- Bitcoin ETFs noticed robust inflows, with $298M internet influx on the thirty first of July.

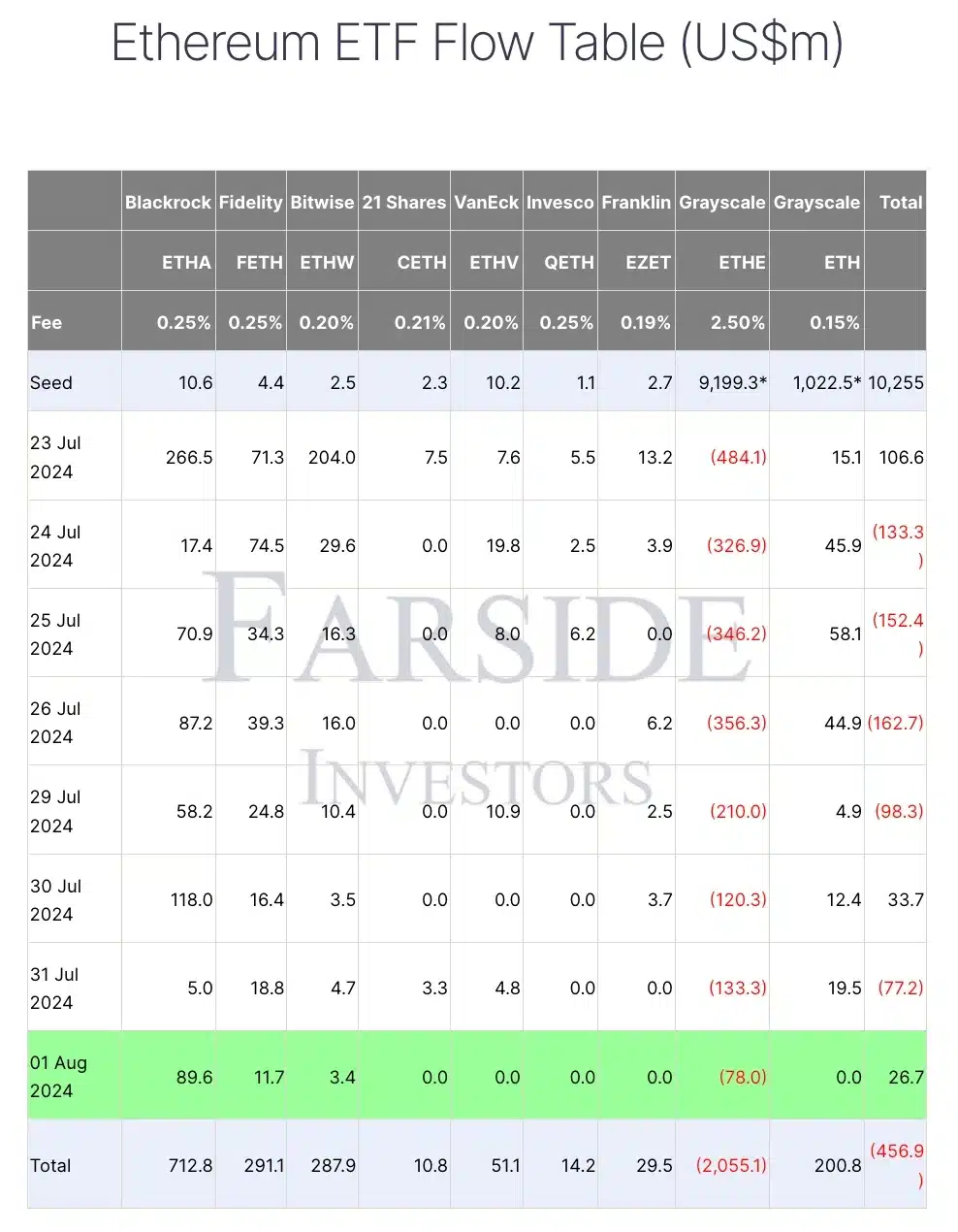

- Alternatively, Ethereum ETFs skilled outflows of $77.2M on the thirty first of July.

On the primary day of August, Bitcoin [BTC] ETFs skilled vital inflows, with $50.6 million pouring into spot Bitcoin ETFs.

Notably, BlackRock’s IBIT ETF led the cost, capturing $25.9 million in inflows as per Farside Investors.

Bitcoin ETF move evaluation

This pattern mirrored a broader sample of Bitcoin ETFs steadily accumulating BTC, regardless of a short decline in early June. For the reason that 1st of July, inflows have surged, outpacing the averages of the earlier two months.

Infact, on the thirty first of July, spot Bitcoin ETFs noticed a internet influx of $298 million, together with $17.99 million into the Grayscale mini ETF BTC and $20.99 million into BlackRock’s IBIT, per SoSo Value.

Expressing optimism in regards to the growth, X (previously Twitter) account Crypto Empire, a distinguished crypto content material hub, shared,

“That’s fairly the monetary rollercoaster! Attention-grabbing to see the completely different actions within the ETFs for Bitcoin.”

Affect on BTC

Nonetheless, BTC skilled a bearish motion on the worth entrance, dropping to the $62K level on 1st August.

By press time, it had recovered to $64K, although the day by day charts remained within the purple, reflecting a modest 0.30% decline over the previous 24 hours.

Ethereum ETF evaluation

Apparently, the efficiency of BTC ETFs contrasted sharply with that of Ethereum [ETH] ETFs.

Whereas the ETH ETF recorded inflows of $26.7 million on the first of August, it had seen vital outflows of $77.2 million only a day earlier, on the thirty first of July.

Consequently, ETH’s day by day worth chart confirmed purple candlesticks, indicating a decline. On the newest replace, ETH was down by roughly 1% over the previous 24 hours, buying and selling at $3,142.

Remarking on the identical, George from StepFinance famous,

“If you would like a retailer of worth narrative sound cash and so on. theres btc. If you would like some decentralised world laptop for constructing apps there’s solana. Theres no place for eth in that world.”

Right here, George is underlining that Ethereum doesn’t have a novel or mandatory perform in a market dominated by Bitcoin and Solana [SOL].

Thus, with steady inflows into Bitcoin ETFs, will probably be intriguing to observe whether or not ETH ETFs can surpass BTC or if BTC will proceed to steer within the ETF race.