Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s worth motion in latest weeks has been largely highlighted by a trading range between $80,000 and $85,000, with a battle to reclaim shopping for strain. Regardless of the present lack of a strong bullish momentum, many crypto analysts are banking on a bullish continuation and a brand new Bitcoin worth all-time excessive before the end of 2025.

In accordance with crypto analyst TradingShot, Bitcoin may very well be approaching the final leg of this bull cycle, predicting a peak above $125,000. Nonetheless, this evaluation comes with a caveat that an prolonged bear market would possibly roll in by October 2025.

Lengthy-Time period Bitcoin Cycles Trace At Imminent Peak

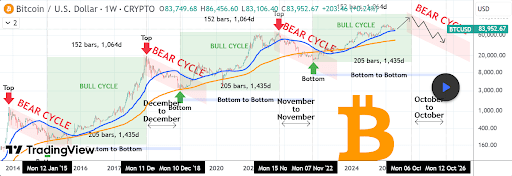

TradingShot’s evaluation, which was posted on the TradingView platform, relies on over a decade of symmetrical Bitcoin market conduct that exhibits each bull and bear cycles unfolding in constant timeframes. In accordance with TradingShot, the bull cycles relationship again to 2015 have all lasted roughly 1,064 days, or 152 weeks, with every cycle topping out virtually precisely three years after the earlier backside. However, bear cycles have constantly lasted for round one yr, both from December to December or November to November.

Associated Studying

This historic symmetry is mirrored within the chart under, which highlights three bull cycles adopted by three bear durations, all forming a repeating sample. The newest backside, recorded on November 7, 2022, marked the beginning of the present bull cycle. If this sample holds, Bitcoin may attain its subsequent peak within the week of October 6, 2025.

The bull cycle has led to Bitcoin breaking above $100,000 and now with an all-time excessive of $108,786, however like many others, the analyst predicted this peak will still be broken this year. This peak will doubtless mirror the explosive rallies that ended the 2017 and 2021 cycles and finally surpass $125,000.

Promote The whole lot In October 2025, Purchase Again In October 2026

TradingShot’s major recommendation is blunt however strategic: promote every part by October 2025. In accordance with the analyst, this window may very well be the ultimate alternative to exit close to the highest earlier than the subsequent bear cycle takes maintain. Counting 1064 days from the newest backside of $15,600 in November 07 2022, offers a time estimate for the subsequent cycle high on October 6 2025. If historical past repeats itself, the next bearish section will doubtless final for 12 months and backside out round October 12, 2026, earlier than the subsequent bull section.

This timing shouldn’t be speculative; it’s based mostly on a constant one-year bearish section throughout three full market cycles. Due to this fact, it will be higher to promote earlier than October 2025 and begin accumulating by October 2026.

On the time of writing, Bitcoin is buying and selling at $84,500, up by 0.9% up to now 24 hours and 48% away from the anticipated peak of $125,000.

Featured picture from Adobe Inventory, chart from Tradingview.com