Intro

The collapse of FTX is clearly one of the impactful occasions within the historical past of crypto.

So what’s the story behind FTX? How did it rise to energy and have become one of many largest crypto exchanges so shortly? What led to its collapse? And how much impression will it have on crypto and DeFi? You’ll discover solutions to those questions and extra on this article.

Rise To Energy

The story of FTX begins with its founder Sam Bankman-Fried or SBF.

In 2014, SBF graduated from MIT with a level in physics and began working full time at Jane Road Capital, a widely known proprietary buying and selling agency in conventional finance.

In 2017, after 3 years of buying and selling, Sam determined to stop Jane Road and based Alameda Analysis, a quantitative buying and selling firm targeted on the crypto market.

Apparently, as a vivid supporter of efficient altruism, Sam dedicated to present away his wealth throughout his lifetime in probably the most environment friendly method. This might’ve been one of many the explanation why he determined to pursue his profession in crypto after realising it might create even better monetary alternatives than his work at Jane Road.

The beginnings of Alameda are extraordinarily worthwhile. Sam, collectively along with his group, seen an enormous arbitrage alternative created by value discrepancies of Bitcoin traded on American and Asian exchanges. The arbitrage allowed the agency to safe early earnings and broaden its operations into different markets together with DeFi.

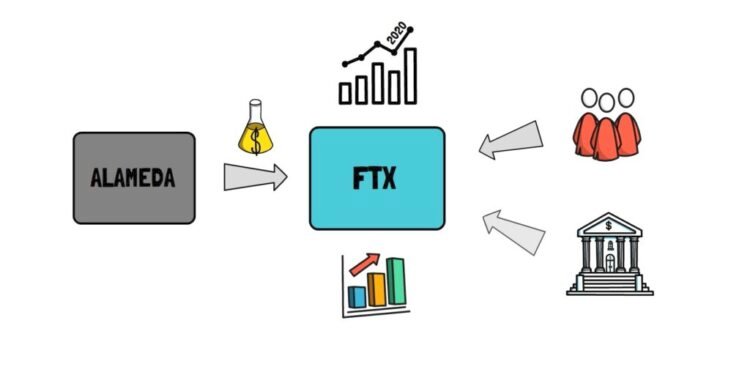

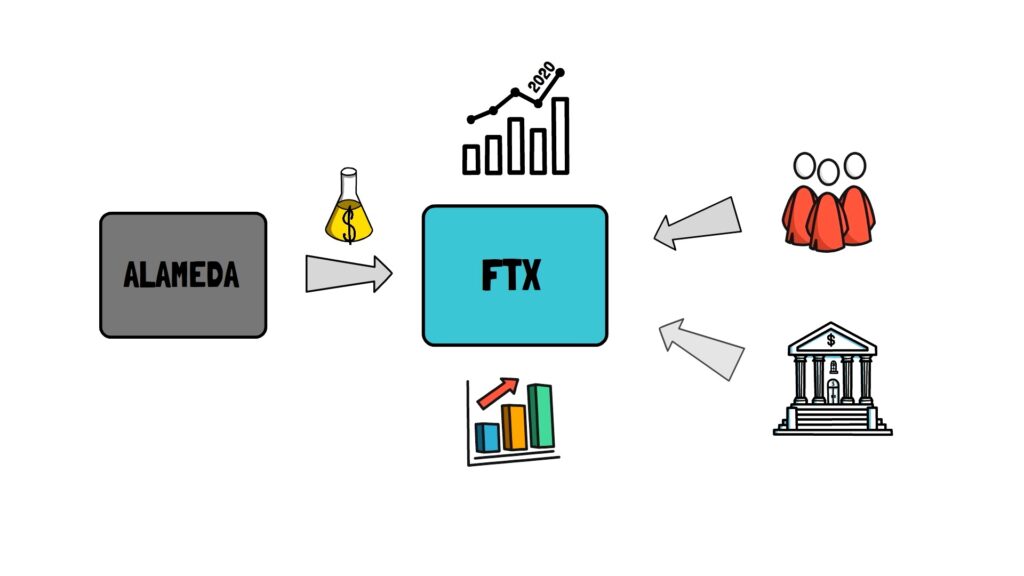

Having a extremely worthwhile buying and selling agency wasn’t sufficient for Sam. In April 2019 he determined to launch a brand new crypto alternate – FTX.

This was a difficult job. With tons of of rivals and high exchanges like Coinbase or Binance already capturing the overwhelming majority of crypto customers, it didn’t seem like there was sufficient area for yet one more participant within the alternate ecosystem.

After a gradual begin, the FTX quantity began rising quickly in late 2020.

The expansion was sped up by having an excellent market maker, in a position to provide liquidity to the alternate – none apart from Alameda itself.

Liquid derivatives market attracted lots of refined merchants and firms seeking to hedge their market publicity.

To totally deal with rising FTX, Sam determined to step down from Alameda making 2 of his shut staff Caroline Ellison and Sam Trabucco the co-CEOs.

SBF, seeing the FTX momentum, began closely investing in advertising and marketing: naming rights to the FTX Enviornment in Miami; adverts with Tom Brady and Larry David; influencer advertising and marketing amongst fashionable youtube channels to call only a few.

Within the meantime, Sam stored elevating cash. From June 2021 to the start of 2022, FTX raised a whopping $1.8 billion from notable traders comparable to Sequoia Capital, SoftBank and Tiger World – constructing increasingly legitimacy.

The valuation of FTX ballooned in measurement to $32 billion, making SBF, with estimated web value of $20b, one of many youngest multi-billionaires on the earth’s historical past.

His life-style was additionally one thing that created lots of consideration.

Vegan, driving a Toyota Corolla, fairly often sleeping on a bean bag at work and sharing an residence with a number of different staff. These weren't the same old traits of a younger billionaire.

By many, together with the media, Sam was perceived as a buying and selling and enterprise genius.

Sam’s fast accumulation of wealth and strange life-style began attracting increasingly media consideration.

With a number of publications from Forbes to Fortune journal claiming Sam is perhaps the following Warren Buffet or JP Morgan, he shortly turned the poster boy of crypto.

In addition to closely investing in advertising and marketing, SBF was additionally lively in politics and lobbying. He donated round $40m principally to the Democratic social gathering and secured lots of excessive stage conferences with regulators and politicians.

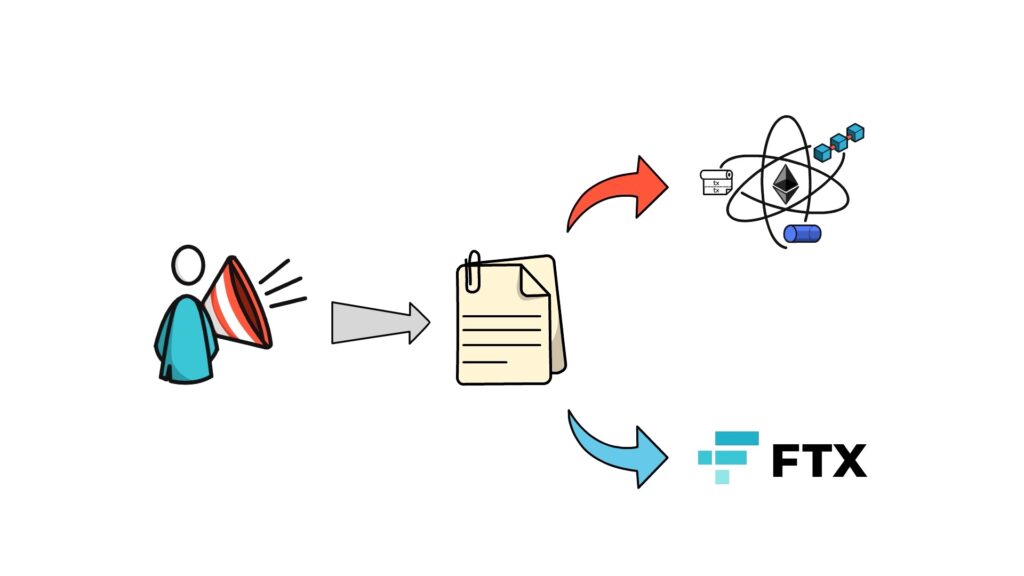

He drew lots of consideration within the crypto area by engaged on a regulatory framework that will additional enhance FTX’s place in DC on the detriment of DeFi.

The paper acknowledged that DeFi Frontends needs to be regulated in a similar way to dealer sellers within the US.

This didn’t make the DeFi group pleased with a number of voices elevating issues concerning the state of the proposed regulation.

The Collapse

Whereas the dialog round DeFi regulation was nonetheless ongoing, one other factor began drawing media consideration.

A CoinDesk article revealed a leaked steadiness sheet of Alameda stating that though the corporate has lots of funds – most of it comes from only one token – FTT – FTX’s personal token, principally used for decreasing buying and selling charges on the alternate.

There was a serious downside right here. FTT had a really small float which implies that solely a small portion of the whole provide of the token was actively traded. On high of this, the overwhelming majority of cash had been held by FTX, Alameda and different related entities.

The CEO of Alameda, Caroline, shortly clarified that the leaked steadiness sheet didn’t signify the complete image of Alameda’s books. No matter her assertion, the crypto market remained sceptical of the scenario with lots of hypothesis concerning the potential insolvency of Alameda.

The earlier huge collapses of Three Arrows Capital and Terra/Luna, meant the market contributors had been extraordinarily vigilant when it got here to any rumours of a possible insolvency.

The following transfer that straight led to the collapse of FTX was much more stunning.

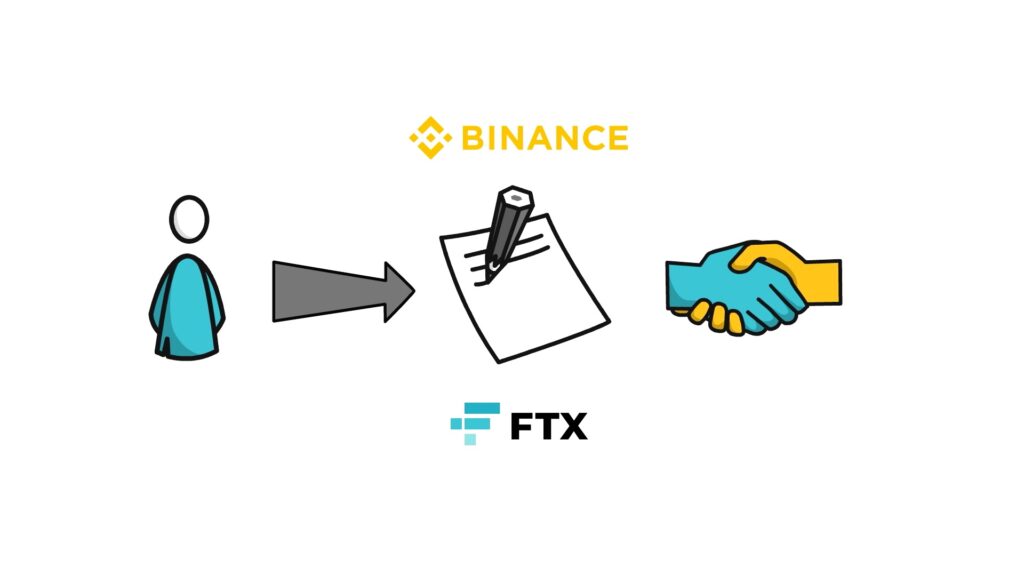

In addition to the well-known FTX traders comparable to Sequoia Capital or Tiger World from the most recent funding rounds, one of many early FTX traders – Binance – remained a bit beneath the radar.

Binance invested in a strategic early funding spherical of FTX on the finish of 2019.

As FTX began rivalling Binance increasingly, the Binance CEO – CZ – determined it was time to exit their FTX funding. Apparently sufficient, FTX didn’t determine to pay again the funding in {dollars} and as a substitute used a mix of stablecoins and their very own token FTT. This in flip made Binance one of many largest holders of the FTT token.

CZ, most probably additionally frightened by the insolvency rumours of Alameda, determined it was time to promote their FTT place.

The transfer was publicly introduced on Twitter by CZ himself – claiming that Binance will attempt to minimise the market impression of their FTT exit by slowly promoting the tokens over time.

This didn’t assist already weak FTT value motion and additional incentivised promoting.

The CEO of Alameda stepped in and introduced that they had been prepared to purchase all of the excellent FTT tokens at a hard and fast value of $22.

The scenario resulted in SBF tweeting a couple of maybe not totally thought via statements that simply added gas to the fireplace.

Beneath the hood, it appeared like there was lots of rigidity between SBF and CZ – most probably pushed by aggressive laws lobbying by FTX that might have been detrimental not solely to DeFi however to its rivals like Binance.

Within the meantime, spooked market contributors accelerated withdrawing their funds from FTX inflicting a serious financial institution run on the alternate.

The outflow of funds from FTX reached $6b over the span of simply 72 hours inflicting FTX to pause their withdrawals.

There have been much more surprises alongside the way in which.

Out of nowhere, Sam publicly introduced that Binance and FTX signed a non-binding letter of intent stating that Binance is desirous about totally buying FTX.com after finishing a due diligence course of.

The assertion created a shock wave throughout the entire crypto trade with all main media retailers reporting on the scenario inside the subsequent few hours.

A day later nonetheless, after taking a more in-depth look into the FTX and Alameda books and seeing an enormous multi-billion greenback gap, Binance determined to tug out from the provide.

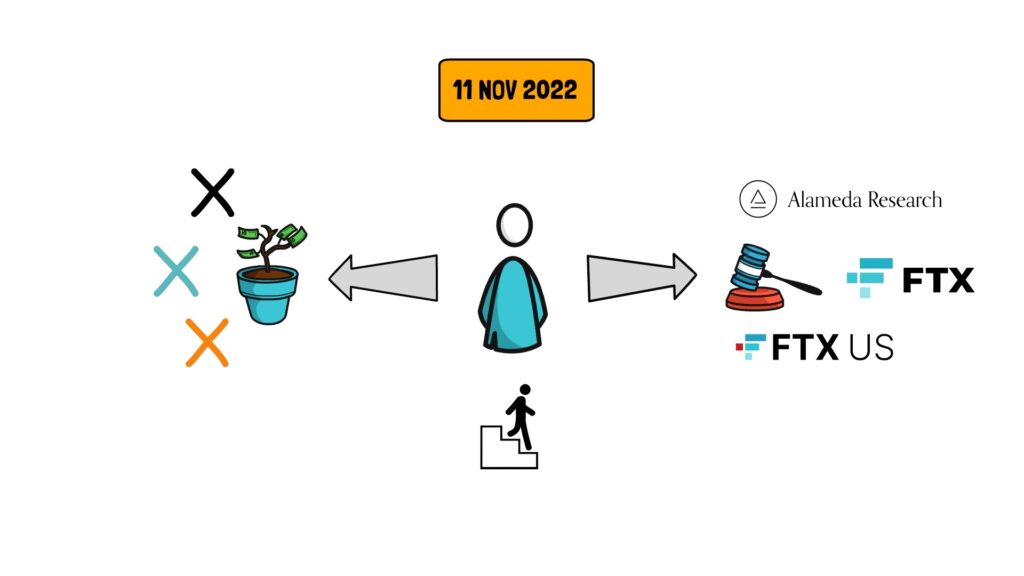

On the 11 of November, Sam, after a couple of extra unsuccessful tries at elevating further capital, determined to lastly quit, introduced stepping down because the alternate CEO and filed for the Chapter 11 chapter. This would come with FTX.com, Alameda and FTX.us that till this second was nonetheless not thought of to be affected by the scenario.

Chapter 11 included appointing a brand new CEO, John J. Ray III, who beforehand led disgraced vitality titan Enron via the chapter course of.

Within the meantime, CZ clarified in an announcement to his staff that he hadn’t deliberate to carry down FTX and that he uncovered the outlet of their steadiness sheet by chance.

Whatever the intent, CZ’s actions will stay one of the strategic strikes within the historical past of crypto.

After the chapter was introduced, a couple of extra vital issues got here into the sunshine.

FTX and Alameda consisted of 134 authorized entities, most probably to additional obfuscate the circulation of funds between the businesses.

FTX additionally didn’t have a board of administrators or perhaps a CFO – these had been clearly among the largest crimson flags.

We’re nonetheless ready for the complete story to unfold, however for the time being it seems like the principle gap within the FTX steadiness sheet was brought on by lending funds to Alameda that grow to be bancrupt, most probably in some unspecified time in the future throughout the 3AC saga.

It additionally seems that FTX’s accounting methods had a backdoor the place the circulation of funds between FTX and Alameda wouldn’t be reported appropriately, making it unimaginable for the auditors and different staff to determine the issue earlier.

So as to add gas to the fireplace, on November twelfth, the remaining alternate balances instantly began dropping. Later that day it turned clear that the alternate was being exploited. It stays to be seen if the assault was executed internally or externally.

Looking back, we will see that elevating capital, donating to political events, heavy advertising and marketing and even bailing out different bancrupt corporations was only a energy transfer by SBF to detract the general public from the insolvency of his personal firm – FTX.

Influence

In addition to dropping prospects’ and traders’ funds, the collapse of FTX is already having a knock-on impact on different corporations and the general crypto market.

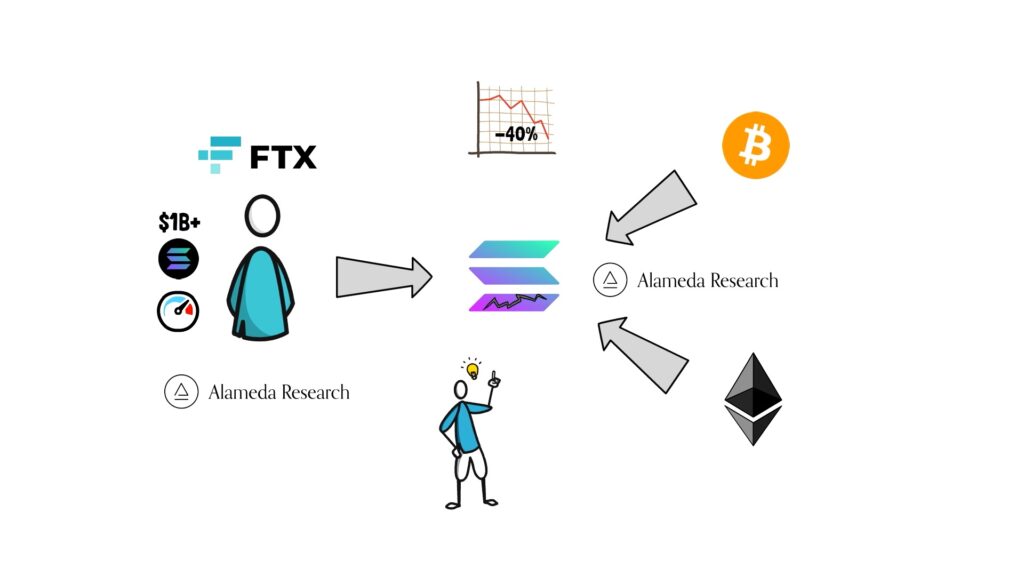

Solana, a layer 1 blockchain, was closely affected by the collapse of FTX. This was pushed by a couple of primary components.

To start with, FTX, Alameda and SBF had been huge supporters of the Solana ecosystem, holding over $1b value of the Solana SOL token.

The market anticipated potential SOL promoting stress which resulted within the value of the coin dropping by over 40% in a single single day.

Secondly, wrapped property on Solana comparable to bitcoin and ether had been backed by Alameda and immediately misplaced their worth inflicting havoc within the lending markets.

BlockFi was one other firm closely affected by the FTX collapse. In July 2022, BlockFi was bailed out by FTX by providing a $400m credit score facility. After the FTX collapse the BlockFi group issued an announcement that they paused withdrawals.

We are able to additionally most probably anticipate to see extra affected corporations being revealed within the close to future.

One other huge impression of the FTX collapse is the lack of belief within the crypto trade, already shaken by Terra and Three Arrows Capital.

Every time an enormous occasion like this occurs, it sadly attracts increasingly folks away from crypto and creates extra crypto sceptics.

There's additionally a fear about potential regulatory implications of the FTX collapse. The regulators would possibly see this occasion as an excellent purpose to closely regulate the entire area which is perhaps detrimental to additional adoption.

Because of Alameda going beneath, the crypto markets are additionally experiencing a interval of low liquidity. Alameda was one of many largest market makers in each CeFi and DeFi, however outdoors of that, we will now see different market makers lowering their market publicity by scaling again on their market making actions.

This hopefully needs to be just for a brief time period till all the knowledge concerning the FTX collapse and its knock-on results grow to be clear.

The collapse of one of many largest exchanges may also result in additional centralization of energy within the alternate area. The shoppers’ alternative might be restricted to some main gamers.

To create extra transparency, lots of exchanges determined to begin making a proof of reserves of their property. This might help with seeing apparent misconduct however it’s not a golden bullet. Sadly, the proof of reserves doesn’t present all of the excellent liabilities, so it can't be used to create a full image of the alternate solvency.

The Path Ahead

The collapse of FTX additional broken the already shaken status of the crypto trade.

At this level it’s value answering the query. What's the path ahead for crypto?

One factor is for certain, we certainly can't simply assume the dearth of different, new dangerous gamers inside the ecosystem. A few of them is perhaps constructing their legitimacy for years earlier than benefiting from their place.

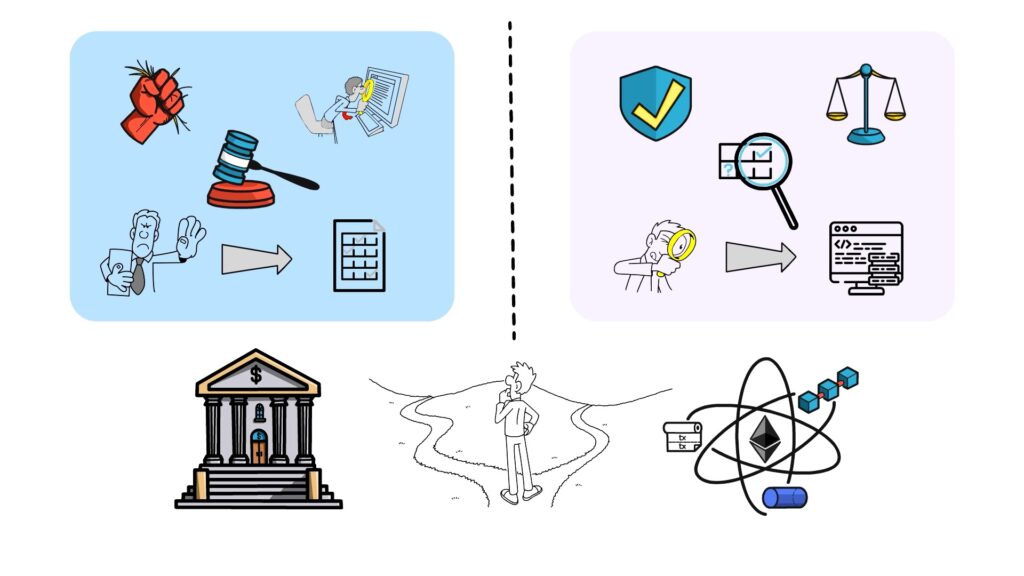

It seems like there are two primary paths ahead.

One focuses on extra regulation, extra centralization and extra oversight mainly recreating energy buildings recognized from conventional finance. This path additionally strengthens arbitrary entry to monetary providers primarily based in your nation of origin and monetary historical past.

The opposite path is a little more fascinating and focuses on on-chain transparency, self-custody, truthful entry and is self-regulated by protocols whose mechanics will be totally understood from the code that may be audited by anybody – that is DeFi.

There's additionally a chance these two paths will exist in parallel. Centralised entities that take custody over prospects’ funds might be closely regulated whereas DeFi, because of its clear and self-custody nature, will stay free and open to anybody.

One factor is obvious, DeFi wants to seek out methods to make it simple for brand new customers to onboard. This contains bettering person expertise of non-custodial wallets and rising the safety of interacting with DeFi protocols.

It’s additionally value emphasising that throughout the collapse of FTX, Ethereum, DeFi and even the overwhelming majority of different chains labored precisely as anticipated.

Uniswap, the largest decentralised alternate in DeFi, has been working flawlessly for over 4 years processing on common greater than 1 billion {dollars} in day by day buying and selling quantity.

Abstract

To summarise this text, it’s vital to keep in mind that the crypto trade began with Bitcoin and it was created with the significance of self-custody and transparency in thoughts.

I wish to spotlight that lots of people misplaced their life financial savings within the FTX collapse. I want all of them the very best with regards to recovering the funds throughout the chapter course of.

Going ahead, we needs to be sceptical of recent leaders who shortly come to energy and will even faster go away in shame.

I’d additionally like to see extra folks being onboarded to DeFi taking the custody of their very own property into their very own palms.

This comes with its personal challenges however I imagine they are often solved over time.

So what do you concentrate on the collapse of FTX and the way forward for crypto? Remark down beneath.

In the event you loved studying this text it's also possible to try Finematics on Youtube and Twitter.