- Bitcoin surged to $93,477 earlier than a slight dip; main withdrawals from Binance mirror investor sentiment.

- Key metrics, together with MVRV ratio and open curiosity, present sturdy market engagement amid the worth rally.

Bitcoin’s [BTC] bullish momentum has continued to push the asset into uncharted territory. The main cryptocurrency achieved its newest all-time excessive of $93,477 on thirteenth November, capping off a run of latest peaks.

Regardless of this record-setting achievement, Bitcoin has confronted a modest correction, presently buying and selling at $90,031—a 3.4% decline from its excessive however nonetheless exhibiting a 4.1% achieve over the previous 24 hours.

The rally, whereas notable, has additionally introduced into focus investor conduct and market dynamics, as exercise round exchanges alerts potential shifts in sentiment and technique.

Massive strikes on Binance

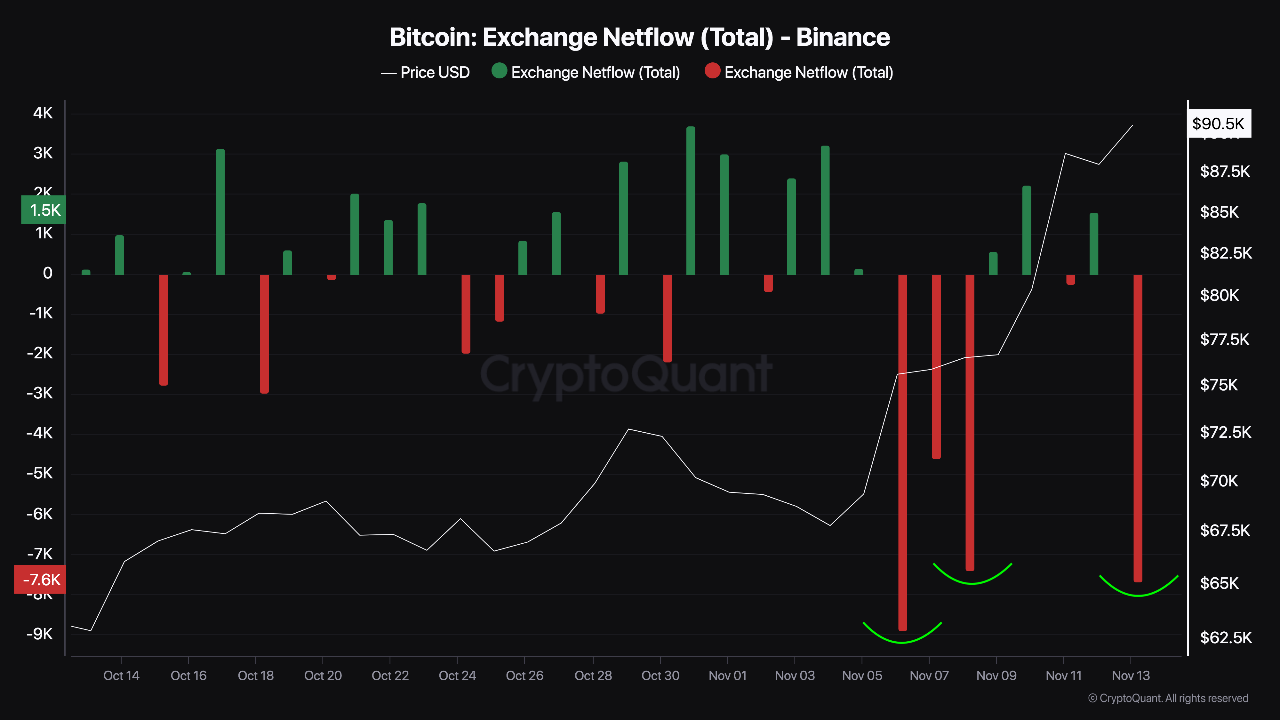

A CryptoQuant analyst often called Darkfost has highlighted a key pattern that unfolded alongside Bitcoin’s latest document excessive.

In response to Darkfost, buyers have been withdrawing important quantities of Bitcoin from Binance, one of many world’s largest cryptocurrency exchanges. Particularly, over 7,500 BTC had been withdrawn in what marks the second-largest such motion this yr.

In response to the analyst, this exercise may sign a shift in investor sentiment, suggesting confidence within the asset’s long-term worth and probably indicating a transition towards safer, long-term holdings slightly than energetic buying and selling.

By shifting Bitcoin out of exchanges and into non-public wallets, buyers could also be positioning themselves for future beneficial properties or elevated market stability, signaling a optimistic sentiment inside the market.

How is Bitcoin faring essentially

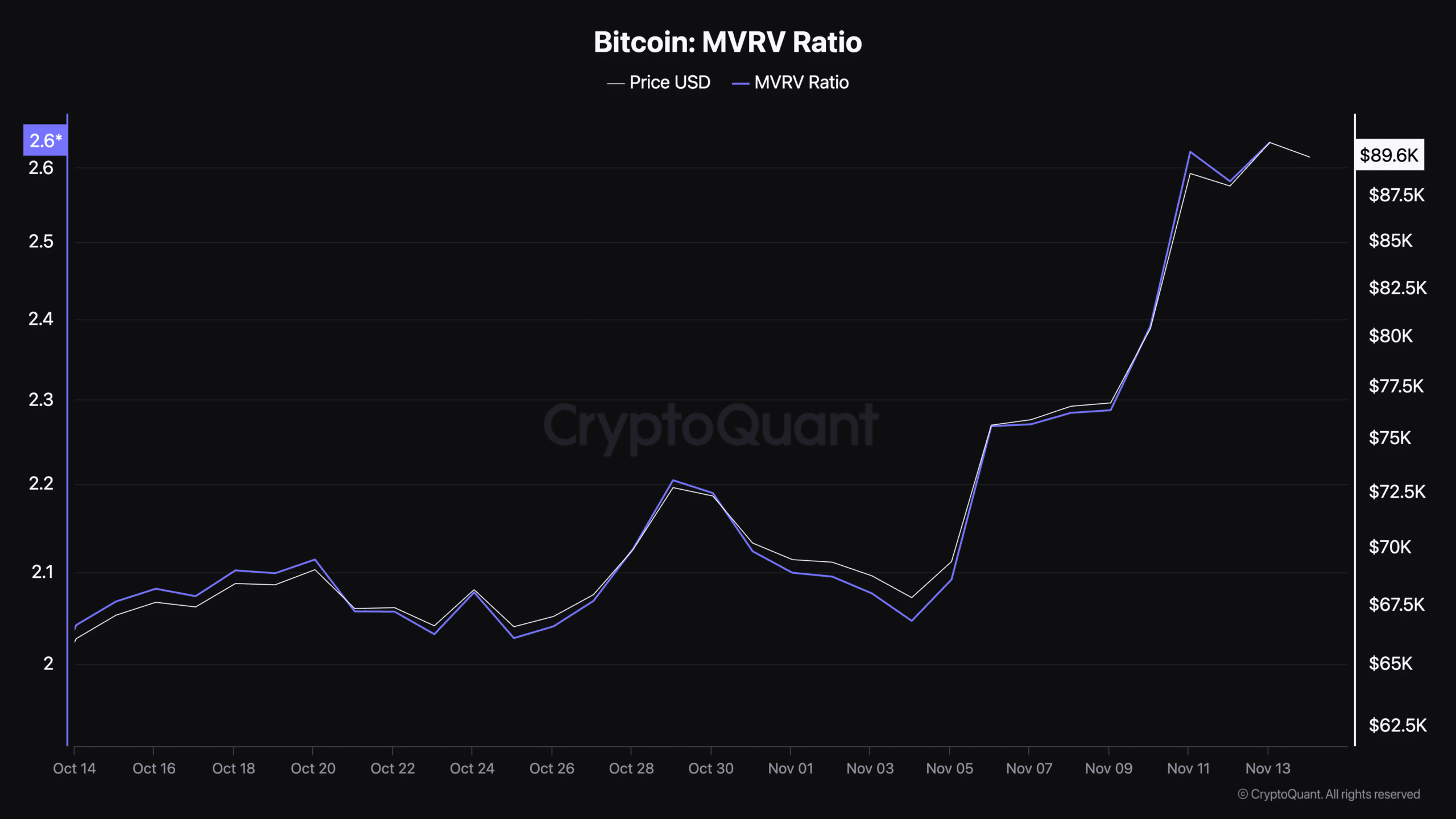

Past alternate exercise, Bitcoin’s elementary metrics provide extra perception into its efficiency amid the continued rally. One key measure is the Market Worth to Realized Worth (MVRV) ratio, which displays Bitcoin’s market capitalization relative to the realized worth of its holdings.

This metric can point out whether or not Bitcoin is overvalued or undervalued relative to its historic value tendencies.

An MVRV ratio above 1 means that the asset is buying and selling above its combination value foundation, signaling potential profit-taking conduct. At the moment, Bitcoin’s MVRV ratio has risen to 2.58, indicating that a good portion of buyers are seeing notable beneficial properties.

Traditionally, such ranges have typically coincided with heightened curiosity and, in some instances, market corrections. The elevated MVRV ratio suggests sturdy profitability, nevertheless it additionally requires warning amongst buyers because the potential for volatility stays.

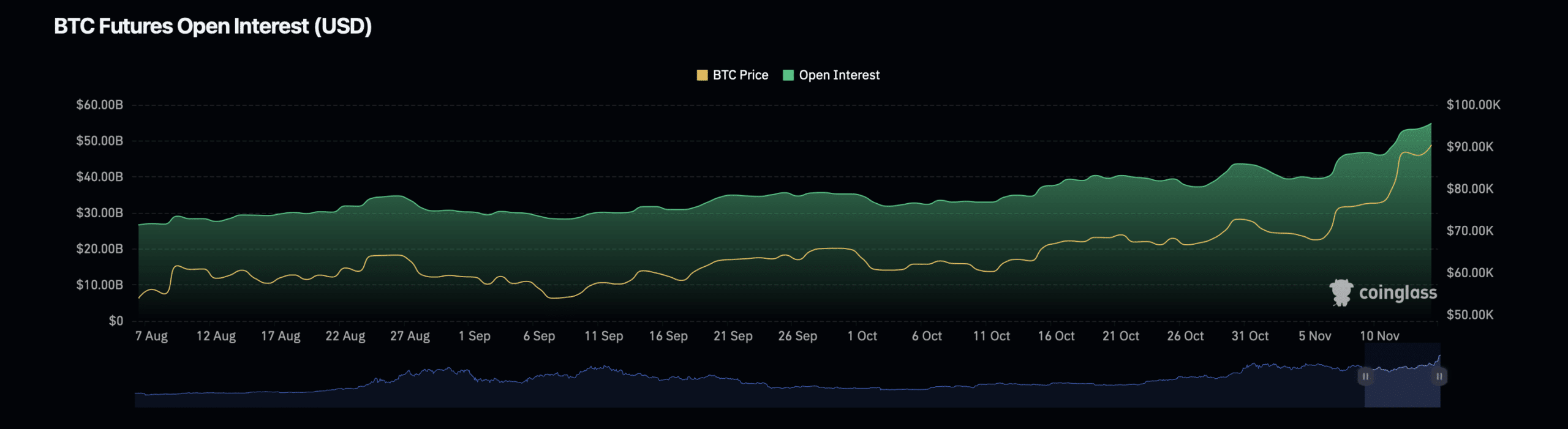

One other essential metric price monitoring is Bitcoin’s open curiosity, which refers back to the whole variety of excellent by-product contracts, comparable to futures or choices.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Data from Coinglass revealed that Bitcoin’s open curiosity has risen by 4.23%, reaching a valuation of $54.85 billion. This improve displays rising speculative curiosity and should point out heightened buying and selling exercise or market confidence.

Nonetheless, Bitcoin’s open curiosity quantity has seen a slight decline of 1.51%, settling at $182.70 billion. A lower in open curiosity quantity may indicate consolidation or a shift in market dynamics as contributors reassess their positions following the latest rally.