- Traditionally, Bitcoin has famous a 50% correction after reaching a brand new excessive in Open Curiosity.

- It’s the starting of a brand new cycle- is that this cause sufficient for Bitcoin to not repeat historical past?.

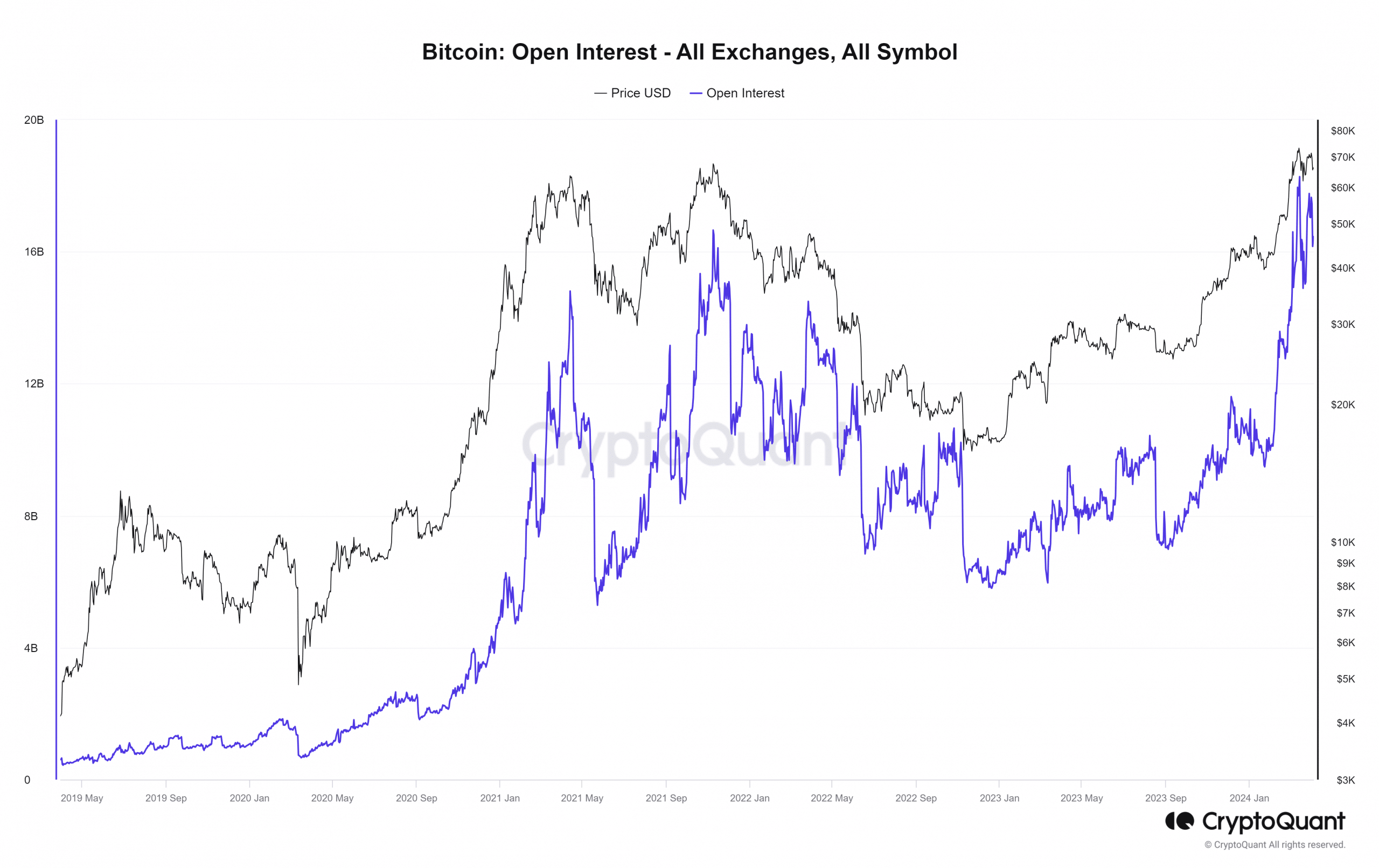

Bitcoin [BTC] famous a 6.8% drop previously two days even after accounting for the bounce from $64.5k to $66.5k. An Insights post on CryptoQuant drew consideration to the truth that every time the Open Curiosity (OI) pushed above the $13 billion mark, the Bitcoin market witnessed vital corrections.

The OI reached $17.7 billion on the twenty eighth of March. This was adopted by the losses we noticed previously few days. With a superb chunk of retail members purged from the futures markets, will BTC see a restoration, or development downward for the following two months?

Bitcoin Open Curiosity previous the $13 billion mark as soon as extra

Supply: CryptoQuant

Because the Insights submit factors out, at any time when BTC OI climbs previous $13 billion, we see a serious correction. This was as a result of the acute highs in OI are achieved when the market is in a state of euphoria or has grown significantly bigger.

The 2021 Open Curiosity peaks reached $14.8 billion in April 2023 and $16.6 billion in November 2021. Each instances, BTC witnessed a 50% retracement within the subsequent 70 days.

The current OI surge measured $18.2 billion, however that doesn’t mechanically imply we’d see a 50% drop within the subsequent two months. In the course of the 2020 rally, the OI breached earlier highs convincingly. This implied the capital influx was a number of instances better than it was earlier than.

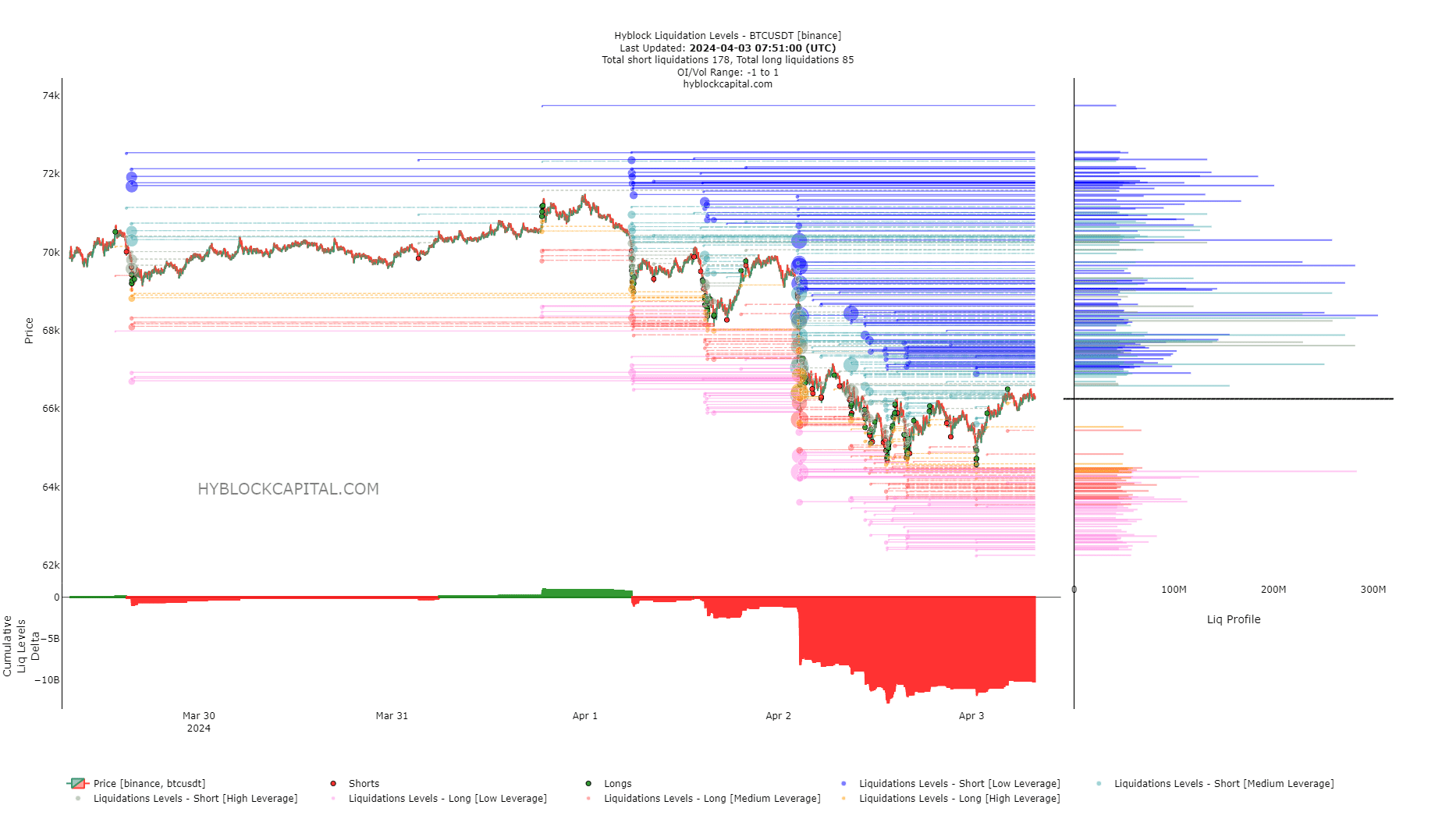

The liquidation charts argue for a bullish short-term reversal

Supply: Hyblock

The rationale excessive OI sees giant volatility is as a result of worth is drawn to liquidity. When a market is propped up by demand from the spot market, vital volatility in a brief period of time is tough as a result of spot market orders.

When the market is close to a neighborhood prime, and costs are pushed larger by curiosity within the futures market however a lot much less spot demand, the opportunity of liquidation cascades vastly will increase. That is one thing members ought to concentrate on.

At press time, the cumulative liq ranges delta was extremely unfavorable. Quick liquidations outnumber lengthy liquidations by a superb margin. Subsequently, costs may very well be attracted higher to wipe out the bears.

The $68.2k, $69.6k, and $70.3k are ranges that BTC might rally to within the coming days. There was an enormous focus of quick liquidations at these ranges that may very well be swept.

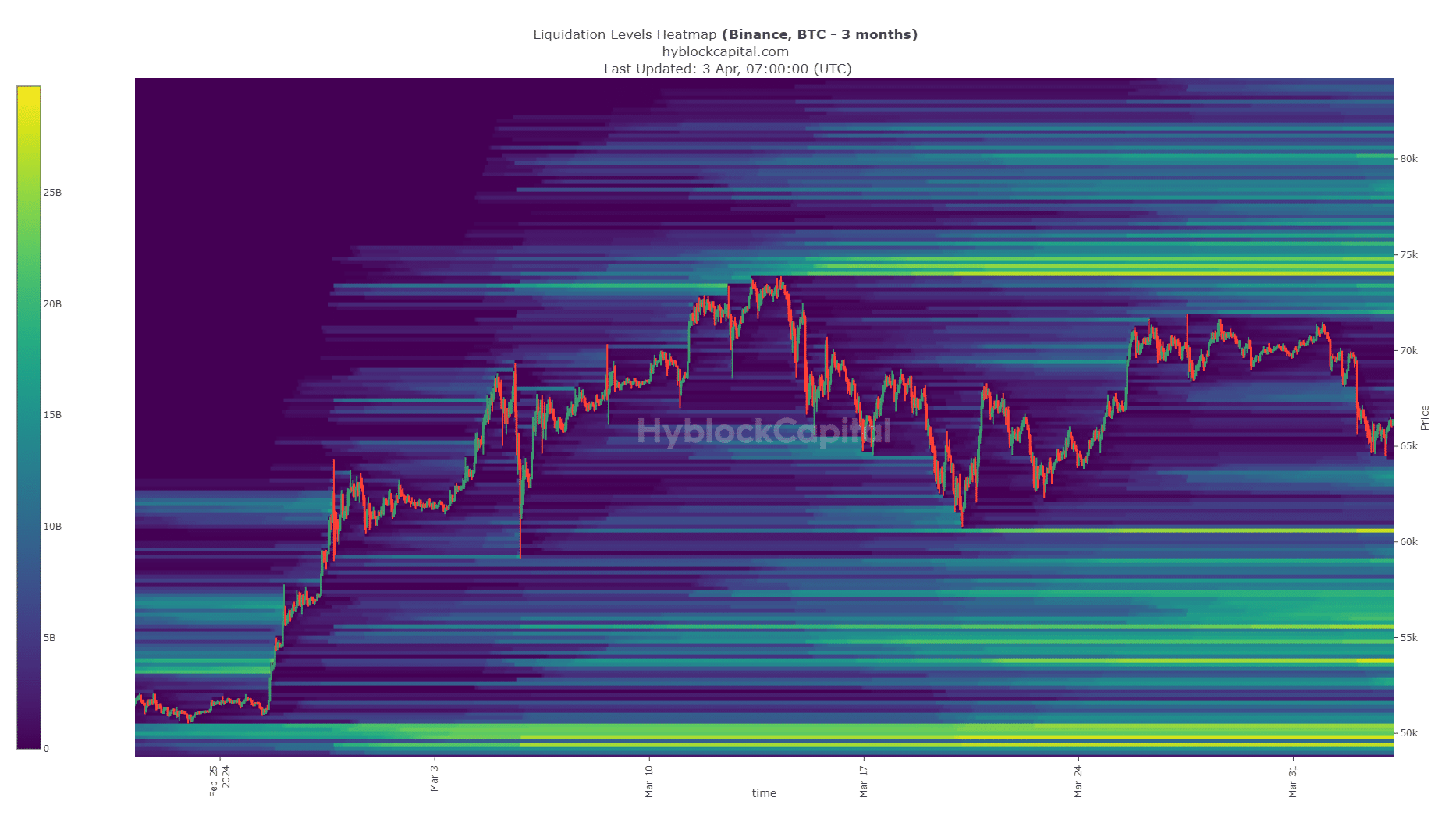

Supply: Hyblock

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

The longer-term outlook for Bitcoin highlighted two areas of curiosity. To the south, it was the $60.6k area whereas the $74k-$74.6k zone to the north would show key.

With the Bitcoin halving occasion slightly below three weeks away, we may very well be in for extra volatility earlier than the true bull run begins.