Commonplace Chartered CEO Invoice Winters expects each transaction to in the future run on blockchain, calling it a “full rewiring” of world finance.

Commonplace Chartered CEO Believes Blockchain Will Host All Cash Ultimately

As reported by CNBC, Invoice Winters talked about the way forward for finance and Hong Kong’s function within the international digital property house at a Hong Kong FinTech Week panel on Monday. “Our perception, which I believe is shared by the management of Hong Kong, is that just about all transactions will choose blockchains finally, and that each one cash will probably be digital,” stated the Commonplace Chartered CEO.

The remark comes as there was a push towards digital ledger tokenization all over the world. Funds large SWIFT, for instance, is growing a blockchain-based ledger, as announced in September.

Tokenization of an asset creates a digital copy of it that may be traded on the blockchain. Final 12 months, Hong Kong launched a mission to check the appliance of tokenization in real-life enterprise eventualities, with Commonplace Chartered as a participant.

Commonplace Chartered is a British financial institution that operates all over the world, together with Hong Kong. The establishment, designated as a World Systemically Essential Financial institution (G-SIB) by the Monetary Stability Board (FSB), has been rising its presence within the digital property house lately.

Earlier this 12 months, the financial institution turned the first of its stature to launch a spot Bitcoin and Ethereum buying and selling desk for institutional purchasers. It has additionally shaped a joint venture with Animoca Manufacturers and Hong Kong Telecom (HKT) to acquire a stablecoin license from the Hong Kong Financial Authority (HKMA).

Stablecoins characterize a distinguished instance of tokenization, performing as blockchain counterparts to fiat currencies. Commonplace Chartered is planning to launch an asset of this type based mostly on the Hong Kong Greenback (HKD).

The present tokenized property might solely be the start if the prediction from the financial institution’s CEO about all cash finally turning into digital is to go by. “Take into consideration what which means: an entire rewiring of the monetary system,” famous Winters.

Bitcoin Has Taken A 3% Hit Throughout The Previous Day

Bitcoin has kicked off the brand new week with one other retrace as its value is again right down to the $107,500 mark. The chart under exhibits how the cryptocurrency’s pattern has seemed lately.

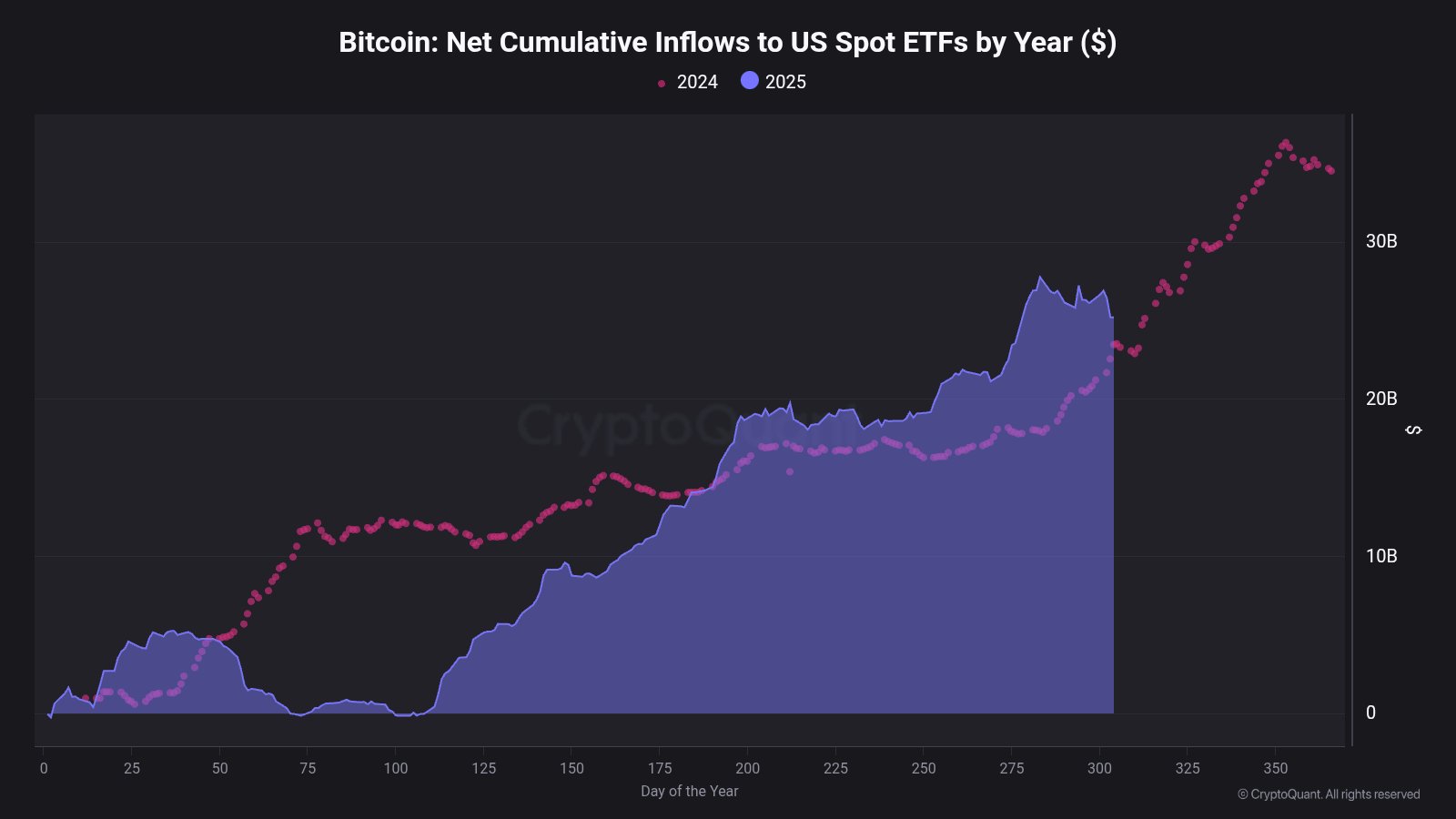

Regardless of the latest bearish wave, nevertheless, Bitcoin continues to be outperforming in 2024 when it comes to the spot exchange-traded fund (ETF) inflows. As CryptoQuant group analyst Maartunn has identified in an X post, 2025 is forward of 2024 in year-to-date inflows.

How the cumulative spot ETF inflows have in contrast between the 2 years | Supply: @JA_Maartun on X

At this level final 12 months, US Bitcoin spot ETFs registered round $22.5 billion in cumulative inflows. The identical metric for 2025 is now sitting at $25.18 billion.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.