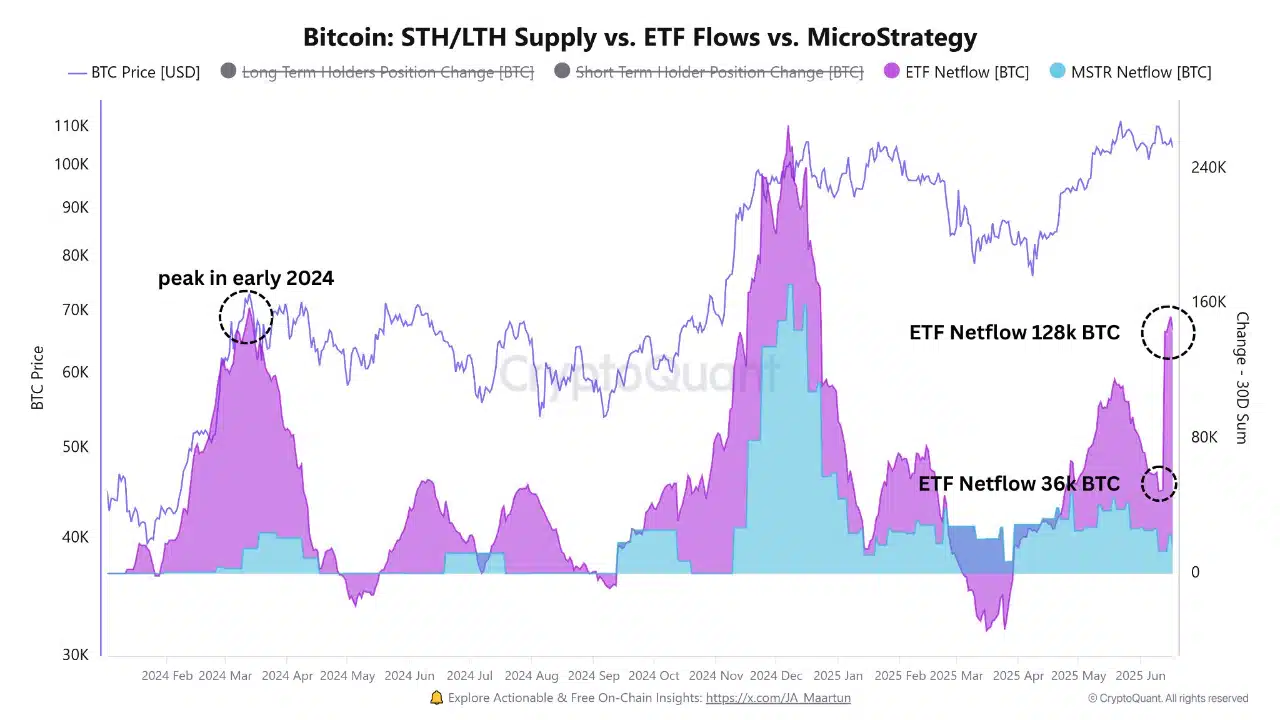

- ETF Netflows jumped by 128K BTC in 30 days, marking the strongest institutional influx since early 2024.

- Declining short-term HODL exercise and whale-sized transfers level to a structural bullish setup.

Bitcoin [BTC] ETF Netflows surged by 128,000 BTC in 30 days, marking the most important institutional accumulation wave since early 2024.

On high of that, Binance whale deposits jumped from $2.3 billion to $4.59 billion in a single day.

This synchronized surge displays rising confidence amongst high-net-worth entities, who seem like positioning early for a significant value growth.

Clearly, massive holders aren’t ready—they’re already uncovered to a macro-led rally.

Bitcoin shortage intensifies

BTC’s Inventory-to-Circulation ratio surged to 2.12 million, reflecting a 133.34% improve and reinforcing the asset’s shortage narrative.

New provide is lagging far behind circulating inventory, signaling robust accumulation conduct. Subsequently, the shift aligns with long-horizon funding methods by institutional gamers in search of uneven upside.

Traditionally, such drastic rises within the ratio have sometimes preceded main bull runs pushed by provide shocks.

Has the steadiness of energy shifted?

Transaction Rely by Dimension confirmed a steep decline throughout lower-value bands, with the $1–$10 tier down 38.26%.

In the meantime, the $1M–$10M band grew by 5.35%, confirming that whales have taken management of market movement. Naturally, this shift suggests a structural pivot—much less noise, extra conviction from deep-pocketed gamers.

Overheating or speculative conviction?

The Bitcoin NVT ratio skyrocketed to 824, a degree not often seen in earlier cycles. This indicators that market cap is outpacing transaction throughput, a possible signal of short-term overvaluation.

Nonetheless, seen alongside ETF inflows and whale positioning, the spike possible displays strategic holding, not speculative euphoria.

So, whereas it’s elevated, this may occasionally level to delayed distribution, not speedy draw back.

Are short-term holders giving up as long-term conviction takes over?

The 0–1 day Realized Cap HODL Wave has plunged to 0.187%, its lowest studying in weeks.

This drop reveals that short-term holders are retreating, with fewer individuals partaking in fast sell-offs.

As an alternative, BTC seems more and more held by long-term believers, reinforcing the shortage dynamic already echoed in ETF and S/F information. As fast flips vanish, the market tilts towards structural energy.

Backside line

ETFs and whales seem like getting ready for liftoff.

The alignment of deep-pocket inflows, shrinking retail presence, rising shortage, and long-term holding conduct displays strategic conviction, not short-term hypothesis.

Whereas metrics like NVT counsel momentary overheating, they’re offset by clear indicators of provide tightening.

So long as these structural dynamics persist, Bitcoin’s bullish momentum stays well-supported—and institutional capital could possibly be the catalyst that sustains the rally.