Following a quick ascent above $99,000 on Friday, the Bitcoin market skilled a destructive finish to the previous buying and selling week as costs crashed beneath $96,000 in a pointy descent. Primarily based on these happenings, the premier cryptocurrency stays in consolidation with little indication of its long-term value motion. Notably, blockchain analytics agency Glassnode has shared a latest community improvement hinting at a potential value rally.

Bitcoin At A Crossroads: Key Metric Set Might Determine Subsequent Transfer

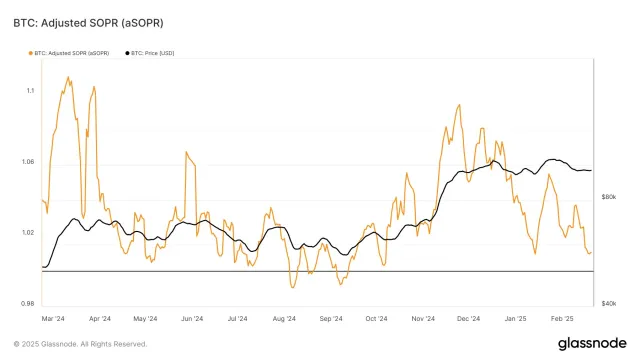

In an X post on Friday, Glassnode studies that Bitcoin’s aSOPR is at 1.01, a crucial metric stage that locations the crypto asset in a fragile market place. Typically, an adjusted Spent Output Revenue Ratio (aSOPR) is an on-chain metric that measures the profitability of Bitcoin transactions by evaluating the promoting value of cash to their acquisition value.

When the aSOPR is above 1, it signifies that the common Bitcoin holder is promoting at a revenue. Conversely, a worth beneath one signifies that BTC is being offered at a loss. Due to this fact, Bitcoin’s aSOPR at 1.01 means that market individuals are barely making income on their transactions.

Based on Glassnode, the BTC market is traditionally a breakeven level the place additional motion of the aSOPR in both path may considerably impression value trajectory. In 2021, Bitcoin’s aSOPR reset to round 1.01 preceded a robust bull run that ultimately resulted within the then new-all time of $64,800. An identical reset was additionally seen in late 2023 leading to a value surge to round $69,000.

Going by these previous occasions, if Bitcoin’s aSOPR holds above 1.01, it will counsel purchaser absorption indicating a renewed market confidence in anticipation of an incoming value rally. Alternatively, if the aSOPR decline continues a break beneath 1.0, this improvement would imply sellers are offloading BTC at a loss which may sign additional downward stress.

BTC Worth Outlook

On the time of writing, Bitcoin trades at $96,300 following a major 1.98% loss previously day. In the meantime, its every day buying and selling quantity has gained by 51.28% indicating an elevated market curiosity. This elevated market curiosity amidst value decline could possibly be indicative of both a panic promoting by involved traders or robust accumulation by market bulls.

Primarily based on the BTCUSDT every day chart, breaking and holding above $99,000 may mark an finish to the present consolidation part resulting in a sustained value uptrend. Nonetheless, a value fall beneath $95,000 may pave the best way for all bearish prospects with sure analysts hinting at a potential return to $76,000.

Featured picture from iStock, chart from Tradingview