Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Tony Severino has warned that the Bitcoin value dangers an additional crash. This got here as he revealed a essential technical indicator, which has turned bearish for the flagship crypto, though he famous that BTC bulls can nonetheless invalidate this present bearish setup.

Bitcoin Worth At Threat Of Additional Crash As S&P Month-to-month LMACD Turns Bearish

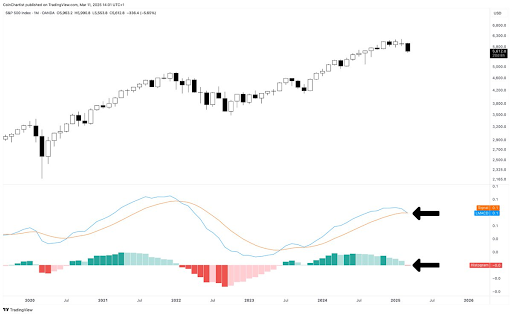

In an X post, Severino indicated that the Bitcoin value may crash additional because the S&P 500 month-to-month LMACD has begun to cross bearish and the histogram has turned pink. This improvement is important as IntoTheBlock knowledge exhibits that BTC and the stock market nonetheless have a powerful optimistic value correlation.

Associated Studying

The crypto analyst acknowledged that BTC bulls can flip this bearish setup for the Bitcoin value within the subsequent 20 days, as diverging would result in a bullish setup as a substitute. Nonetheless, the Bulls’ failure to show this round for Bitcoin may result in a massive decline for the flagship crypto, worse than it has already witnessed.

Severino acknowledged {that a} affirmation of this bearish setup on the finish of the month may kick off a bear market or Black Swan kind occasion much like what occurred when the final two crossovers occurred. It’s value mentioning that BTC has already crashed to as little as $76,000 just lately, sparking considerations that the bear market would possibly already be right here.

Nonetheless, crypto specialists equivalent to BitMEX co-founder Arthur Hayes have recommended that the bull market continues to be effectively in play for the Bitcoin value. Hayes famous that BTC has corrected round 30% from its present all-time excessive (ATH), which he remarked is regular in a bull run. The BitMEX founder predicts that the flagship crypto will rebound as soon as the US Federal Reserve begins to ease its financial insurance policies.

BTC Nonetheless Trying Good Regardless of Current Crash

Crypto analyst Kevin Capital has recommended that the Bitcoin value nonetheless seems to be good regardless of the latest crash. In his newest market replace, he acknowledged that BTC stays the best-looking chart and that all the pieces goes in response to plan for the flagship crypto. The analyst predicts that Bitcoin may nonetheless come down and take a look at the vary between $70,000 and $75,000, which he claims would nonetheless be utterly high-quality.

Associated Studying

Kevin Capital remarked that the Bitcoin value may stay afloat if it holds a key market construction and the 3-day MACD resets. He added that some respectable macro knowledge may assist the flagship crypto keep above key assist ranges. The US CPI data shall be launched immediately, which may present some reduction for the market if it exhibits that inflation is slowing. The analyst is assured that one good inflation report and the FOMC can assist flip the tides.

On the time of writing, the Bitcoin value is buying and selling at round $81,860, up over 2% within the final 24 hours, in response to data from CoinMarketCap.

Featured picture from Adobe Inventory, chart from Tradingview.com