- Ethereum’s CME brief stress eased as arbitrage trades unwinded, lowering structural drag on the worth

- ETH’s fundamentals stay sturdy, however contemporary catalysts are wanted to ignite a sustained breakout

Ethereum [ETH] should be ready on a macro spark to rally; however the structural weight that’s been dragging it down is lastly easing. The large brief positions opened on CME Ethereum Futures late final yr, pushed by arbitrage trades exploiting a sky-high foundation, have now been largely unwound.

Whereas not an outright bullish set off, this cleanup removes a key supply of market stress, resetting the stage for a possible breakout.

If the precise catalysts emerge.

Structural power, stalled value

AMBCrypto not too long ago reported on Ethereum’s resilient fundamentals – Rising whale accumulation, sturdy DeFi dominance with over $190 billion in TVL, and a traditionally undervalued MVRV Z-Rating. On-chain knowledge pointed to rising community exercise and early indicators of re-accumulation, hinting that ETH might be gearing up for a reversal.

And but, regardless of these indicators, the worth motion has remained muted.

One neglected purpose? A wave of brief futures positions on CME. Not out of bearish conviction, however as a part of an enormous arbitrage commerce. That structural stress might now be fading and it might change issues.

Mechanics behind the brief stress

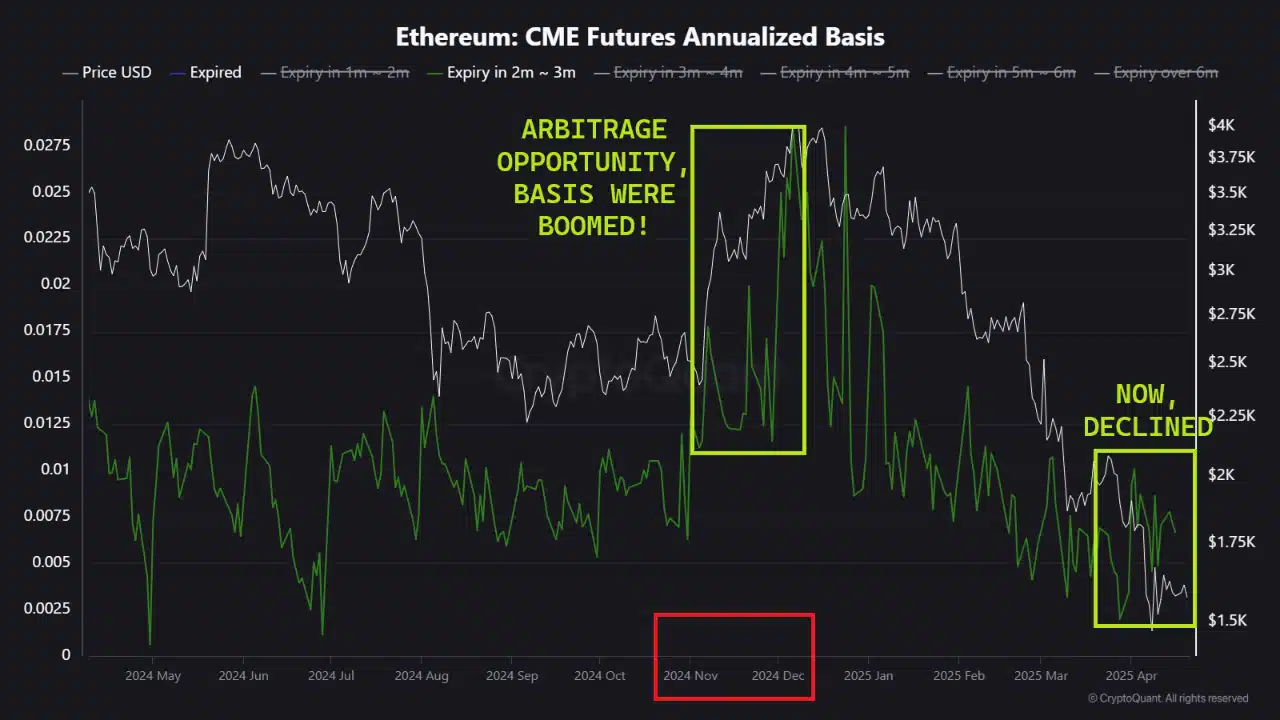

In November 2024, Ethereum’s CME Futures foundation surged previous 20%, making a textbook arbitrage alternative. Merchants – largely institutional – capitalized by shopping for spot ETH, typically through ETFs, whereas concurrently shorting CME Futures. This wasn’t a directional guess in opposition to Ethereum. however a structured arbitrage commerce exploiting the premium between Futures and Spot markets.

As the information revealed, this era noticed an aggressive spike within the annualized foundation. As soon as macro components hit, the commerce started to unwind, dragging spot ETH down as arbitrageurs exited. With the idea now round 4-5%, the stress from this commerce has largely dissipated.

What’s modified within the final two months?

The arbitrage window has closed.

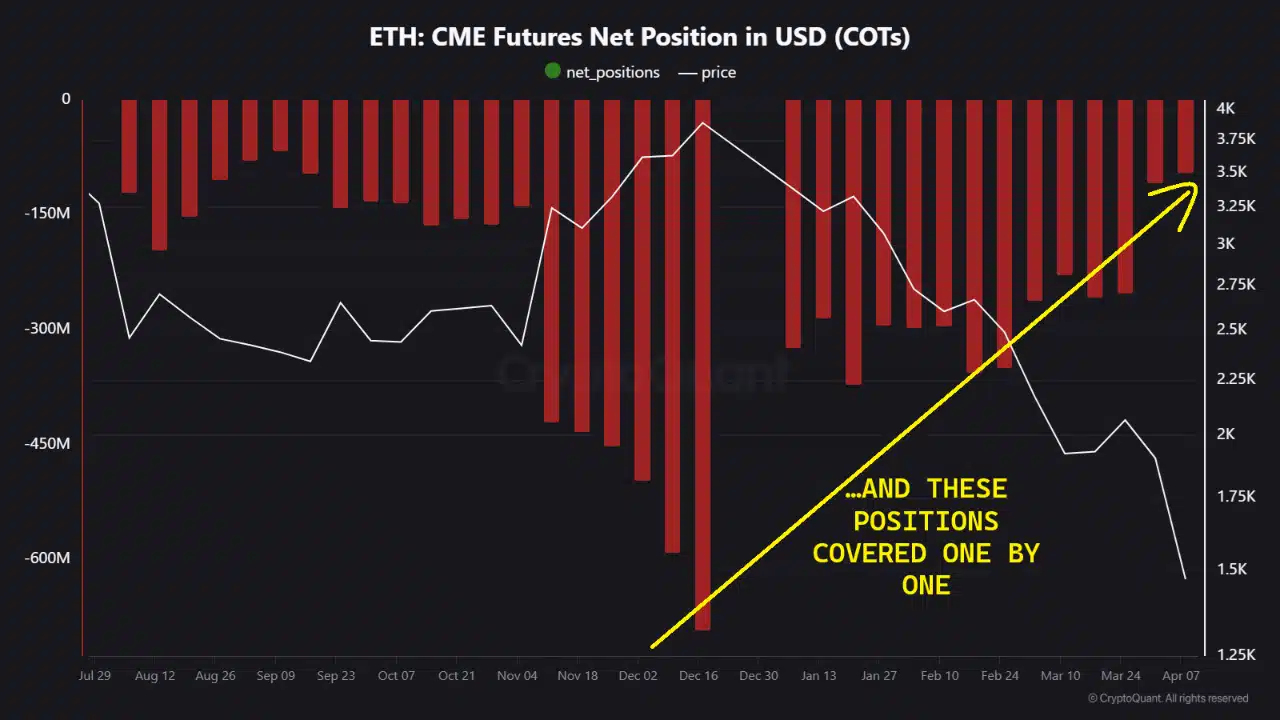

CME Futures foundation has dropped sharply to simply 4–5%, now aligning carefully with U.S. Treasury yields. This collapse heralded the tip of the commerce. Over the previous two months, funds have begun unwinding their structured positions; protecting shorts on CME and offloading spot ETH in tandem.

The once-deep web brief positions (over $600M at their peak) have been progressively lined.

Nonetheless, this hasn’t come low-cost. It contributed considerably to Ethereum’s Q1 value correction as ETF flows dried up and spot market stress mounted.

Not bullish but, however the deck is clearer

The unwinding of CME brief positions is a structural cleanup and NOT a bullish set off. Whereas it eliminated a significant technical headwind, it didn’t fairly inject contemporary shopping for curiosity. With no macro-driven spot demand and tepid ETF flows, Ethereum’s Futures foundation is flat and conviction longs are nonetheless absent.

That being mentioned, ETH is now extra reactive to upside catalysts.

A lukewarm pivot from the Federal Reserve, the approval or influx surge into an Ethereum spot ETF, or a wave of L2 migration and adoption might reignite momentum. With the deck cleared, the following breakout will depend on actual demand stepping in.