- Market sentiment round BTC turned bullish.

- The promoting stress on the coin was comparatively low.

Bitcoin [BTC] continued to commerce above the $70k mark, and issues would possibly quickly get higher for buyers. The most recent evaluation instructed that BTC went up a resistance degree, which allowed it to succeed in an all-time excessive.

Does this assure yet one more bull rally for BTC?

Bitcoin is holding its floor

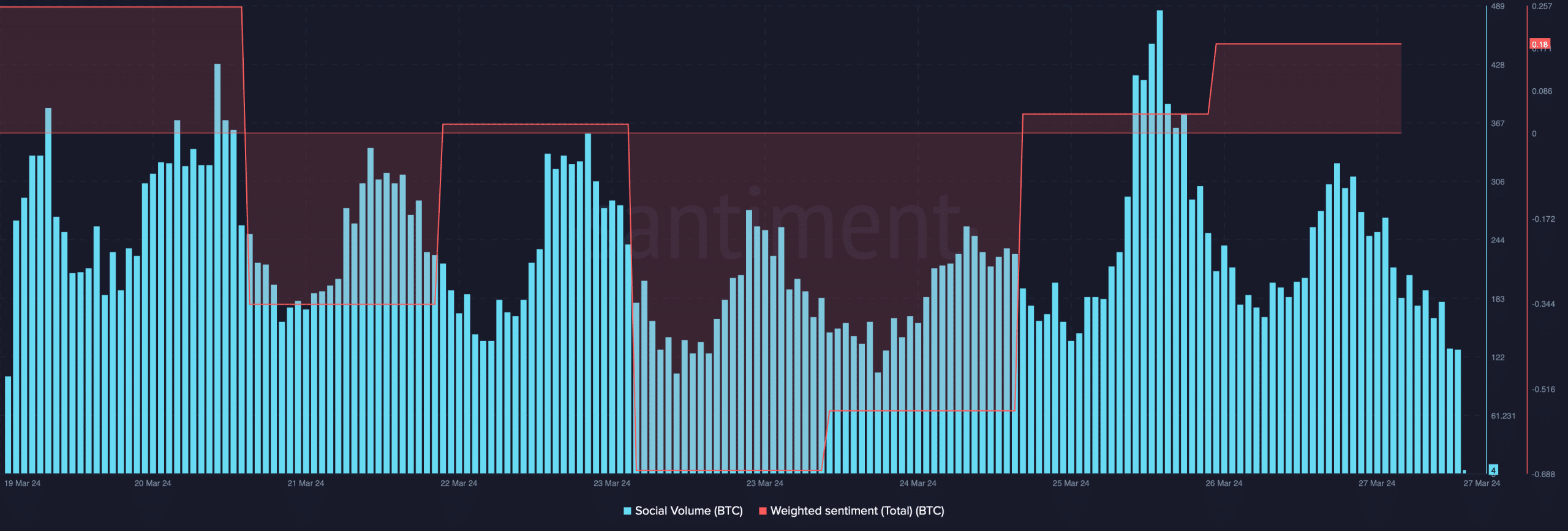

Based on CoinMarketCap, the king of cryptos was up by greater than 12% within the final seven days. Due to the current uptrend, BTC’s social quantity spiked in the previous few days.

Moreover, its Weighted Sentiment went into the optimistic zone, indicating that bullish sentiment across the token elevated.

Within the meantime, Ali, a preferred crypto analyst, posted an analysis highlighting an attention-grabbing truth. As per the tweet, BTC’s value went above a key resistance degree of $70.8k.

This hinted at an additional uptrend within the days to comply with. To verify if the uptrend might occur, AMBCrypto checked BTC’s metrics.

Are buyers promoting Bitcoin?

Since BTC’s worth crossed a resistance degree, AMBCrypto checked different metrics to search out out whether or not individuals are shopping for BTC.

As per our evaluation of CryptoQuant’s data, BTC’s alternate reserve was dropping, that means that promoting stress on the coin was low.

The miners’ place index revealed that they had been promoting holdings in a average vary in comparison with their one-year common.

Moreover, shopping for sentiment amongst US buyers was dominant, which was evident from its inexperienced Coinbase premium.

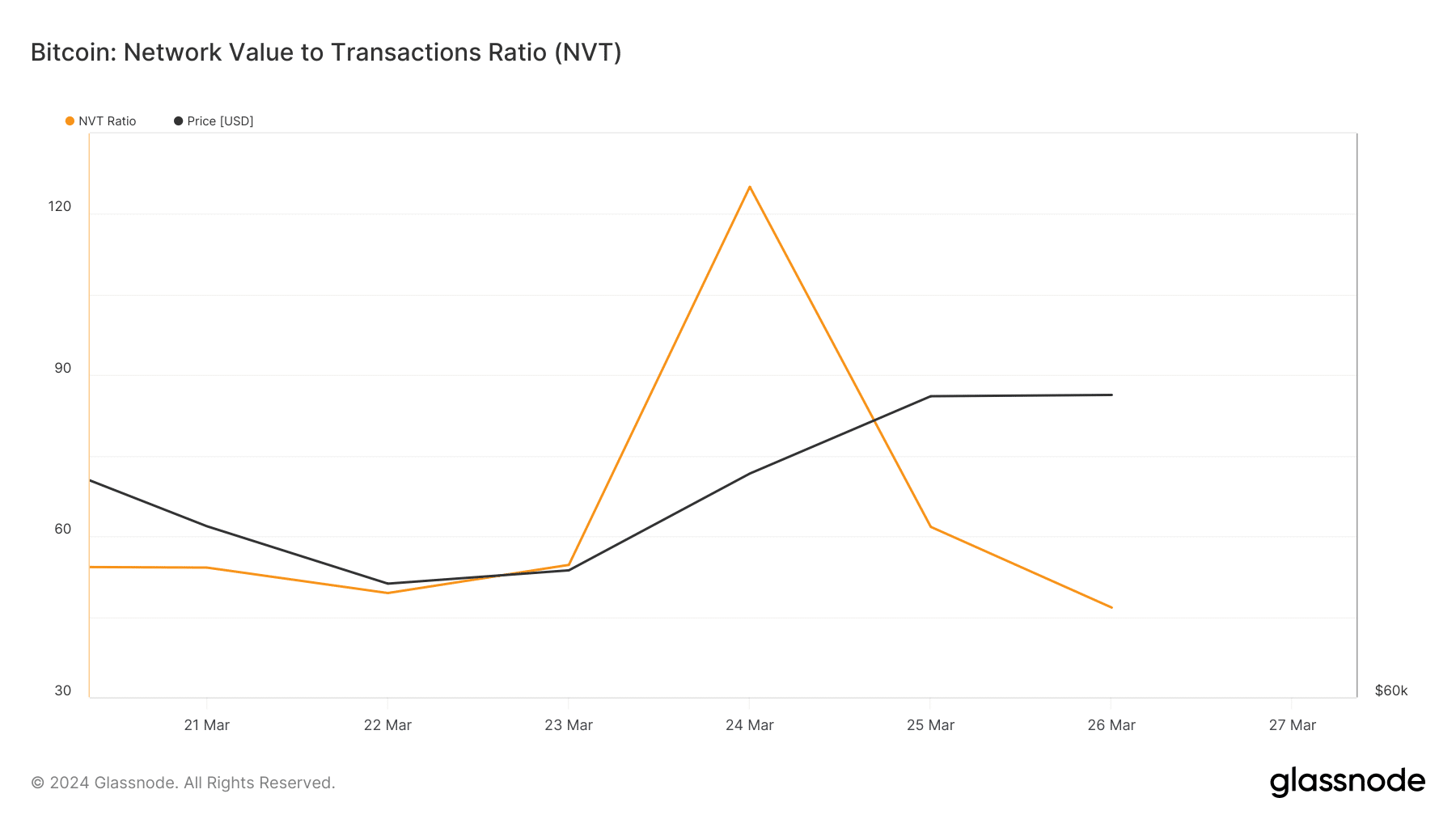

The possibilities of BTC persevering with the uptrend had been even greater once we analyzed Glassnode’s information. We discovered that BTC’s Community Worth to Transactions (NVT) ratio dropped.

For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

At any time when the metric drops, it signifies that an asset is undervalued. This indicated that BTC buyers would possibly witness yet one more bull rally from the token quickly.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

To higher perceive what to anticipate from BTC, we then checked out derivatives metrics. In addition they regarded fairly bullish, as its Funding Price was excessive.

This meant that derivatives buyers had been actively shopping for the coin at press time. Nonetheless, its Taker Purchase Promote Ratio was crimson, suggesting that promoting sentiment was nonetheless dominant within the derivatives market.