- Bitcoin’s halving schedule reduces mining rewards, enhancing scarcity-driven worth.

- How a lot provide is admittedly left for the remainder of the market?

Bitcoin’s [BTC] edge over fiat isn’t simply that it’s decentralized, it’s that there’ll solely ever be 21 million cash.

In contrast to common cash, which governments can print endlessly and watch lose worth, BTC’s provide is locked in, making it extra more likely to recognize over time as a result of it’s turning into scarcer.

With the subsequent Bitcoin halving approaching, a diminished provide may impression worth motion, doubtlessly driving stronger bullish momentum.

The countdown to Bitcoin’s final shortage

Glassnode reported that Bitcoin has now mined 900,000 blocks since its inception. Every mined block releases new Bitcoin, rising the availability.

Nonetheless, resulting from halvings, block rewards are minimize in half each 210,000 blocks. This implies Bitcoin’s issuance slows considerably because it approaches the 21 million provide restrict.

To place that into perspective: miners course of Bitcoin blocks each 10 minutes, producing about 6 blocks per hour—totaling 144 blocks day by day.

Earlier than the halving, every block rewarded 6.25 BTC, leading to 900 new BTC coming into the market per day.

After the halving, rewards dropped to three.125 BTC per block, chopping day by day Bitcoin issuance to 450 BTC—practically half.

Since then, BTC has surged 47%, reflecting the impression of diminished provide.

Just one.7 million left, and it’s drying up quick

Notably, miners anticipate the subsequent halving to hit round block peak 1,050,000 in 2028, slicing the block reward all the way down to 1.5625 BTC.

Run the numbers, and that’s simply 1.5625 BTC × 144 blocks = 225 BTC per day hitting the market, half of at the moment’s already-thin issuance.

That’s a significant provide minimize. With just one.7 million Bitcoin left to mine earlier than we hit the 21 million cap, every halving makes Bitcoin even scarcer. And while you have a look at the highest wallets, the availability squeeze feels even tighter.

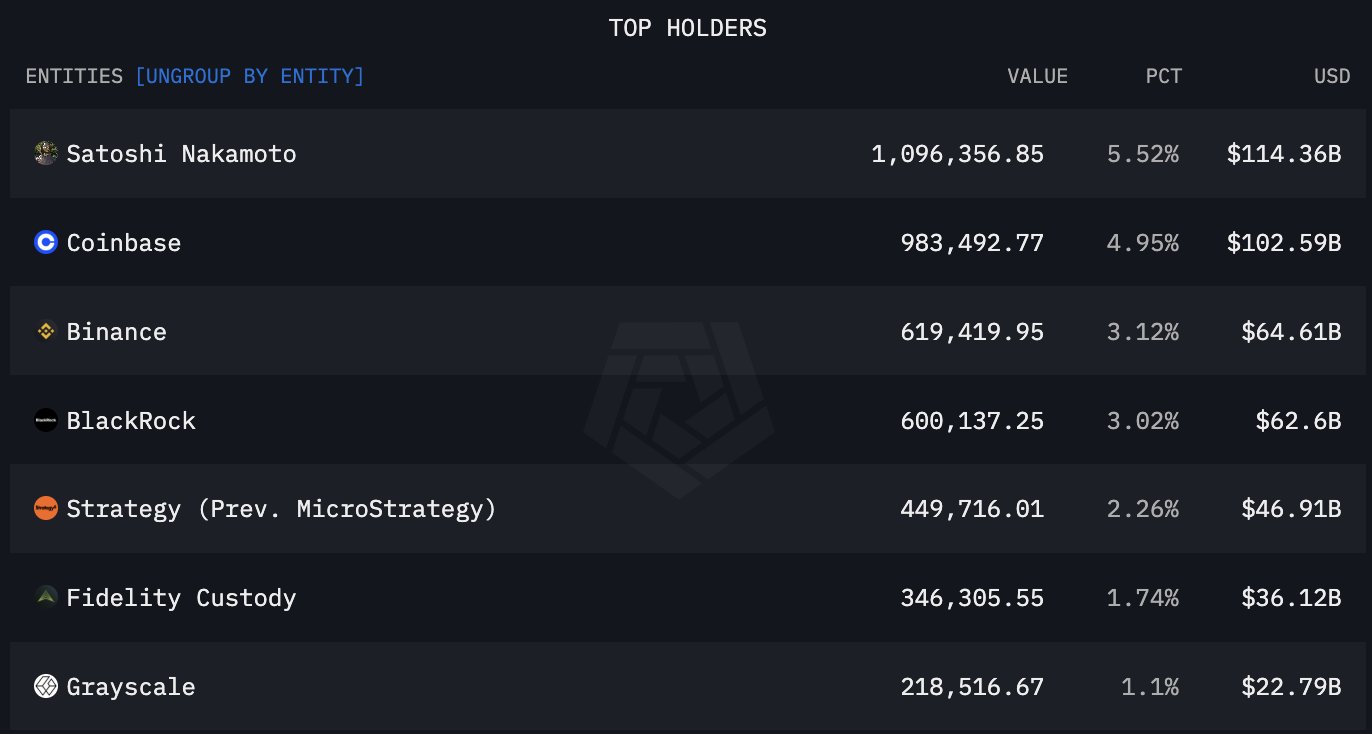

The chart under highlights how the highest 8 holders management 4.51 million BTC, holding roughly $471 billion. Which means they lock away over 21% of Bitcoin’s total supply, protecting it off the market.

However that’s solely the opening act. If demand retains ramping up and Bitcoin’s market cap rockets to $3 trillion or $5 trillion, every BTC may simply soar to $143k, $238k, and even past.

After all, these numbers are tough estimates, however that’s the genius of BTC’s design. It’s like a high-stakes public sale with no reserve worth: How excessive can the bids go?

Thus, with supply tightening and massive gamers holding sturdy, BTC’s “digital gold” story is just getting began. The stage is ready for some critical positive factors over the lengthy haul.