The Bitcoin recent price volatility, together with a crash beneath $50,000 final month, has considerably slowed down the momentum of the bull run many analysts are anticipating. Regardless of the value lull, a sure crypto analyst believes that the Bitcoin bull run continues to be on observe, predicting a pointy rise to over $100,000 as soon as present value corrections stabilize.

Bitcoin Bull Run Nonetheless Going Robust

Fashionable crypto analyst, CryptoCon sees Bitcoin’s recent price drop as a minor setback, suggesting that the cryptocurrency’s extremely anticipated bull run stays unfazed. The analyst took to X (previously Twitter) on August 28 to make a bullish forecast for Bitcoin, primarily based on its present value habits primarily based on historic development patterns.

Associated Studying

CryptoCon indicated that current market occasions or information involving Bitcoin’s price decline and market volatility could also be distracting for a lot of traders, inflicting them to lose sight of the massive image. The analyst shared an in depth Bitcoin price chart depicting all of the halving cycles from 2013, every clearly displaying an identical bullish sample.

The analyst Recognized a recurring sample in Bitcoin’s value actions earlier than and after every halving cycle, highlighting an preliminary interval of decline followed by an intense bullish momentum. CryptoCon disclosed that in August 2012, Bitcoin’s value witnessed a major bearish dip earlier than climbing to new highs in 2013.

This development was evident within the subsequent halving cycles, with August 2016, and 2020 marked by prolonged durations of “boring” value motion earlier than a dramatic improve to new peaks in 2017, and 2021, respectively. CryptoCon has described this distinctive bullish 12 months because the “Purple Yr.”

The analyst describes 2024 as a “Blue Yr” characterised by steady or unexciting value motion. He indicated that this era is probably going a construct up or preparation part earlier than a “Purple Yr” the place Bitcoin’s price hits a brand new all time excessive.

Drawing from his evaluation of Bitcoin’s historical halving cycles, CryptoCon has notably raised his conservative estimate for the Bitcoin cycle high, adjusting the vary from $90,000 – $130,000 to $110,000 – $160,000.

Different Analysts Share Related Sentiment

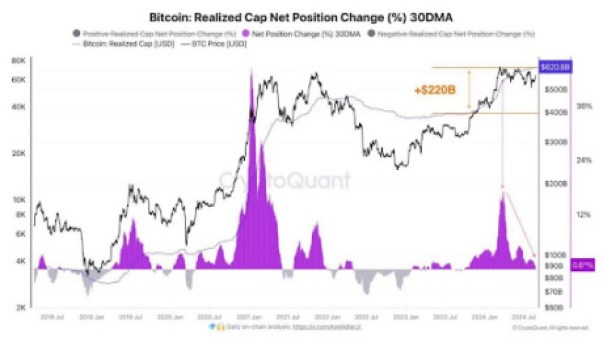

One other crypto analyst recognized as ‘Kyledoops’ on X shares an identical bullish sentiment for Bitcoin’s future value outlook. In line with Kyledoops, Bitcoin’s net capital inflow is slowing down considerably, indicating a fragile state of affairs the place traders’ positive aspects and losses are almost balanced.

Associated Studying

He revealed that traditionally, durations of decreased capital influx, like what Bitcoin is experiencing presently, have usually been adopted by important price fluctuations and volatility spikes. Nonetheless, this lull additionally hints that massive value swings might be simply across the nook for Bitcoin.

As of writing, the value of Bitcoin is buying and selling at $58,051, reflecting a steep 9.07% decline over the previous seven days, based on CoinMarketCap. Regardless of persistent bearish tendencies, the pioneer cryptocurrency stays intent on reaching and stabilizing above the $60,000 value mark.

Featured picture created with Dall.E, chart from Tradingview.com