- BTC fashioned an fascinating accumulation sample seen earlier than 2024 rallies.

- Lengthy-term holders scooped 150K BTC in April, whereas U.S. greenback liquidity recovered.

Bitcoin [BTC] has flirted with the $97K degree for the primary time since February, bringing it solely 3.5% away from the $100K mark. Curiously, extra on-chain metrics urged that $100K was inside attain.

Particularly, CryptoQuant highlighted that the short-term holders’ (1 day to 1 week) accumulation pattern in Q2 2025 mirrored patterns that triggered value rallies in early and late 2024.

The chart confirmed that every time short-term holder accumulation made a better excessive, it was adopted by a BTC value surge in Q1 and This autumn 2024. Per CryptoQuant,

“If this pattern continues within the brief time period, Bitcoin could also be on observe to interrupt above $100K and enter a robust upward part.”

Bitcoin’s bullish cues

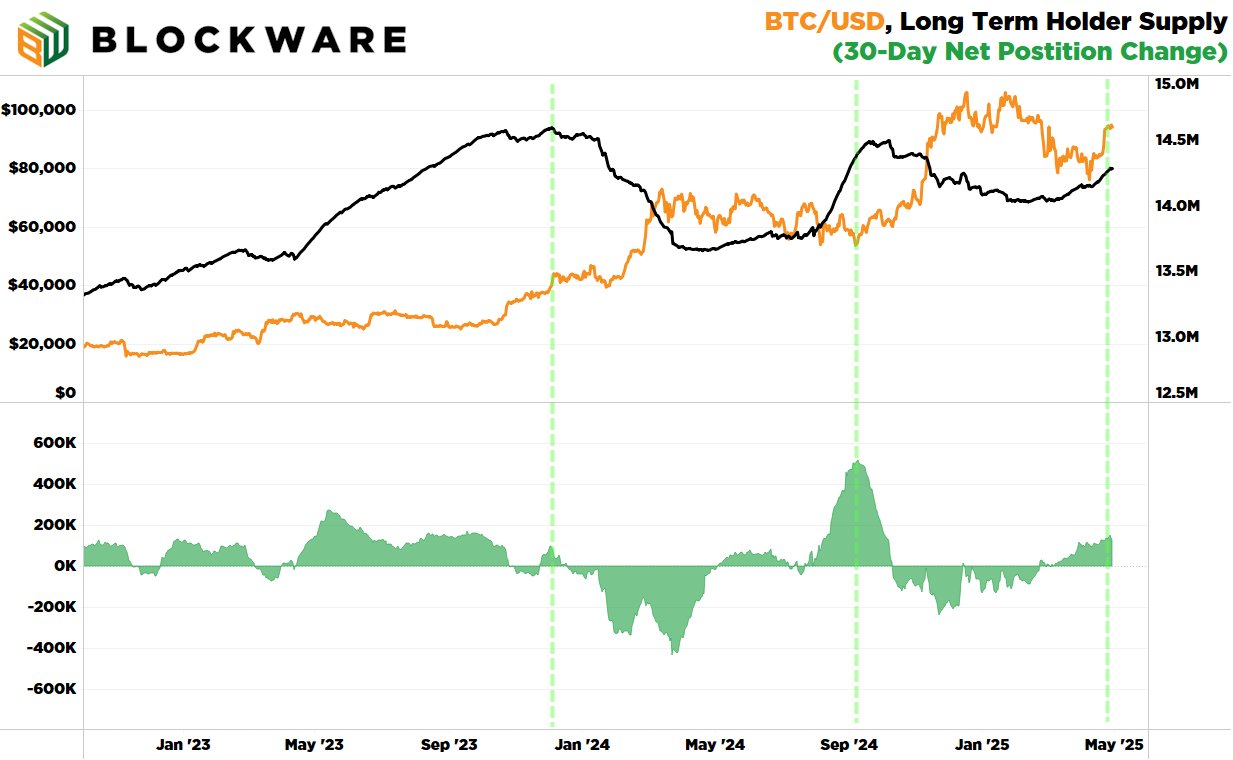

Bitcoin mining system supplier, Blockware, shared an identical bullish outlook. The agency famous that long-term holder provide was rising.

This meant the main promoting strain from worthwhile long-term holders (held BTC for over 6 months) was easing. In actual fact, BTC analyst Robert Breedlove said,

“Over the previous 30 days long-term holders have acquired ~150,000 extra BTC. Bitcoin is working out of sellers within the $80k to $100k vary.”

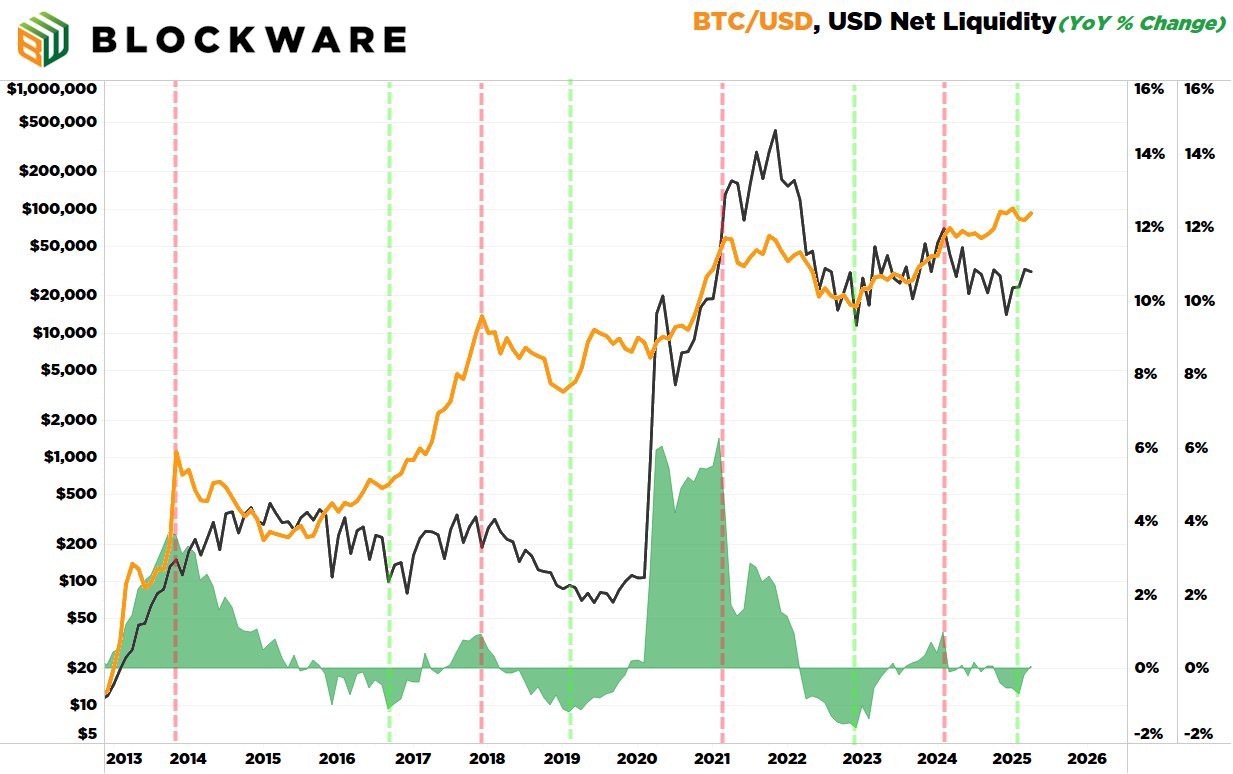

However maybe probably the most essential demand issue was the rebound in U.S. greenback liquidity. The Blockware chart confirmed a optimistic correlation between BTC and U.S. liquidity.

For instance, the huge spike in U.S. greenback liquidity in 2020-2021 led to the huge BTC rally to $69K from $3.5K.

The liquidity contracted in late 2024 and early 2025, however appeared to rebound in Q2 2025. If the liquidity pattern continues, it may enhance BTC bids and gasoline additional upward momentum.

On the value chart, the 4-hour Tremendous Pattern indicator was in ‘purchase’ mode on the time of writing. In addition to, value motion was above key transferring averages, suggesting that bulls had the market edge.

Taken collectively, on-chain and technical indicators leaned on the bulls’ aspect, and an additional rally to $100K might be doubtless within the brief time period.