- The Bitcoin sell-side ratio and transferring averages trace at a doable market rally.

- The adjusted spent output revenue ratio (aSOPR) reveals that long-term merchants are promoting at a loss.

Bitcoin [BTC] has maintained comparatively secure efficiency during the last 24 hours, dropping barely by 0.84%, exhibiting clear indicators of exhaustion out there.

A number of indicators now counsel {that a} rally is close to and in movement, with Bitcoin doubtlessly extending its transfer additional.

Has Bitcoin bottomed but?

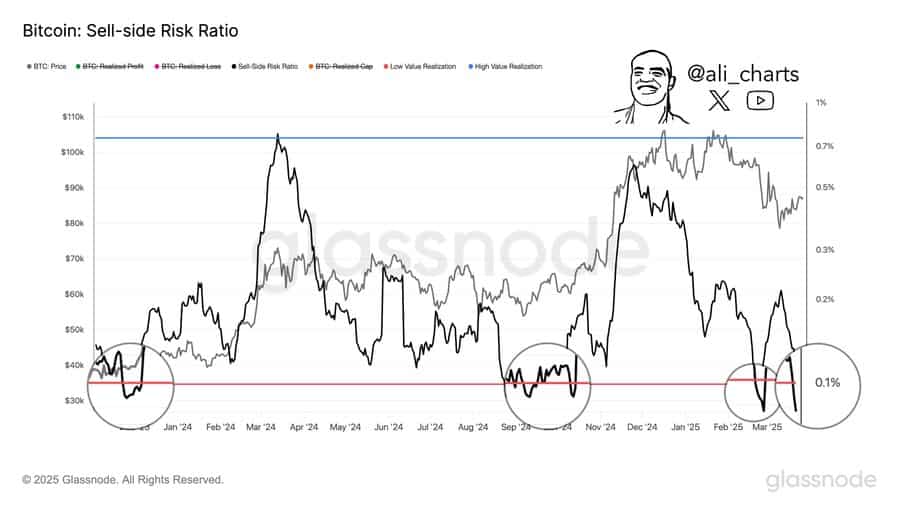

One vital metric aligning with the bullish narrative is the sell-side ratio. This ratio compares investor spending inside a particular interval to the realized market capitalization.

Traditionally, when this stage drops to the 0.1% area or under, it usually indicators the beginning of a significant worth rally. Presently, the sell-side ratio is at 0.086%, implying that Bitcoin may resume its rally quickly.

Including to this bullish outlook is the adjusted spent output revenue ratio (aSOPR), which lately crossed under 1, with a studying of 0.99—indicating that merchants are promoting at a loss.

Promoting at a loss usually forces the market upward as Bitcoin is gathered at a reduction.

Whereas these indicators stay bullish and counsel a rally might be close to, AMBCrypto’s evaluation reveals that merchants could also be ready for the optimum shopping for alternative.

The Bitcoin Market Worth to Realized Worth (MVRV) momentum (70-day) indicator helps decide this prime alternative. A serious worth run sometimes begins when the MVRV crosses above its 70-day transferring common.

If this occurs, Bitcoin may begin making increased highs, growing its total month-to-month acquire, presently at 4.32%, in response to CoinMarketCap.

Market exercise stays low

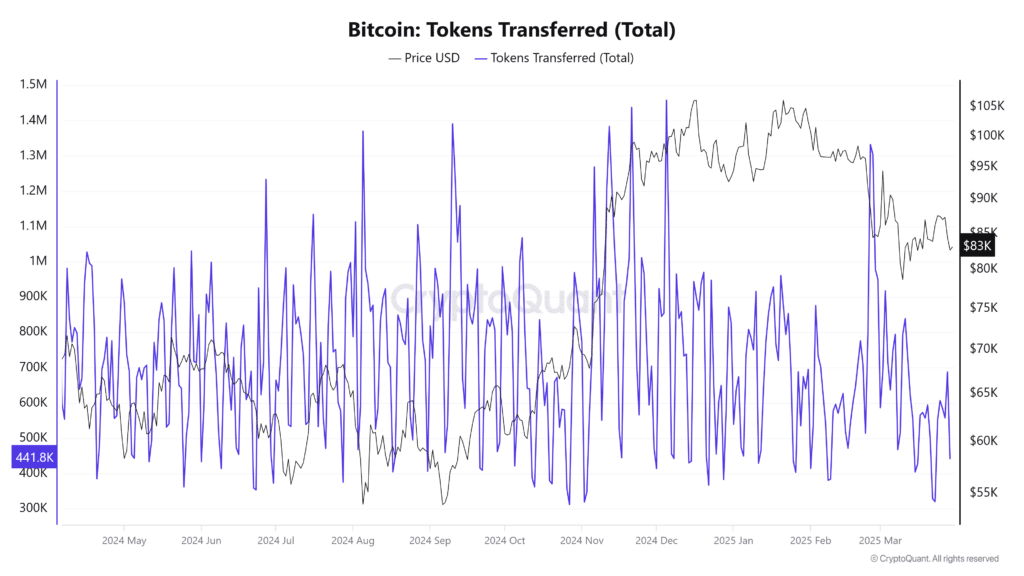

Market exercise stays subdued, with fewer transactions occurring, indicating a scarcity of momentum to push Bitcoin ahead.

On the time of writing, the quantity of BTC being transferred has dropped considerably, presently at roughly 441,000 BTC—a pointy decline from earlier highs.

If market momentum continues to say no, the probability of a sustained rally stays slim. For a rally to happen with full pressure, each quantity and worth should rise concurrently.

A divergence between the 2 would point out weak momentum, making a rally unlikely.