Key Highlights

- Hyperliquid leads Perp DEX inflows with $53M, while other chains see mixed capital movement, highlighting uneven blockchain activity.

- Despite competition, Hyperliquid maintains high open interest and steady revenue, showing strong institutional participation and platform stability.

- DEX trading grows steadily, with volumes hitting $419B and the DEX-to-CEX ratio holding near 21%, signaling a shift toward on-chain trading.

Hyperliquid has surged to the top of the decentralized perpetual exchange (Perp DEX) market, claiming the highest net chain inflows and solid revenue gains. The platform has recorded over $53 million in bridged net flows in the past 24 hours, far surpassing competitors.

According to Artemis data, capital inflow across different blockchain networks was highly varied, with sizable inflows into some and heavy withdrawals from others. This week, Hyperliquid received the most significant share of the bridged assets, indicating impressive activity from both traders and institutional participants.

Ethereum followed Hyperliquid with net inflows of roughly $20 million, showing ongoing interest despite increased competition. Chains like Sonic, Starknet, Bitcoin, OP Mainnet, Solana, Sui, Mantle, Ink, and Sei saw smaller, but positive inflows.

On the other hand, some networks saw significant outflows. Base, Arbitrum, and edgeX each lost tens of millions in funds. Other chains like Polygon PoS, Avalanche C-Chain, BNB Chain, Unichain, Berachain, and zkSync Era also saw smaller withdrawals. This shows that money is moving unevenly across different blockchain networks.

Rising dominance in perpetual DEXs

So far, the 2025 Perp DEX market has been highly competitive, with Hyperliquid, Aster, Lighter, and EdgeX fighting for the top spot. Hyperliquid boasts solid infrastructure and a consensus mechanism called HyperBFT, which enables high-speed and high-efficiency throughput. It therefore maintains the highest open interest, reflecting high long-term conviction.

Aster's growth in trading volume owes much to high incentives and endorsements by influential figures. However, with controversy over manipulated volumes and the removal of data by DefiLlama, doubts over its credibility have been cast.

Even so, Hyperliquid’s established systems and support from institutional participants keep it ahead. EdgeX and other DEXs had some activity but stayed well behind in both fund inflows and user engagement.

Hyperliquid Daily even posted a comment about rival Perp DEX Lighter, saying, “Lighter maxis are completely deluded if they think their points will ever reach Hyperliquid-level value.” The post continued, “It’s never going to happen — especially not when your founder has an ego the size of a planet and jumps into every single post just to prove he’s right.”

Meanwhile, Lighter has outperformed Hyperliquid on trading volume throughout the month. According to dnap, “Lighter OI +50% since 10/10 while Hyperliquid OI has actually gone down since 10/10. The wash trading argument is also mid; Lighter has no fees, of course people will trade there.”

Revenue highlights across crypto protocols

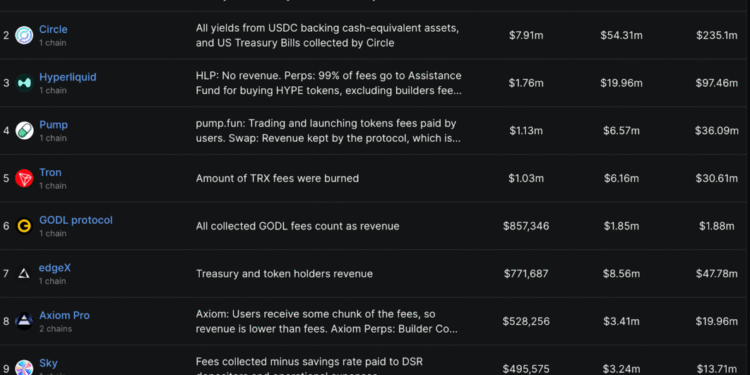

Revenue figures further support Hyperliquid's market standing. According to data from DefiLlama, Tether leads with $23.5 million in daily revenue, most of which is due to the yields from USDT-backed assets. Second-place Circle made $7.91 million from USDC-backed assets in daily revenue.

Meanwhile, Hyperliquid recorded $1.76 million in 24 hours, all going toward the purchase of HYPE tokens to put into its Assistance Fund. Weekly and monthly revenues reached $19.96 million and $97.46 million, respectively.

Other notable earners include the Pump protocol at $1.13 million daily, Tron with $1.03 million, and GODL protocol with $857,346. EdgeX collected $771,687, Axiom Pro earned $528,256, Sky protocol garnered $495,575, and Lighter took in $421,422.

These figures highlight that revenue generation in DeFi and DEXs remains highly concentrated among top platforms, with Hyperliquid maintaining a steady presence.

DEX vs CEX trading trends

Decentralized exchanges are gaining more popularity compared to centralized ones. According to CoinGecko analyst Yuqian Lim, the share of trading on DEXs versus CEXs has more than tripled in the past five years. It reached a peak of 37.4% in June 2025 and has stayed around 21% in November, showing that DEX trading is holding strong.

Lim explains, “This seems to further highlight a gradual but steady shift in preferences toward onchain trading.” Even with a broad market slowdown, DEX trading volumes from May to October reached a record $419 billion in October, showing that more users are sticking with onchain trading.

Hyperliquid’s recent jump in asset inflows and steady earnings show why it’s leading the Perp DEX market. Its fast platform, trusted reputation, and smart use of fees keep it ahead of competitors.

Also Read: Bybit Launches USDT0 Omnichain USDT on Mantle L2 Network