- Quick-term BTC holders had been going through losses, and BTC has fallen under its 200-day Transferring Common.

- Lengthy-term traders must bide their time, a bullish development reversal was not but in sight.

The “Liberation Day” that U.S. President Donald Trump has mentioned is approaching. Heading into the week, U.S. tech shares noticed losses within the overnight trading, with Tesla [TSLA] and Nvidia [NVDA] posting 5% and three% losses, respectively.

The Kobeissi Letter famous that the financial coverage uncertainty reached the very best it has since 2020, with the 2nd of April being the date to observe.

Furthermore, the U.S. jobs report will arrive on the 4th of April, which may additionally affect market sentiment exterior of the tariff information.

Gold ETFs noticed huge capital inflows, seemingly a direct consequence of the rising financial uncertainty. This has additionally put Bitcoin [BTC] and the remainder of the crypto sphere on the again foot, as they’re risk-on belongings.

AMBCrypto delved into on-chain metrics to grasp if BTC can stabilize across the March lows at $78k or if traders ought to anticipate extra losses.

Bitcoin nears overbought territory, however…

Supply: Checkonchain

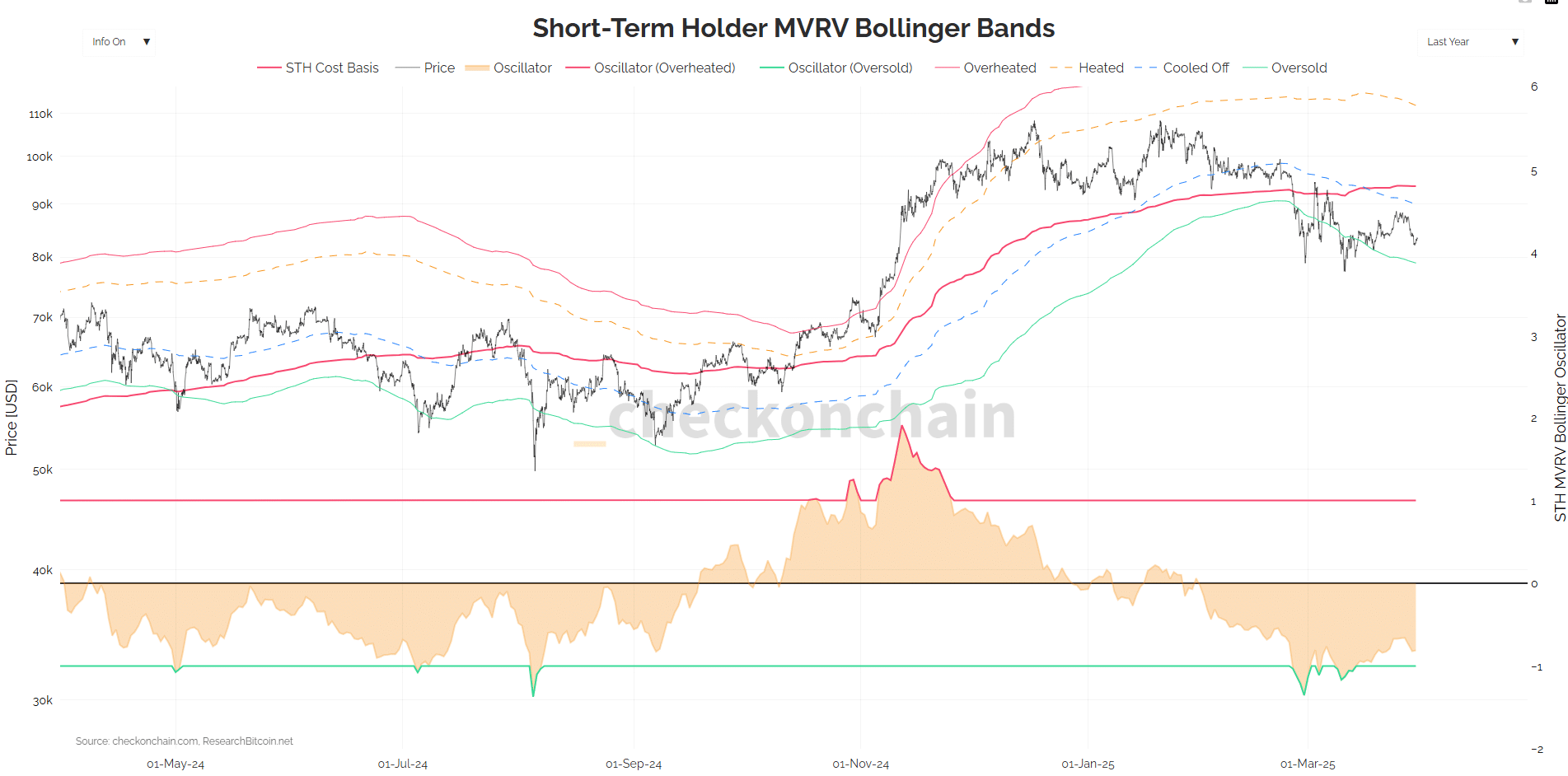

The short-term holder MVRV Bollinger Bands chart confirmed that the oscillator was in oversold situations in late February and early March.

Additionally, the worth of Bitcoin was under the cost-basis of short-term holders. That is calculated utilizing the realized worth of cash moved inside the final 155 days.

The worth of BTC had been “heated up” in November and December however has cooled off considerably since then. Bitcoin was prone to transfer under the oversold degree, which stood at $78.95k at press time.

Supply: Checkonchain

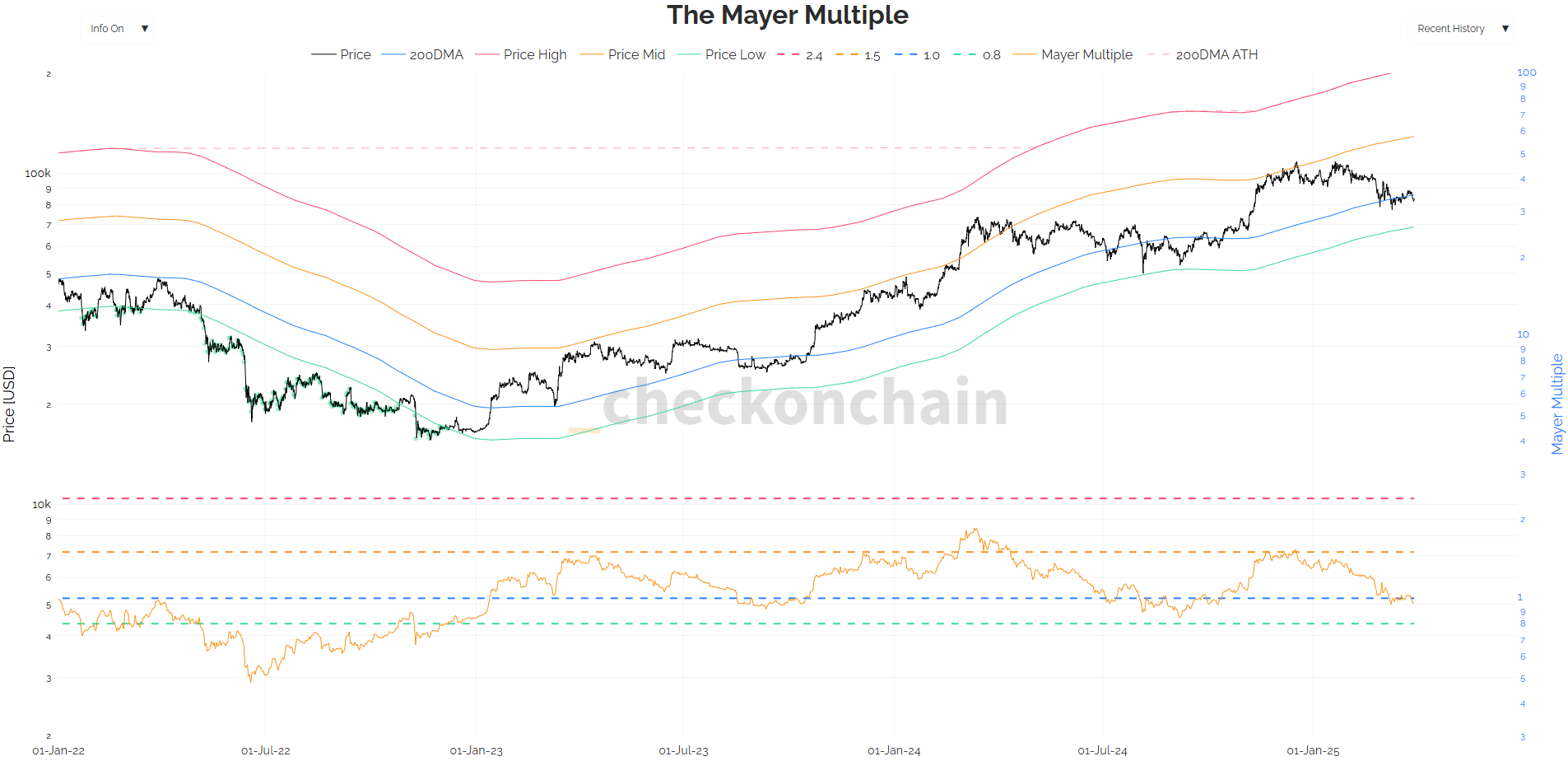

The Mayer a number of serves as a key metric for figuring out whether or not Bitcoin is pretty priced, overvalued, or undervalued primarily based on historic tendencies.

Analysts calculate it by dividing Bitcoin’s market worth by its 200-day Transferring Common (MA). At press time, the Mayer a number of stood at 0.96.

Two weeks in the past, BTC fell under its 200DMA and has traded just under this degree for many of this time. It stood at $85.92k at press time.

The final time the worth fell under the 200 DMA was August 2024. The worth stayed under this MA for nearly two months again then.

An analogous state of affairs may unfold now. Buyers trying to purchase BTC low-cost ought to regulate the 0.8 Mayer a number of, which represented the $68.74k degree. Bitcoin can be thought of “low-cost” round this worth degree.

In conclusion, long-term traders must hunker down and climate the financial storm of the approaching weeks and months. As soon as the sentiment throughout the market begins to shift, the development may shift bullishly.

Till then, they’ll Greenback Price Common (DCA) into BTC or anticipate nasty worth drops from large liquidation occasions to seize extra BTC.