- Bitcoin’s value actions in March 2025 have been extra secure, in comparison with altcoins

- Divergence is an indication of Bitcoin’s maturity as a secure asset, whereas altcoins face higher speculative strain

In March 2025, altcoins like Cardano [ADA], Solana [SOL], and XRP noticed a pointy spike in realized volatility, with ADA hitting a file 150%, and SOL and XRP surpassing 100%.

In the meantime, Bitcoin [BTC] additionally noticed important volatility, however it remained comparatively subdued at 50% – Properly under its historic highs.

Realized volatility displays value variation over a set interval. The hike in ADA, SOL, and XRP volatility is an indication of bigger value swings, whereas Bitcoin’s volatility has remained comparatively secure.

Altcoins as high-risk hypothesis

In comparison with Bitcoin, altcoins are extra prone to speculative buying and selling, typically pushed by information, rumors, and community-driven momentum. This may result in exaggerated value swings.

XRP has been notably delicate to regulatory information, with the continuing SEC lawsuit contributing to erratic value actions.

Throughout market uptrends, traders typically shift capital from Bitcoin to altcoins in pursuit of upper returns, additional amplifying altcoin volatility. Whereas this volatility presents higher revenue alternatives, it additionally will increase the danger of serious losses.

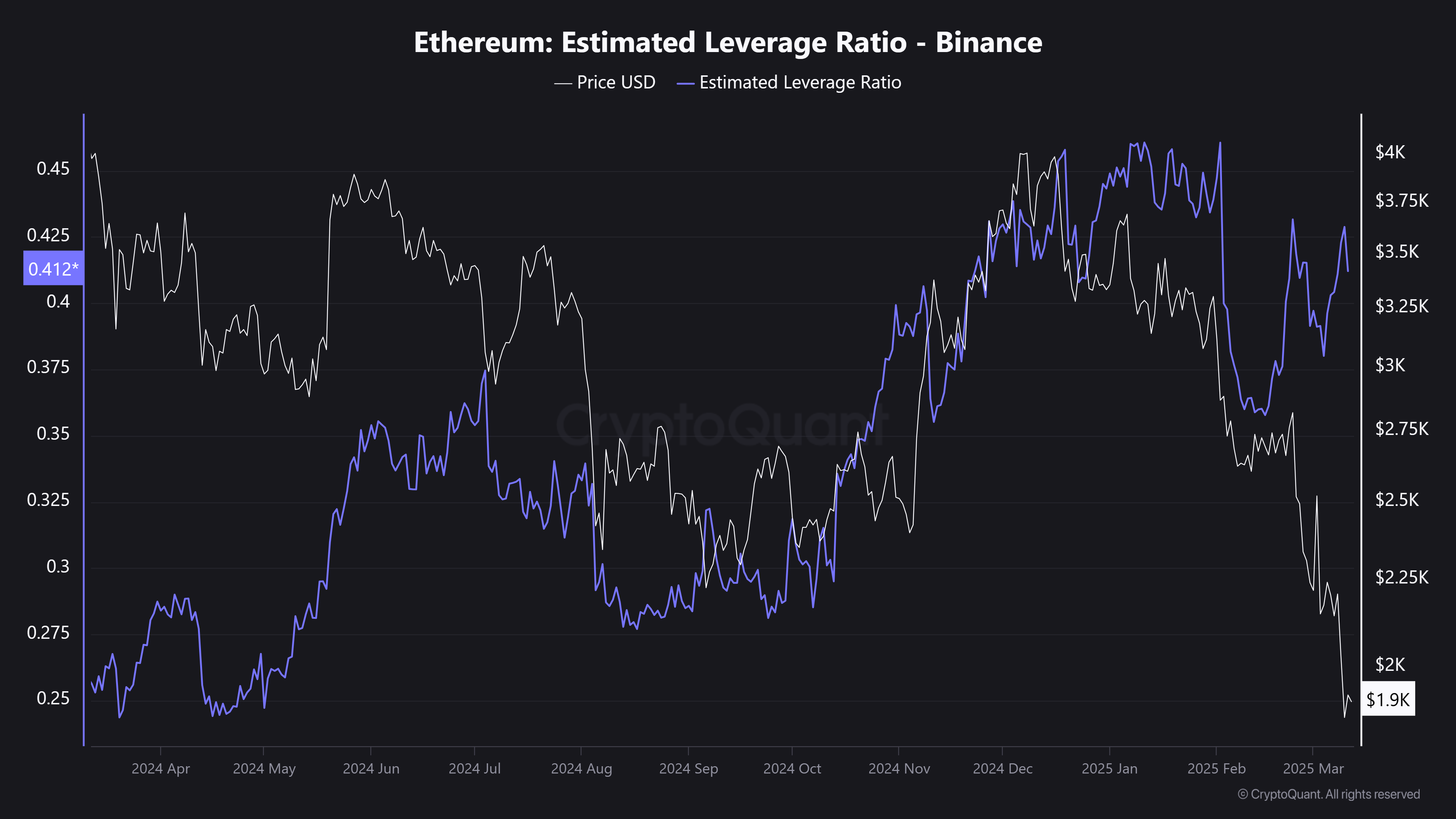

Ethereum (ETH) exemplifies this pattern. Regardless of shedding the $2,000 assist for the primary time since 2023 and trade reserves rising, its Estimated Leverage Ratio (ELR) has surged to a month-to-month excessive. That is indicative of elevated danger publicity in derivatives markets.

In different phrases, merchants are aggressively leveraging positions on either side, amplifying volatility – A traditional “excessive danger, excessive reward” setup that would gas sharp value swings.

This altcoin divergence is obvious in value motion as properly, with ADA, SOL, and XRP breaking under key assist zones and caught in consolidation.

Rising volatility is popping altcoin buying and selling right into a high-risk, speculative play.

Nevertheless, is Bitcoin positioning itself because the extra secure asset amid the rising uncertainty?

Bitcoin as a secure retailer of worth

Traditionally, BTC has seen volatility spikes above 100%, however March 2025’s data appeared to trace at a extra secure value construction.

Whereas Bitcoin affords a safer haven with decrease volatility, it additionally curtails short-term revenue potential. This, not like altcoins, the place amplified danger brings the lure of upper rewards.

Does this reinforce Bitcoin’s position as a long-term holding? Properly, volatility developments recommend it simply would possibly.

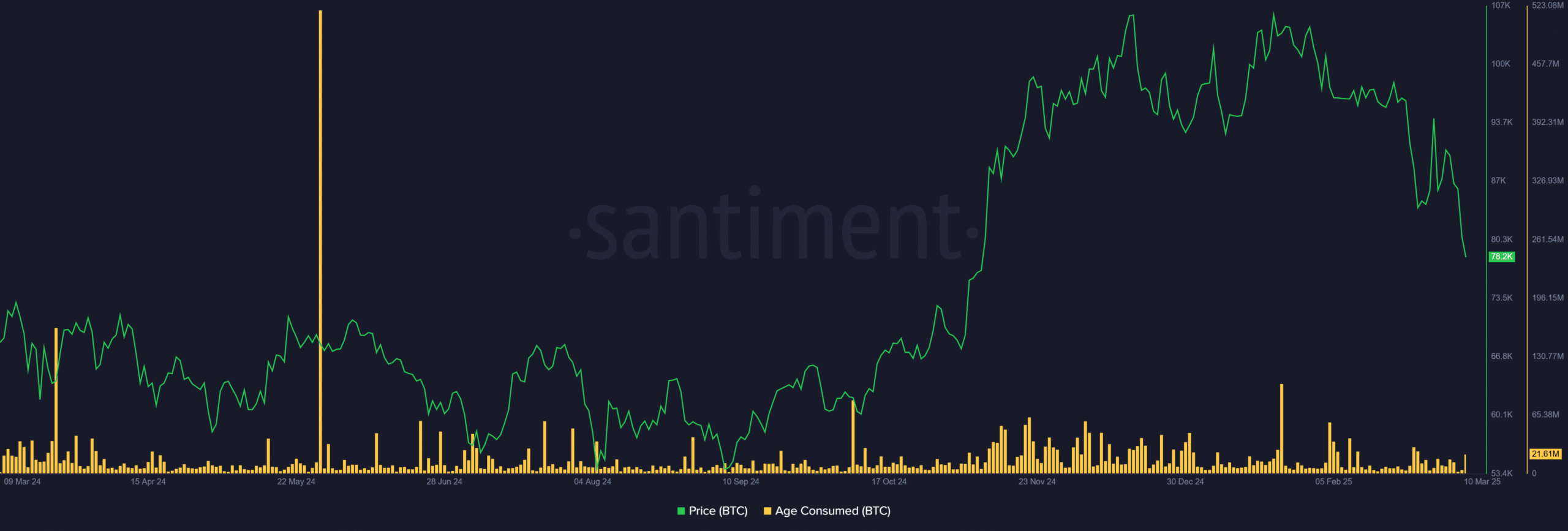

In the meantime, the Age Consumed metric – monitoring long-term holder actions – didn’t spike regardless of BTC plunging under $80k and erasing billions in market worth.

This prompt that seasoned traders stay unfazed, reinforcing confidence in Bitcoin’s long-term trajectory.

Clearly, volatility developments are actually shaping buying and selling methods.

With altcoins exhibiting greater risk-reward potential, they may dominate short-term hypothesis. All whereas Bitcoin continues to ascertain itself as the popular long-term retailer of worth.