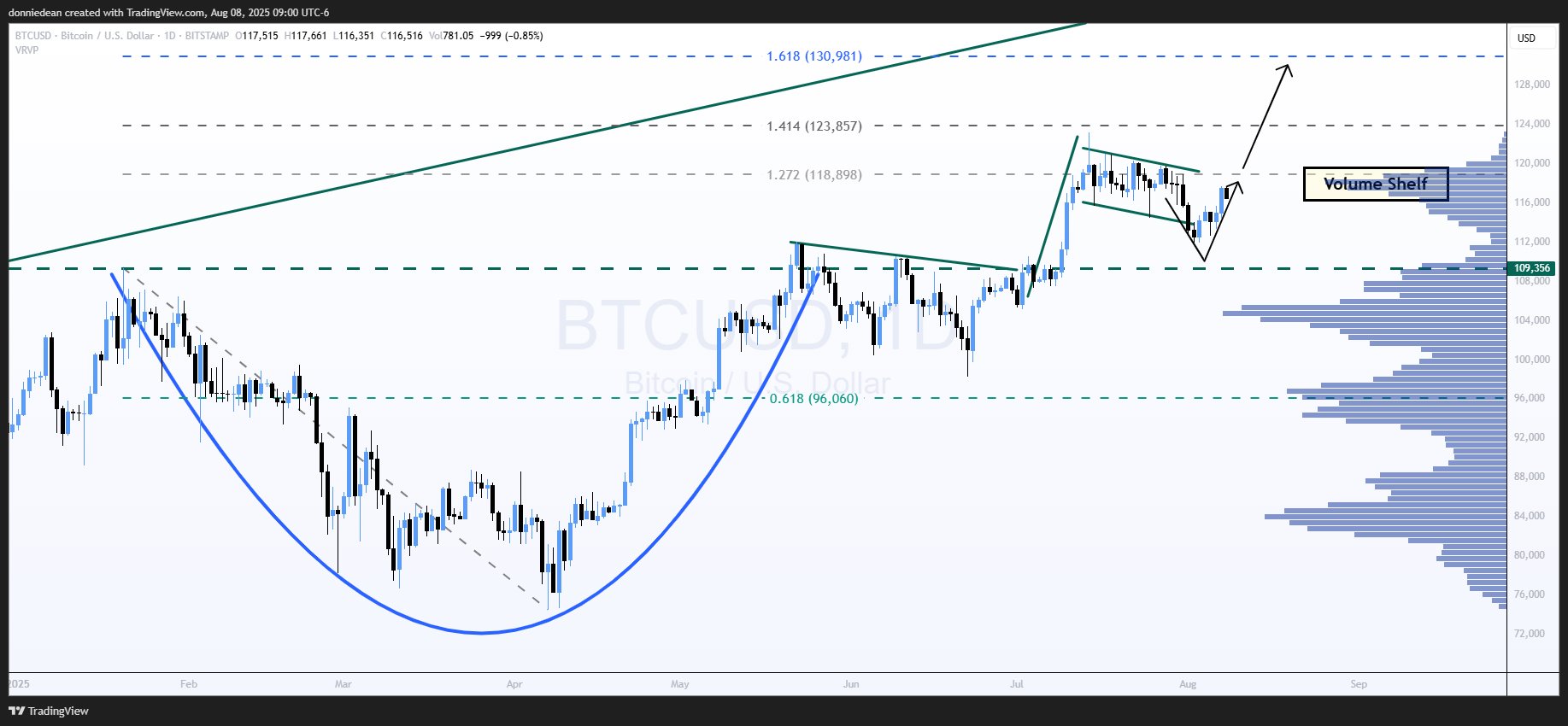

In an X post on August 8, standard monetary market analyst Donald Dean shares an attention-grabbing bullish worth prediction on the Bitcoin market. Primarily based on the existence of a quantity shelf on the BTCUSDT day by day chart, Dean suggestions the crypto market chief to quickly attain a $131,000 market valuation.

By the use of rationalization, a quantity shelf refers to a worth degree the place a major quantity of buying and selling exercise/quantity has occurred. Within the chart above, this degree of buying and selling is indicated by the horizontal bars on the best aspect of the chart. A quantity shelf tends to behave as a powerful resistance or assist zone as a result of many merchants are assumed to have purchased or bought at this degree.

In keeping with Donald Dean’s evaluation, Bitcoin is at the moment hovering round a quantity shelf between $116,000 – $118,000, which has been recognized as a possible launch space. If Bitcoin can consolidate decisively above this vary, it means that this degree has sufficient shopping for curiosity to probably act as a springboard for the following leg up.

Curiously, Dean predicts that this accumulation section would offer the momentum wanted to propel BTC towards the 1.618 Fibonacci extension degree, a key technical milestone generally known as the “golden ratio.” This degree, positioned round $131,000, represents the following main worth goal for the Bitcoin market, signaling a possible 12.93% acquire on the current market costs.

Bitcoin Market Overview

On the time of writing, Bitcoin was buying and selling at $116,756, after a minor decline of 0.02% over the previous 24 hours. In the meantime, market buying and selling quantity has fallen by 20.97% and is valued at $55.24 billion.

Data from CoinCodex signifies that market sentiment stays strongly bullish, with the Worry & Greed Index at 67. Regardless of this optimism, analysts anticipate BTC to carry inside its present vary, projecting costs of $117,167 in 5 days and $115,980 in thirty days, and a possible dip to $112,688 over the following three months.