- Bitcoin retail investor quantity alongside its value rising.

- BTC completely swept liquidity triggering excessive slippage.

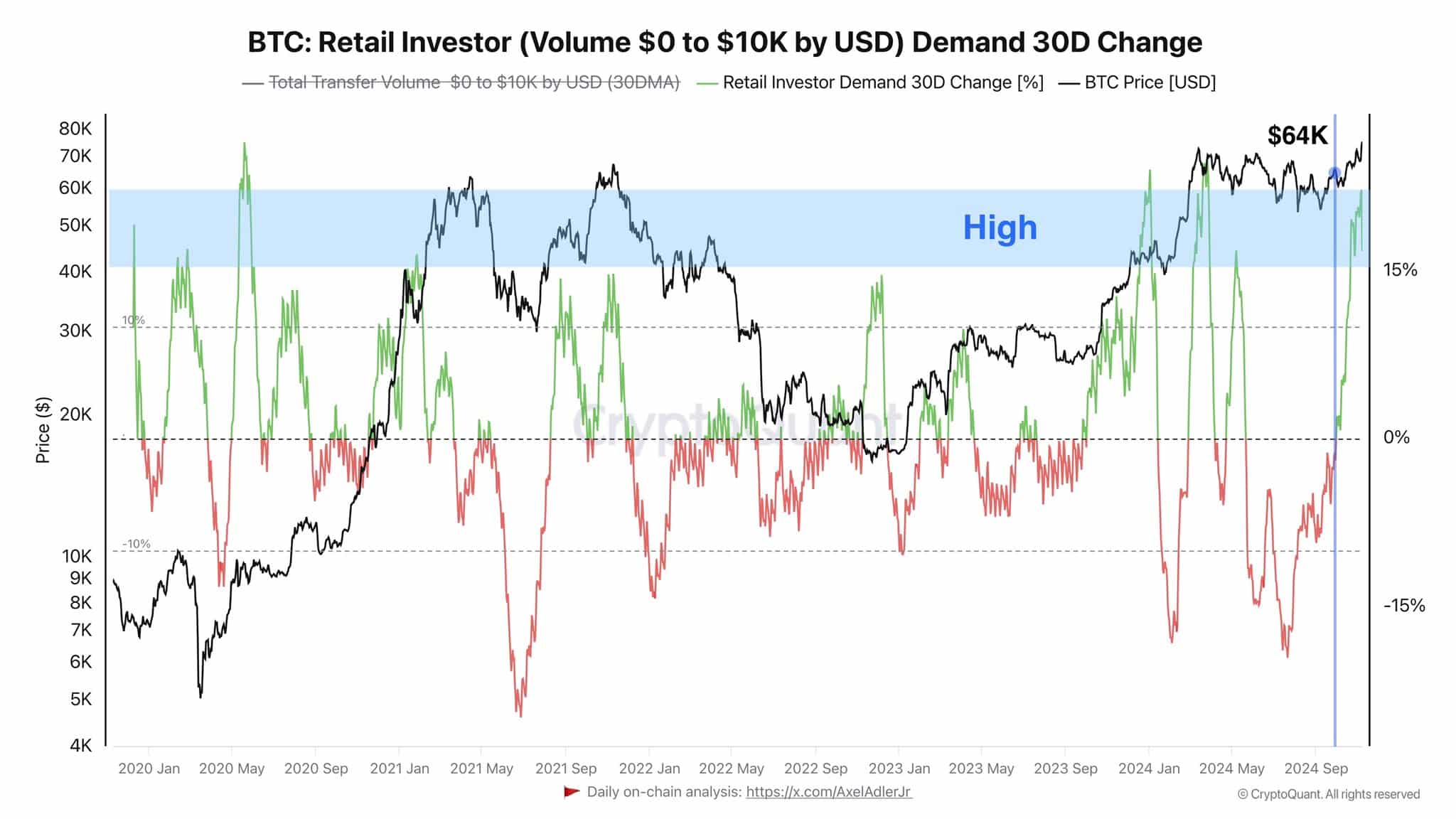

The Bitcoin [BTC] retail investor quantity has been rising alongside its value, showcasing a transparent relationship between elevated retail exercise and value actions.

Notably, since BTC reached the $64K peak, there was a big resurgence of retail curiosity, notably as retail demand change surged above 15%.

This indicated that retail buyers have been capitalizing on value dips, contributing to purchasing stress that usually precedes value recoveries.

The spikes in retail demand change correlated with durations the place the value of Bitcoin stabilized or elevated, suggesting that energetic retail participation is a bullish sign for Bitcoin’s value trajectory.

As retail investor exercise continues to rise above these ranges, it might doubtlessly result in sustained upward stress on Bitcoin’s market value.

Peak in slippage

Following this value surge, excessive slippage in Bitcoin buying and selling on perpetual futures market had been skilled. BTC value swiftly moved up, coinciding with a pointy peak in slippage, which instructed a speedy execution of trades at various costs as a consequence of sudden liquidity adjustments.

Retail quantity has been more and more influencing Bitcoin’s value, pushing it greater and this explicit occasion of slippage probably resulted from BTC “sweeping” out there liquidity at lower cost ranges earlier than abruptly shifting greater.

Traditionally, durations of excessive retail curiosity, have contributed to cost volatility as seen within the sharp uptick and subsequent value corrections.

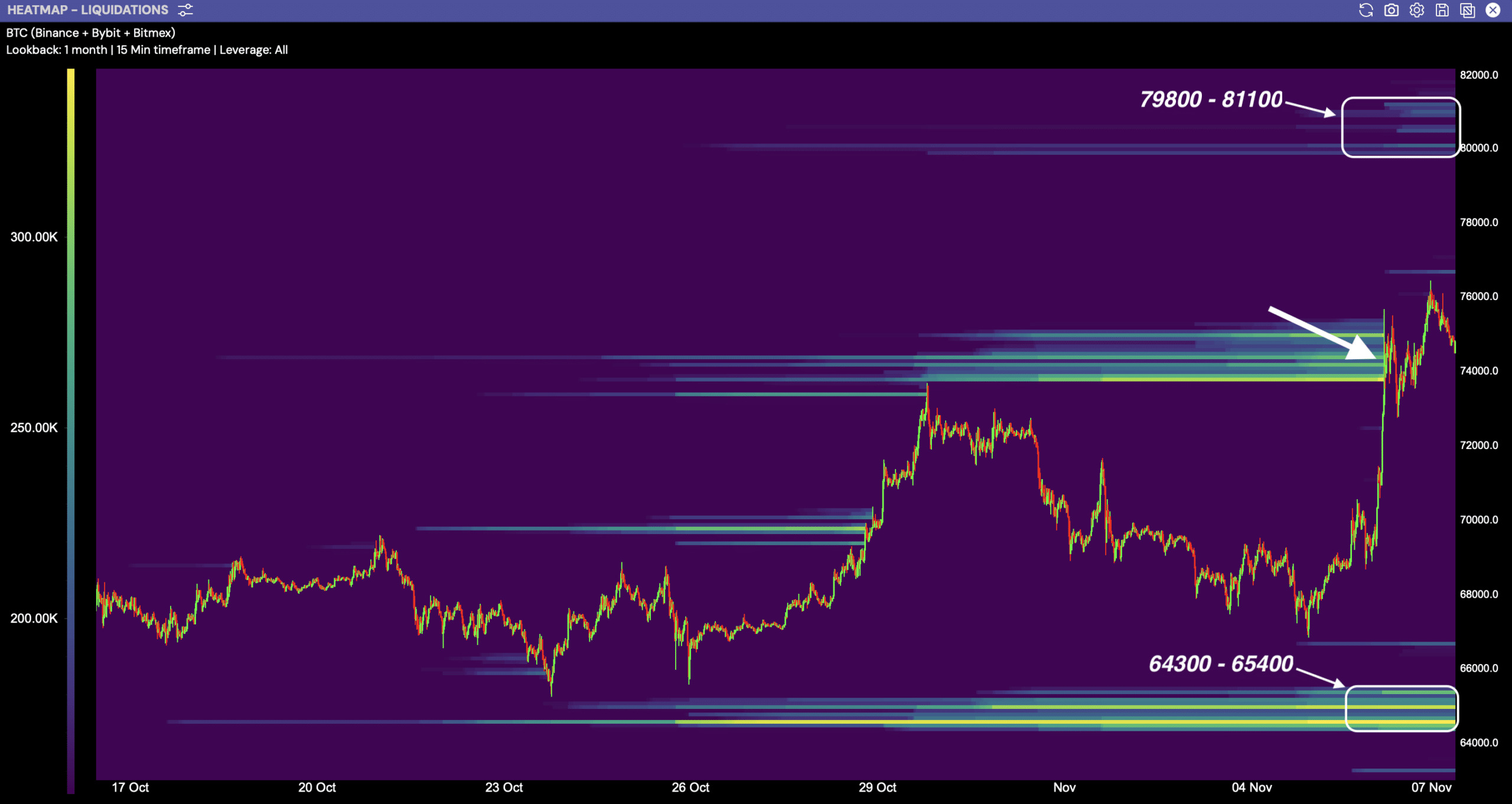

Subsequent liquidity clusters to affect BTC subsequent transfer

The liquidity heatmap for Bitcoin revealed essential clusters round $64K and $79K, highlighting areas the place substantial transaction volumes are more likely to happen.

Lately, retail buyers have propelled Bitcoin in the direction of these greater costs, and now BTC appeared poised to focus on the $79K cluster as a consequence of its proximity and up to date formation.

As Bitcoin approaches this crucial degree, the potential for an additional rally will increase. The power of retail buyers to proceed driving the value greater could hinge on their confidence and market sentiment.

Ought to Bitcoin preserve optimistic momentum, it might efficiently breach the $79K barrier and doubtlessly reverse to check the $64K degree once more.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Nonetheless, if concern and uncertainty creep into the market, the newfound enthusiasm may wane, inflicting BTC to stabilize and even retreat from these ranges.

Quickly, it will likely be decided if retail buyers have sufficient affect and resilience to push Bitcoin to those bold value targets, or if market fears will mood their bullish drive.