- Bitcoin has been hovering just under dense quick liquidation clusters between $83,100 and $83,500

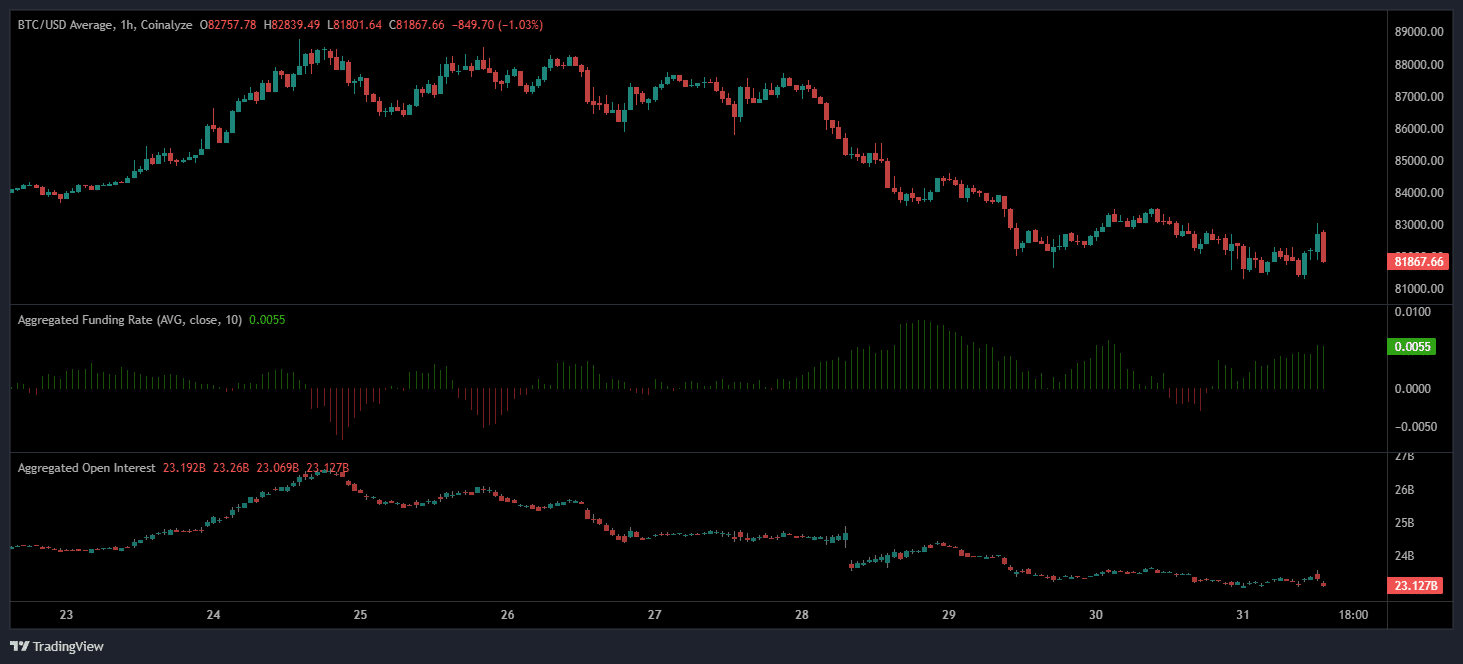

- Open curiosity dropped by 9% in a single week, highlighting dealer exit or liquidation strain

Bitcoin [BTC] is nearing a important threshold, with its value now near tightly packed quick liquidation ranges.

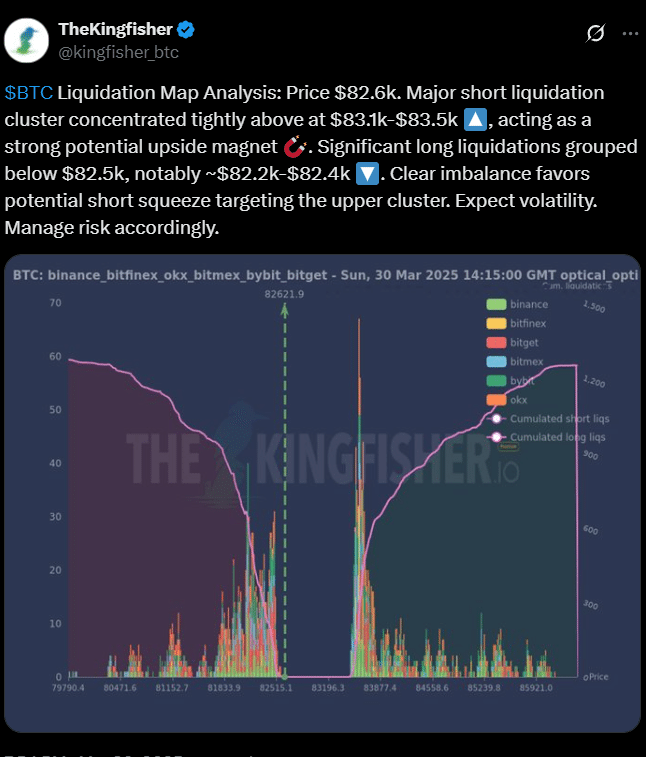

The truth is, on 30 March, TheKingfisher placed Bitcoin at $82,621.9, with the cryptocurrency positioned between two opposing liquidation zones on the charts.

On the time of writing, the quick positions cluster was between $83,100 and $83,500, whereas the lengthy liquidations stretched under $82,400. This compression units the stage for additional volatility on the charts.

A squeeze ready to occur?

Zooming into the chart construction, the imbalance appeared to be clear.

The quick liquidation band sat simply 0.6–1.1% above spot. In the meantime, lengthy publicity appeared to be extra broadly dispersed. This creates an asymmetrical strain zone favoring bulls if the higher boundary is breached.

Now, contemplate how this unfolds throughout buying and selling platforms.

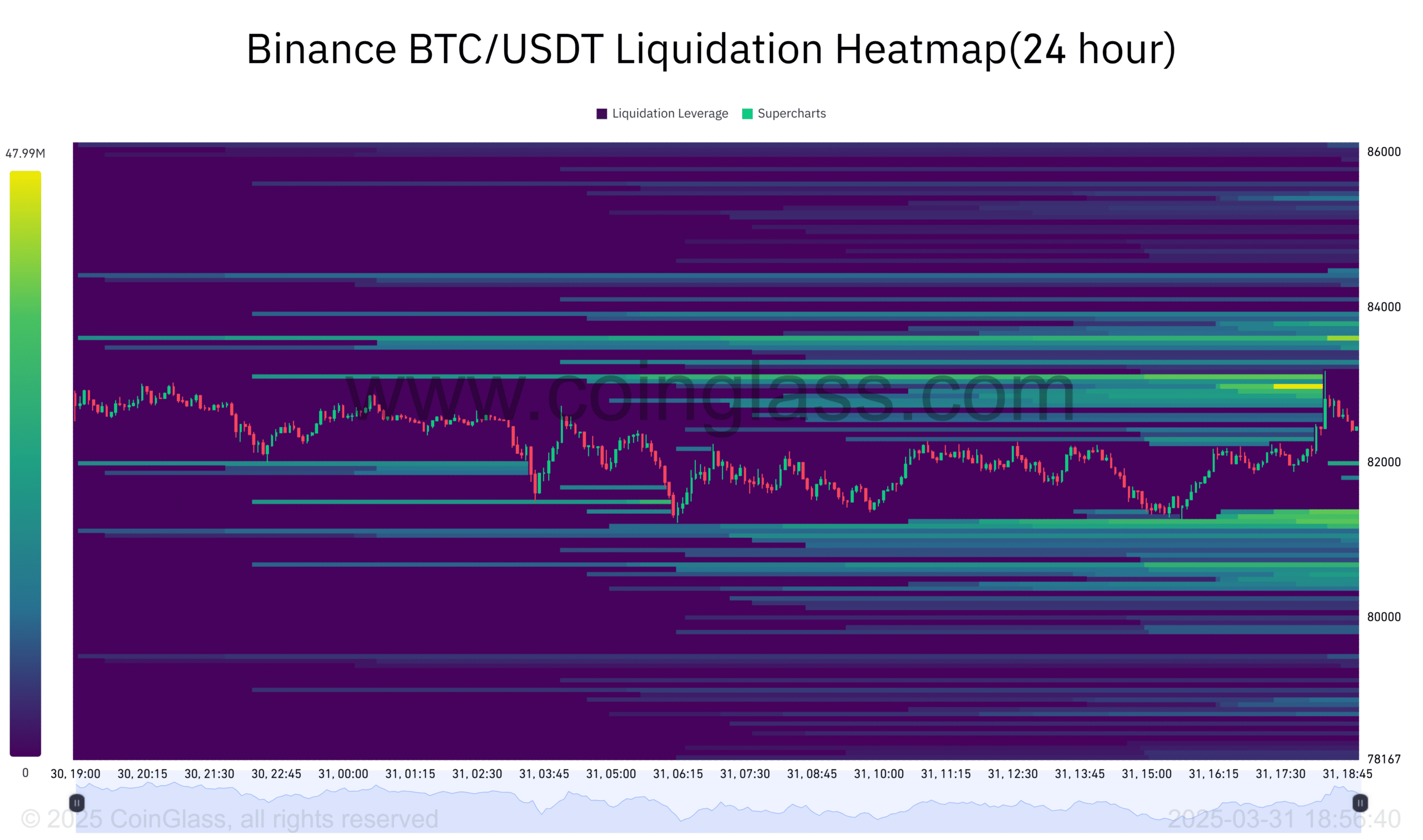

Binance and Bybit highlighted essentially the most concentrated quick positions, primarily based on color-coded zones within the heatmap. This steered platform-specific threat. If value begins to climb, these clusters might set off stop-outs first – Pushing Bitcoin right into a pressured shopping for cycle.

Assist for this setup comes from intraday heatmap exercise too.

Coinglass knowledge additionally confirmed that Bitcoin rose from $80,673 to $83,618 on 31 March. Liquidation leverage surged to $35.43M throughout this transfer. The timing wasn’t random although, as most exercise occurred between 15:15 and 18:30.

A surge… or simply the beginning?

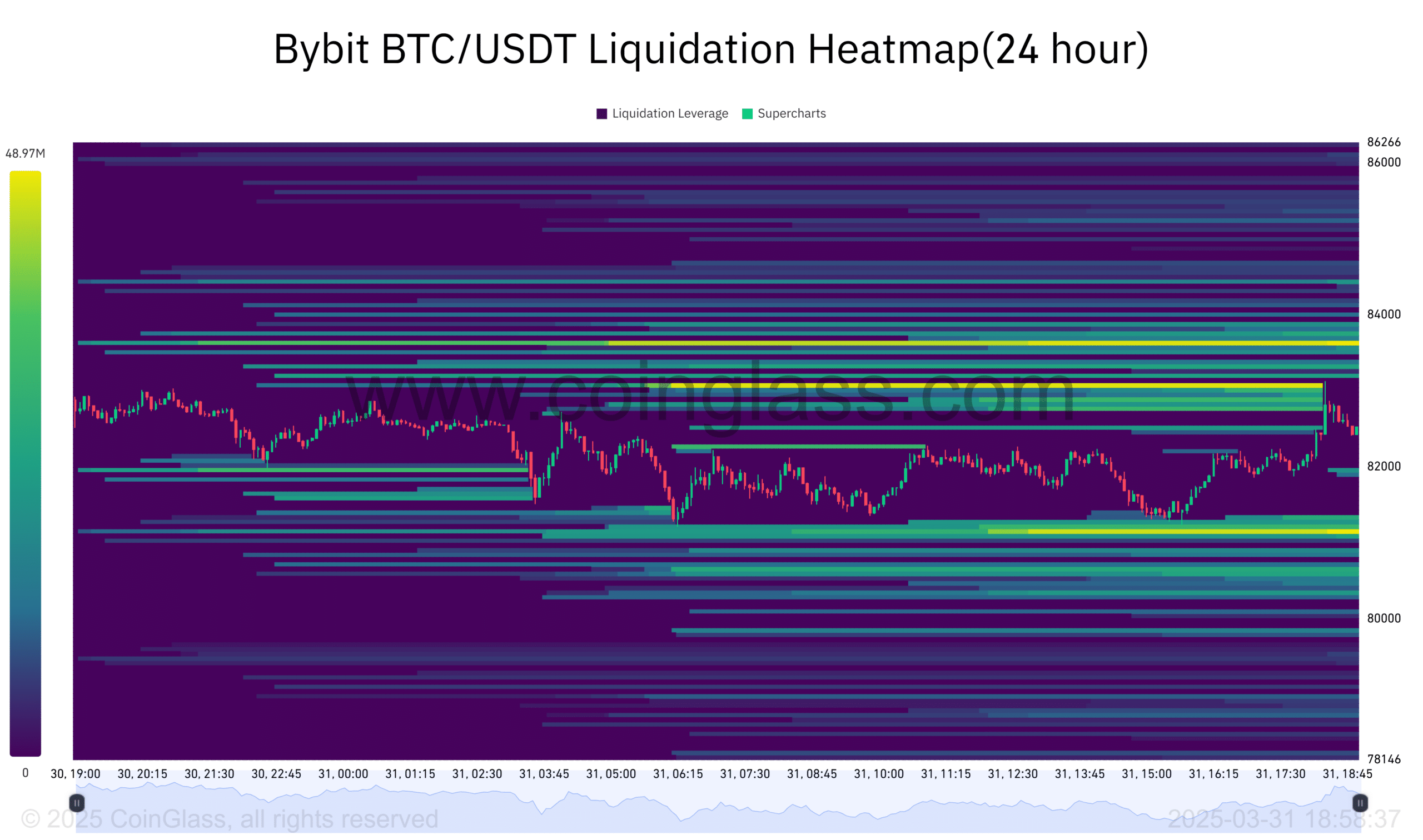

Layer in Bybit’s numbers, and the sign strengthens.

The truth is, a separate heatmap recorded the session’s peak at $83,642. Liquidation leverage hit $48.98M, with over 70% of complete liquidations packed between $81,000 and $83,600.

This appeared to verify that leveraged quick positions had been stacked close to its press time ranges.

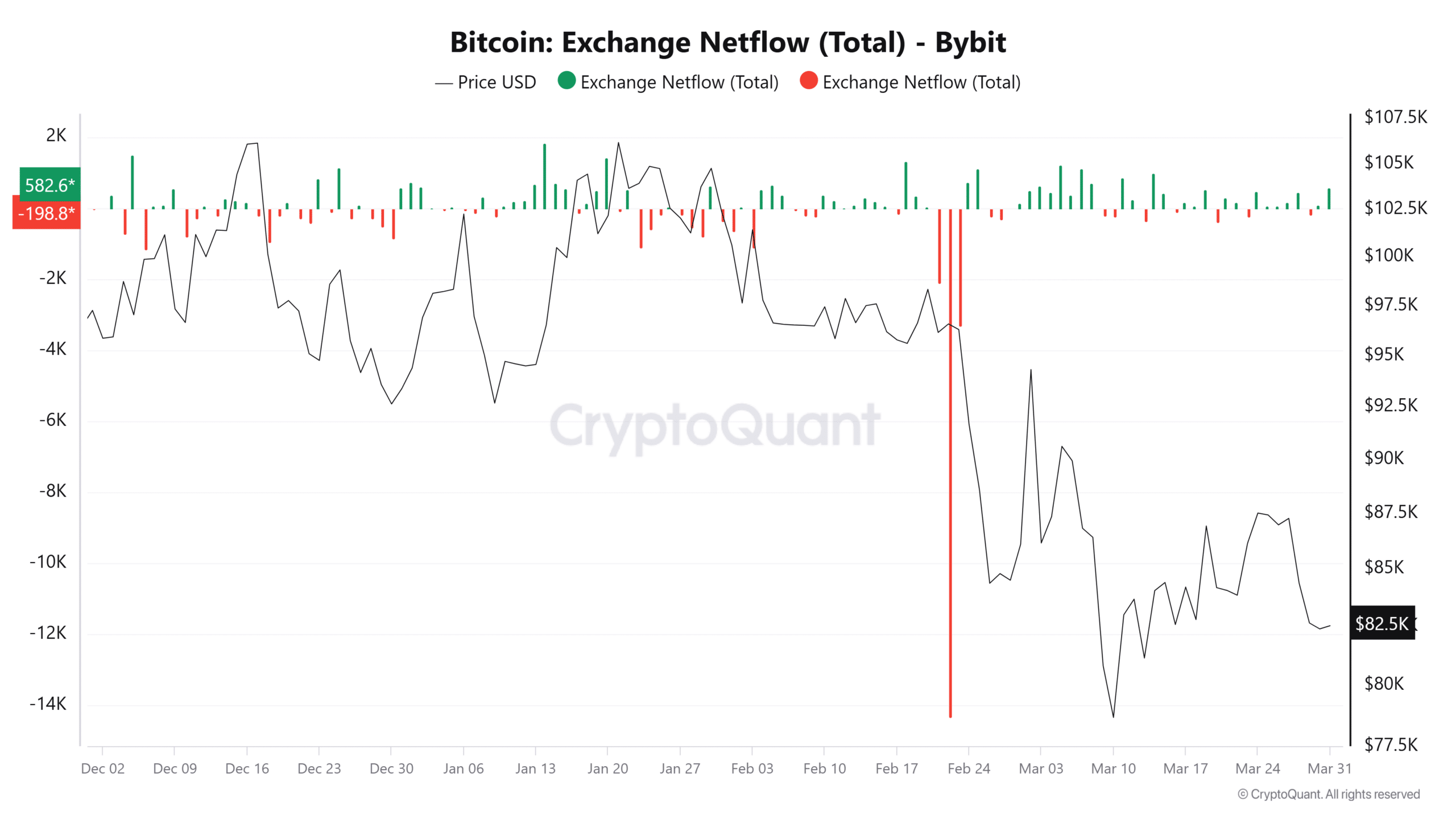

What sits behind this leverage although? Nicely, Trade Netflows may provide a clue.

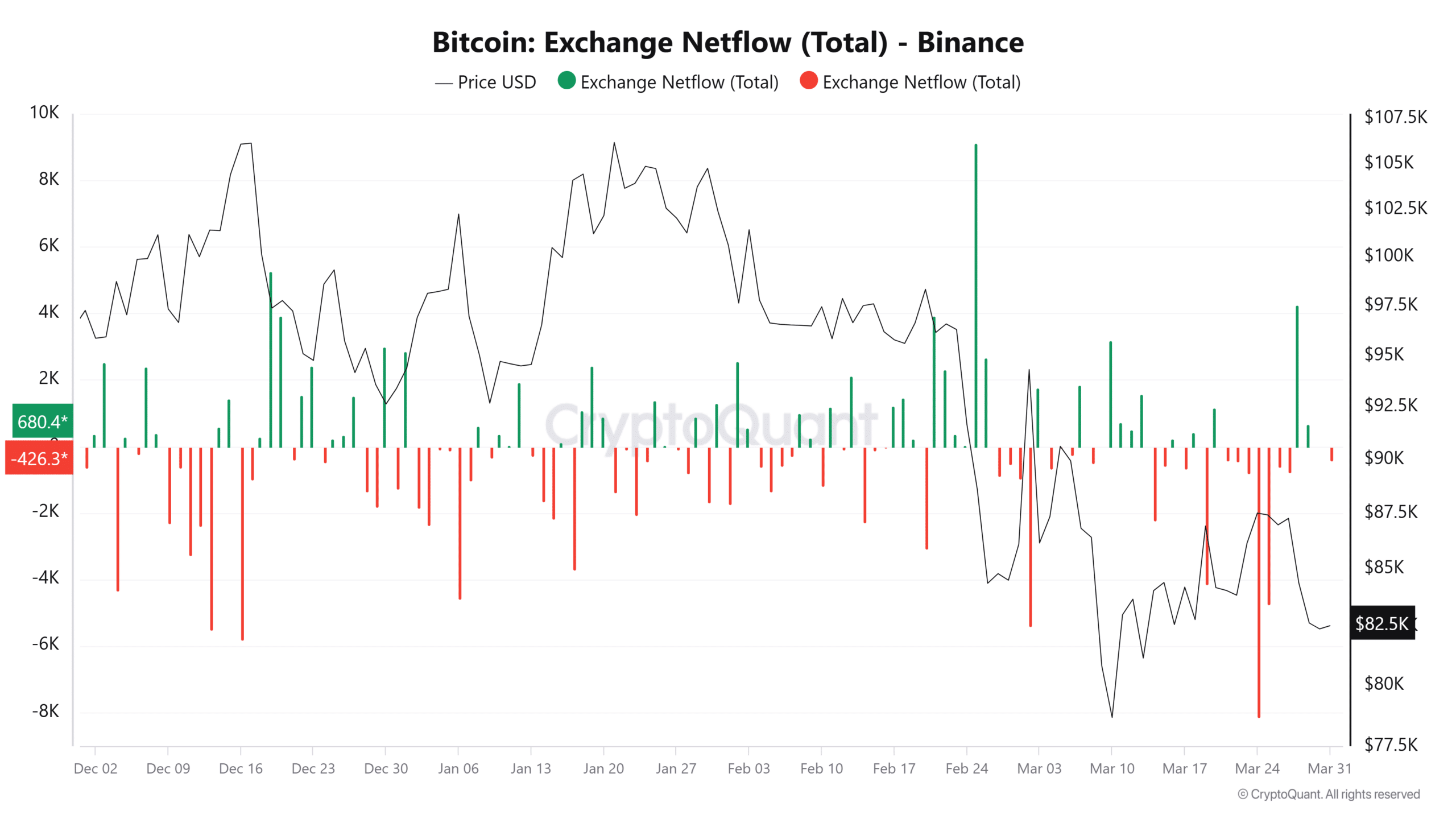

In keeping with CryptoQuant, as an illustration, Bitcoin outflows have dominated Binance and Bybit since February.

Merchants have been pulling belongings amid the cryptocurrency’s falling costs.

Even after inflows of 4,258 BTC on 28 March, the market has remained beneath strain – An indication that these had been probably short-term positioning inflows, not long-term accumulation.

Look again to see ahead

Zoom out additional, and the worth development highlighted this sentiment.

Since peaking at $106,164 on 21 January, Bitcoin has dropped by 22%, closing March at $82,500. This decline appeared to be in step with persistent outflows and growing liquidation occasions.

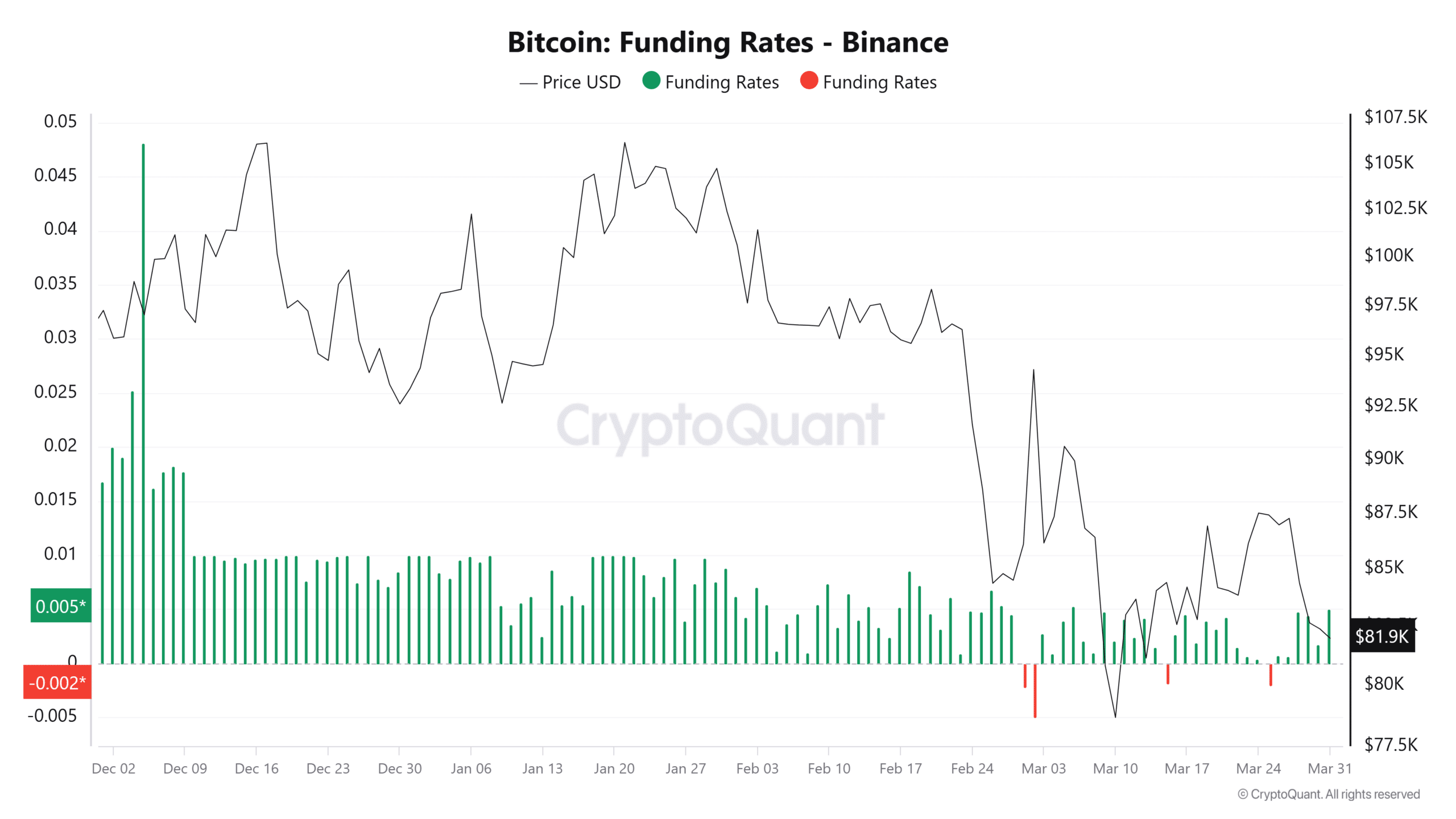

Then, there’s the funding fee.

Between 24-28 March, charges had been damaging—indicating short-dominant sentiment. Nonetheless, by 30 March, that flipped. Constructive funding charges now imply rising lengthy publicity. It’s a key sentiment shift. Shorts could also be closing, and longs could also be starting to re-enter.

Pair this with Open Curiosity and the image sharpens.

The calm earlier than the transfer?

Open curiosity fell from $25.39 billion to $23.12 billion during the last week of March. The sharpest decline got here on 28 March. That drop indicated massive place closures or liquidations.

As Open Curiosity falls and funding rises, it typically marks the early levels of market repositioning.

Shorts outweighed longs by 1.5–2x, triggering a setup traditionally linked to 60–65% upward volatility, as per TheKingfisher. Present liquidation clusters meet that threshold, with a key resistance at $83,100.

A break above $83,100 could push Bitcoin in the direction of $83,500, with low resistance extending to $83,877. Heatmap knowledge revealed minimal order friction on this vary, resembling prior quick squeezes.

If Bitcoin fails to clear resistance, bearish sentiment could return. Particularly if funding flips damaging or inflows decline. Nonetheless, with compressed shorts, optimistic funding, and aligned heatmaps, the short-term bias could be leaning bullish.

Therefore, market timing stays important. And, the window for upside is narrowing.