Following per week of web outflows, the spot Bitcoin ETF market has rebounded with spectacular web inflows this week, highlighting a rising investor confidence in Bitcoin and its related monetary merchandise. This week’s market actions have proven a outstanding reversal from the earlier 5-day net outflow streak, with Tuesday witnessing a considerable web influx of $480 million, adopted by $243.5 million on Wednesday.

Yesterday’s resurgence in investor curiosity was notably boosted by Blackrock’s huge influx of $323.8 million, successfully offsetting Grayscale GBTC’s $299.8 million outflows. Furthermore, Ark Make investments’s ARKB reported its finest day but, with $200 million in inflows, regardless of Constancy experiencing its worst day with a mere $1.5 million in outflows. Nonetheless, Constancy managed to bounce again with vital inflows of $261 million and $279 million on Monday and Tuesday, respectively.

Yesterday’s ETF flows had been constructive for $243.5 million.

Blackrock lastly wakened once more for $323.8 million fully cancelling out $GBTC‘s $299.8 million outflows.

Ark had their finest day but with $200 million. Constancy had its worst day with $1.5 million.

Value dumped on… pic.twitter.com/LLChkITN7q

— WhalePanda (@WhalePanda) March 28, 2024

1% Down, 99% To Go For Bitcoin ETFs

Nevertheless, in response to Bitwise Chief Funding Officer (CIO) Matt Hougan, that is simply the mere starting of what’s to come back within the upcoming months. Hougan’s commentary, a part of his weekly memo to funding professionals, sheds gentle on the present market dynamics and the colossal potential that lies forward. “1% Down; 99% to Go,” Hougan wrote, highlighting the nascent but promising journey of Bitcoin ETFs.

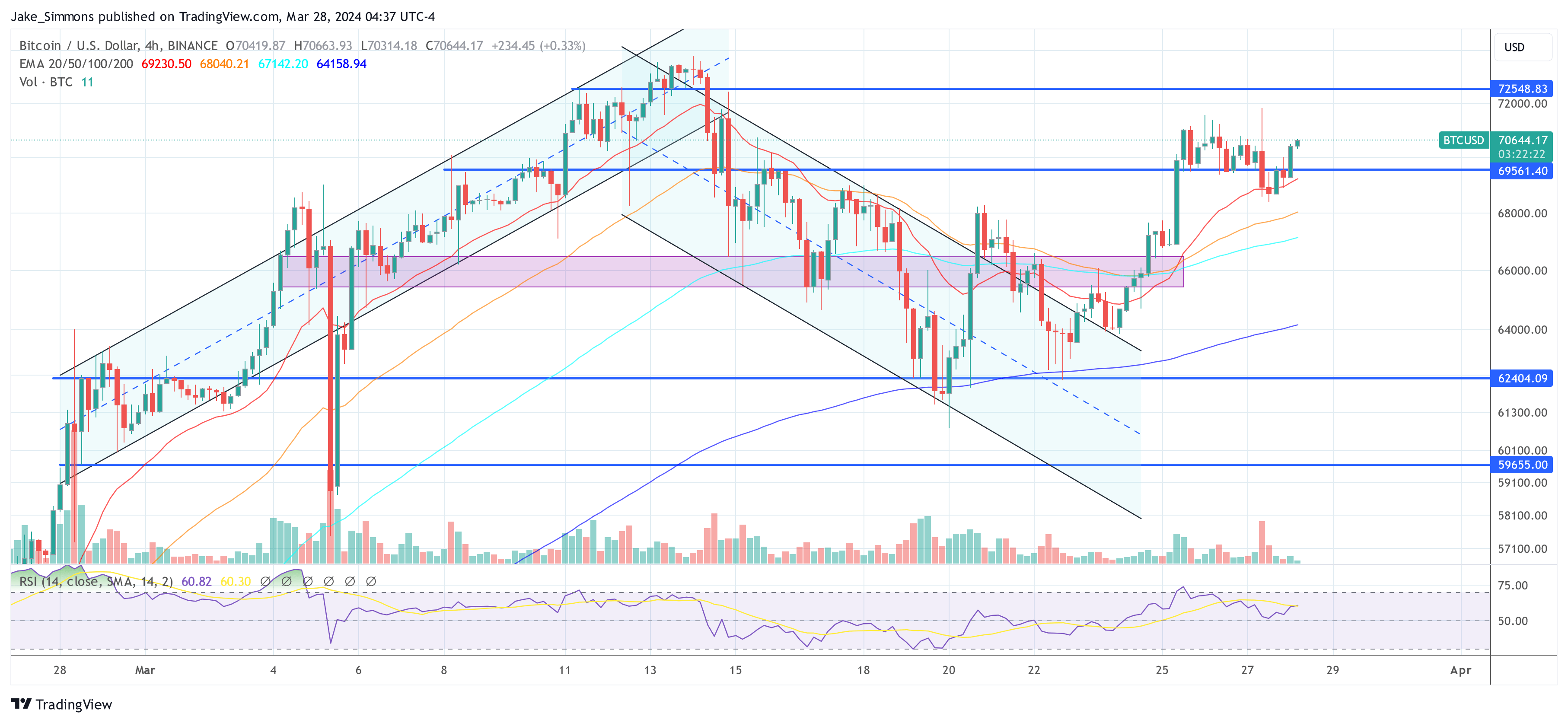

Recently, the market has been characterised by its volatility, with Bitcoin’s worth oscillating between $60,000 and $70,000. Hougan advises a relaxed and long-term perspective amidst this fluctuation, particularly because the sector anticipates the upcoming Bitcoin halving round April 20, the approval of Bitcoin ETFs on nationwide account platforms, and the soon-to-come completion of due diligence by varied funding committees.

Regardless of the present sideways motion of Bitcoin’s worth, Hougan stays bullish about its long-term trajectory. “Bitcoin is in a raging bull market,” he asserts, noting an almost 300% improve over the previous 15 months. The launch of spot Bitcoin ETFs in January has marked a major milestone, opening up the Bitcoin market to funding professionals on an unprecedented scale.

Hougan’s evaluation factors to a profound shift as world wealth managers, who collectively management over $100 trillion, start to discover investments within the “digital gold.” He means that even a conservative allocation of 1% of their portfolios to Bitcoin might end in roughly $1 trillion of inflows into the area.

This attitude is backed by historic information exhibiting that even a 2.5% allocation to Bitcoin has enhanced the risk-adjusted returns of conventional 60/40 portfolios in each three-year interval of Bitcoin’s historical past.

The latest inflows into Bitcoin ETFs, although spectacular, are seen by Hougan as merely the start of a a lot bigger motion. “We’re all excited in regards to the $12 billion that has flowed into ETFs since January. And it’s thrilling: Collectively, probably the most profitable ETF launch of all time..However think about world wealth managers allocate simply 1% of their portfolios to bitcoin on common,” Hougan elaborates, emphasizing the dimensions of potential development awaiting the cryptocurrency market. He concludes:

Take into consideration the implications. […] A 1% allocation throughout the board would imply ~$1 trillion of inflows into the area. In opposition to this, $12 billion is barely a down fee. 1% down, 99% to go.

At press time, BTC traded at $70,644.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.