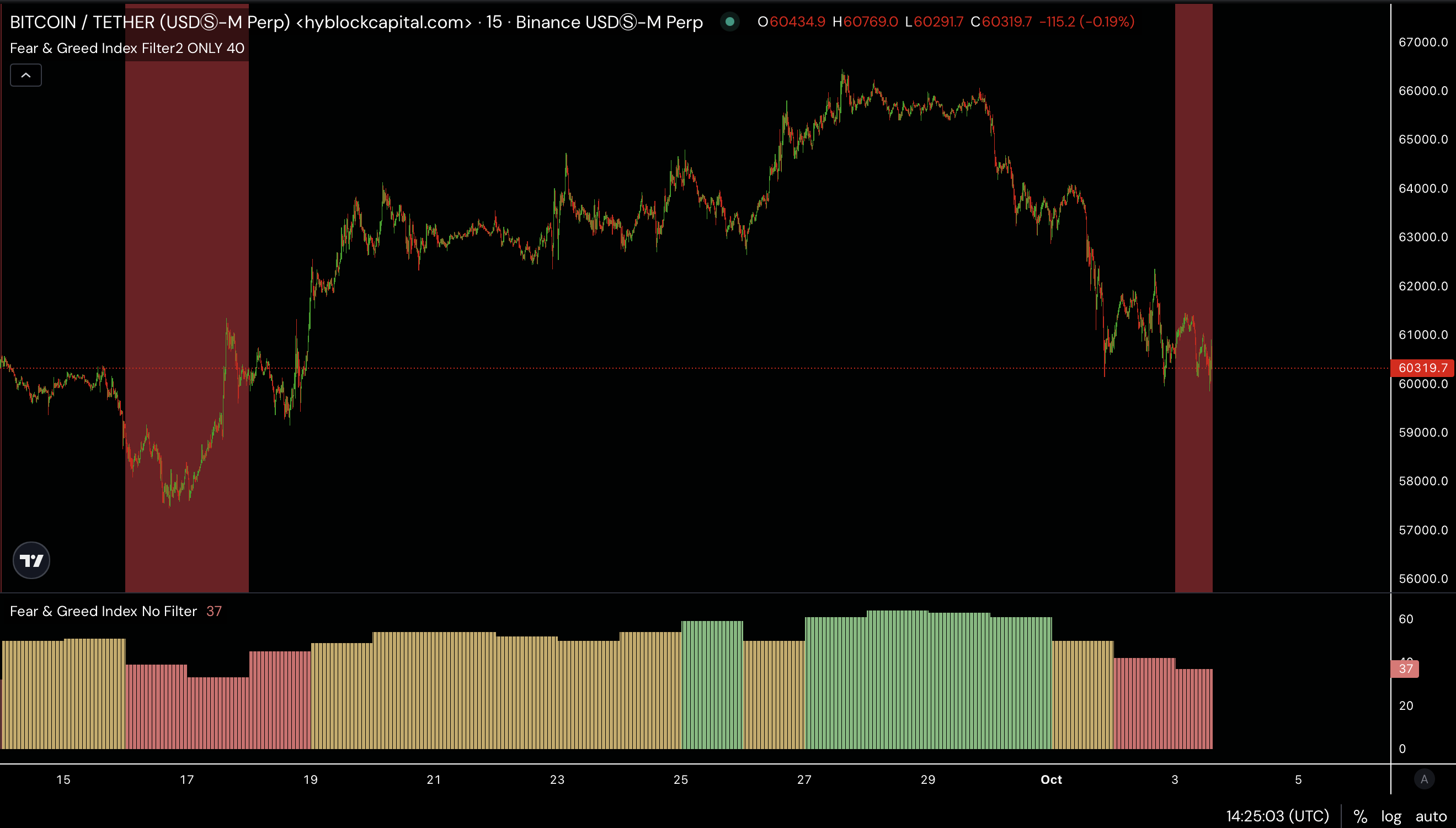

- The market sentiment is again to worry for Bitcoin.

- BTC holding above the imply threshold of the channel.

The cryptocurrency market stays extremely delicate to world occasions, particularly Bitcoin [BTC], with sentiment continuously shifting between worry and greed.

Not too long ago, geopolitical disturbances, notably within the Center East, have triggered worry amongst traders, pushing BTC sentiment again into the worry zone.

Traditionally, when Bitcoin enters this worry zone, it indicators a possibility for traders to “purchase the worry” and promote in periods of greed. As we strategy the final quarter of the 12 months, many are asking: is now the time to purchase Bitcoin?

As September got here to a detailed, Bitcoin had reached the $66K worth mark, shifting sentiment to a impartial stance. Nevertheless, current geopolitical tensions between Israel and Iran have reversed this progress, dropping Bitcoin again into the worry zone.

Regardless of this, the broader crypto market, together with Bitcoin, stays above key help ranges, prompting some to consider it could be time to purchase BTC in anticipation of additional positive aspects within the coming months.

Bid-ask ratio insights

Analyzing the bid-ask ratio helps decide whether or not patrons or sellers dominate the market. Latest information reveals that spot bids have outweighed asks, indicating that merchants have been accumulating Bitcoin in the course of the market pullback.

This pullback, precipitated largely by the geopolitical tensions, appears to have established a brief backside across the $60,000 degree.

Bitcoin has been holding regular round this level, battling towards promoting strain. As BTC begins to reclaim key shifting averages, this may very well be an indication that now could be the precise time to purchase.

BTC holding above the pattern channel equilibrium

Bitcoin’s worth has proven energy regardless of going through resistance. After briefly rising above $66K, it encountered rejection however continues to commerce close to essential ranges.

BTC has been shifting inside a pattern channel for over seven months, and now has discovered help close to its imply threshold. If Bitcoin manages to interrupt and maintain ranges above the higher trendline, it may very well be poised to succeed in new all-time highs.

Nevertheless, failure to interrupt this key resistance might see BTC persevering with to vary all through the remainder of the 12 months.

Supply: TradingView

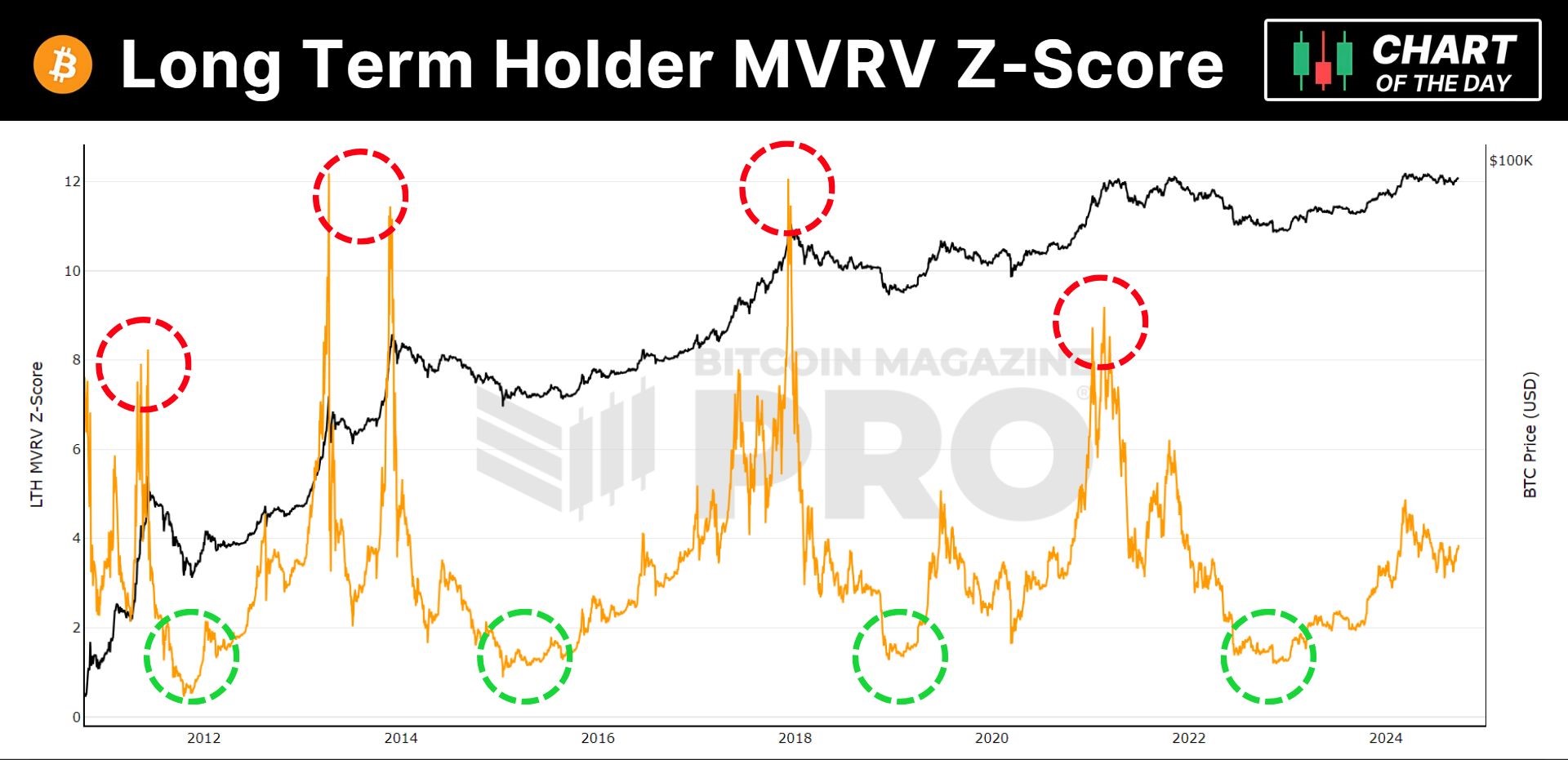

Lengthy-Time period holder MVRV Z-Rating

One key metric that has confirmed efficient in predicting Bitcoin market cycles is the Lengthy-Time period Holder MVRV Z-Rating. This indicator highlights whether or not Bitcoin is overvalued or undervalued, providing perception into potential bottoms and peaks.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

At present, the Z-Rating means that BTC has appreciable room for upward motion, reinforcing the concept now may very well be the precise time to purchase, particularly as market sentiment leans towards worry.

With worry gripping the market, now will be the excellent alternative to build up Bitcoin. The metrics, worth motion, and bid-ask ratio all point out potential upside, making this a really perfect time for traders to think about shopping for BTC earlier than costs climb increased.