Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

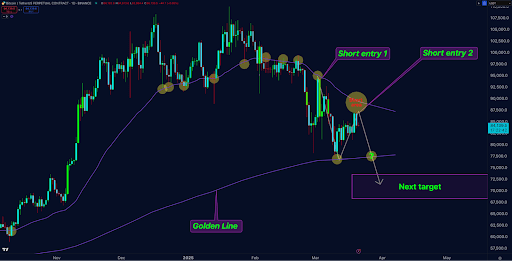

A Bitcoin value prediction made precisely one month in the past by widespread crypto analyst Physician Revenue on social media platform X has unfolded with interesting accuracy. On March 21, Physician Revenue outlined an in depth value trajectory for Bitcoin, predicting particular value actions, resistance and assist zones, and the influence of the M2 money supply. Quick ahead to April 21, Bitcoin’s value actions have carefully mirrored the analyst’s forecast, lending credibility to the remaining elements of his prediction.

How Bitcoin Adopted Physician Revenue’s March Forecast

Physician Revenue’s analysis is based on Bitcoin’s response to modifications within the M2 cash provide, which he recognized as a misunderstood indicator. He argued that though the market skilled a rise in liquidity beginning in February, Bitcoin’s vital bullish rally from September 2024 onwards had already factored on this liquidity enlargement, opposite to what most buyers had anticipated.

Associated Studying

Notably, Physician Revenue had beforehand highlighted a key technical degree, the weekly EMA 50, also referred to as the Golden Line, at roughly $76,000. He anticipated a bounce from this degree, projecting a transfer to the $87,000 to $88,000 area earlier than one other correction.

Bitcoin adopted this script nearly precisely, crashing within the first few days of April earlier than rebounding from round $76,000 on April 9. Now, Bitcoin has rallied back above $87,000, coinciding exactly with Physician Revenue’s prediction.

Subsequent Section: Bitcoin Heading For Help Zone At $70,000 To $74,000

Now that Bitcoin has bounced and is buying and selling above $87,000 once more, Physician Revenue’s fast subsequent goal is a possible crash in direction of $74,000 to $70,000, which is barely under the highlighted Golden Line. In line with the analyst, the market’s habits at this assist zone can be decisive. It’s at this zone that the Bitcoin value will reveal its next main directional bias.

Associated Studying

Physician Revenue laid out two clear eventualities primarily based on Bitcoin’s response throughout the $74,000 to $70,000 value vary. If Bitcoin experiences solely a short lived wick into this vary and manages a powerful each day or weekly shut again above the Golden Line, this may sign a reversal, and it could be prudent to shut brief positions and start accumulating lengthy positions. Nevertheless, if Bitcoin closes under this important space, it may set off a deeper bearish transfer, main its value to considerably decrease ranges, presumably revisiting the $50,000 area beneath a worst-case Black Swan situation.

Notably, whichever bearish situation performs out, it is expected to occur by April and sure into early Could. Regardless of the present short-term bearish outlook, Physician Revenue maintained a bullish long-term view. He confidently predicted that the Bitcoin bull run would resume round Could or June, ultimately driving the worth in direction of new all-time highs within the vary of $120,000 to $140,000.

On the time of writing, Bitcoin is buying and selling at $87,526, up by 3.28% up to now 24 hours. The bearish outlook in direction of $74,000 would solely be invalidated if Bitcoin successfully closes a weekly candle above the $100,000 degree.

Featured picture from Adobe Inventory, chart from Tradingview.com