Bitcoin gained by over 10% up to now week because it reclaimed the $60,000 price mark on Friday. Following an initially unfavorable efficiency in September, this latest worth rise by the crypto market chief has elicited a lot optimistic sentiments from traders. Nonetheless, a Cryptoquant analyst with the username CRYPTOHELL experiences that this bullish momentum is being challenged by reverse forces driving the BTC market to a crossroads.

Bitcoin Market Forces At A Standstill – What Subsequent?

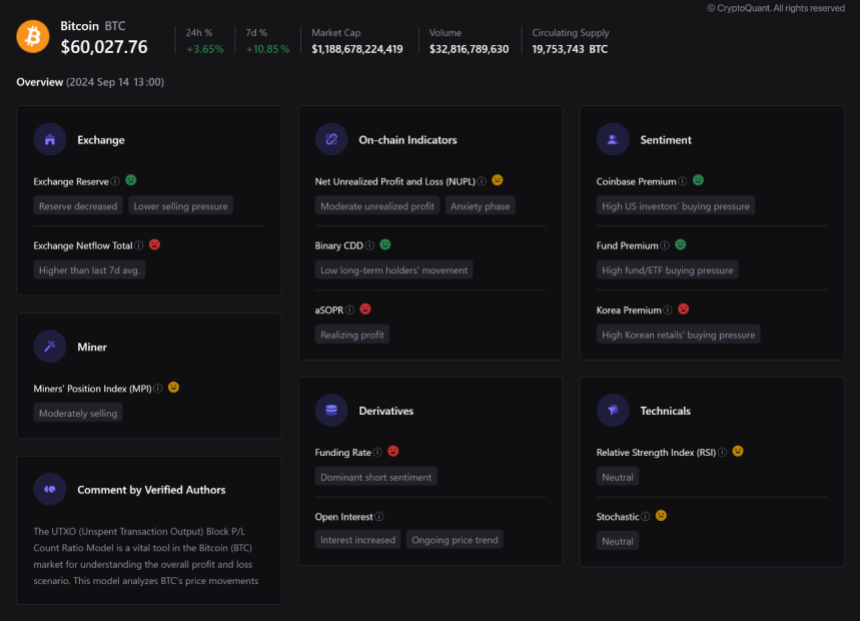

In a Quicktake post on Saturday, CRYPTOHELL said that the present Bitcoin market presents each optimistic and cautionary alerts.

On the optimistic entrance, the crypto analyst notes that there was a lower in BTC exchange reserves which hints at a diminished promoting strain, with traders opting to keep up their holdings in anticipation of a future worth achieve. This bullish sentiment is additional strengthened by a powerful demand from US-based traders as evidently seen within the demand for the Bitcoin spot ETFs and indicated in metrics such because the Coinbase Premium Index.

Alternatively, CRYPTOHELL states there are market developments that will require traders to use some warning.

Firstly, the analyst highlights that there’s a higher-than-average alternate netflows of Bitcoin over the past 7 days, which can point out the presence of some vital promoting strain. Moreover, the Adjusted Spent Output Revenue Ratio (aSOPR), a key metric for assessing market sentiment reveals that there’s a modest stage of revenue realization by traders which signifies a promoting strain on Bitcoin.

As well as, this bearish sentiment is bolstered by the unfavorable funding charges within the derivatives market which signifies that many merchants are taking leveraged brief positions in anticipation of a worth drop.

The presence of those bullish and bearish elements concurrently has pushed the BTC market into “an anxiousness section” the place most traders are unsure concerning the digital asset. Nonetheless, long-term traders are nonetheless largely dormant which is a giant optimistic for the bullish forces.

In conclusion, CRYPTOHELL states the Bitcoin market is at a “choice level”, and with technical indicators additionally presenting a impartial place, future worth actions will probably be probably influenced by vital modifications in market sentiment and essential information probably when it comes to adoption, regulation, and so forth.

BTC Leverage Ratio Hits New Yearly Excessive

In different information, crypto analyst Ali Martinez has reported that the overall estimated leverage ratio of Bitcoin throughout exchanges has attained a brand new yearly excessive. This improvement largely means Bitcoin merchants are taking extra dangers as they open extra positions with borrowed funds. Whereas leveraging usually can result in amplified achieve, it additionally presents the dangers of serious losses which may induce large-scale liquidations. Thus, there’s a want for elevated warning within the BTC market.

On the time of writing, Bitcoin trades at $60,220 with a 0.23% decline within the final day. Notably, Bitcoin’s buying and selling quantity is down by 51.83% and valued at $15.74 billion.

Associated Studying: Bitcoin Price Recovery Hinges On This Key Market Indicator, Reveals Analyst