- Bitcoin’s long-term holders [LTH] proceed to comprehend earnings, however momentum is slowing down

- Quick-term holders [STH] dominate loss realization, indicating weaker near-term demand

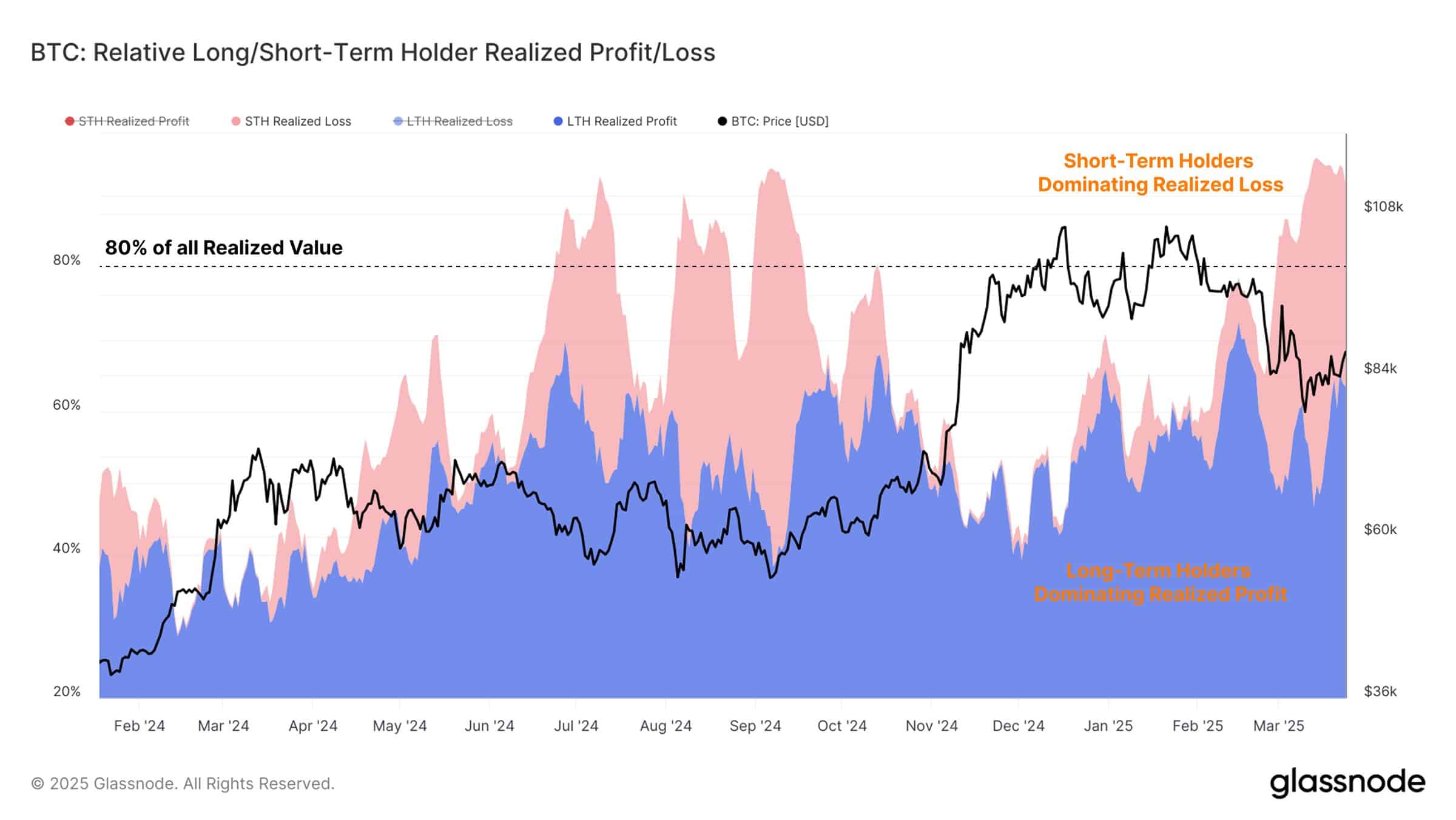

A shifting stability in Bitcoin’s [BTC] on-chain dynamics revealed that short-term holders are actually shouldering almost all the realized losses – A development that might sign a broader market reset.

In the meantime, long-term holders stay worthwhile. Although their promoting momentum has been tapering currently.

Quick-term holders dominate Bitcoin realized losses

In keeping with Glassnode, over 80% of realized worth within the Bitcoin market may be presently attributed to short-term holders [STHs] who acquired their cash throughout the final 155 days.

Actually, the chart highlighted a pointy surge in realized losses amongst STHs, coinciding with Bitcoin’s pullback from above $100k to its press time stage round $83.7k.

This capitulation habits steered that latest patrons, who entered throughout Bitcoin’s parabolic rally, have been exiting at a loss amid heightened volatility.

The realized revenue/loss imbalance hinted at a robust emotional response from newer contributors and waning confidence within the crypto’s instant upside.

Lengthy-term holders nonetheless in revenue, however slowing

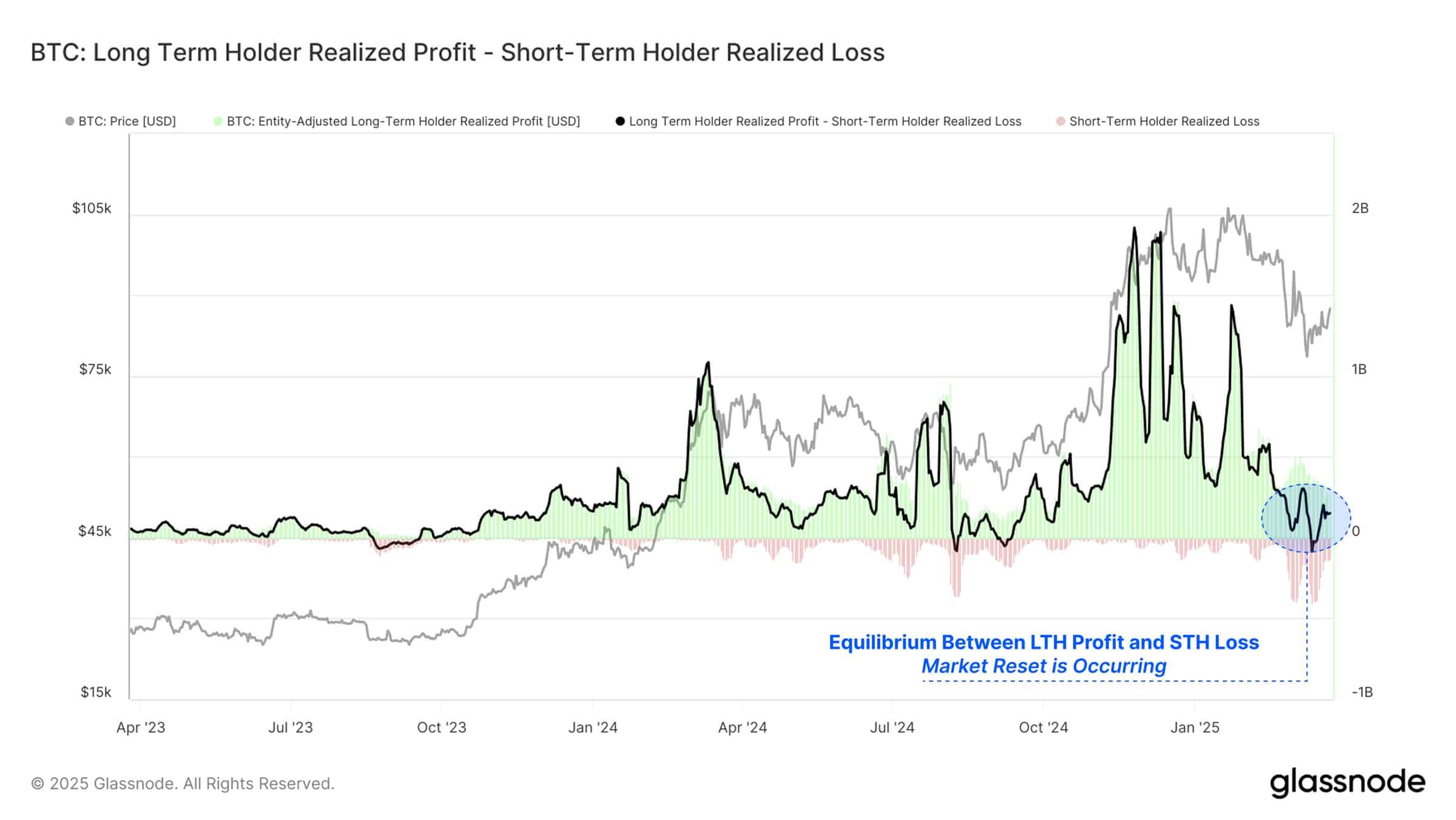

Regardless of Bitcoin STHs absorbing a bulk of the losses, long-term holders [LTHs] stay a constant supply of revenue realization. Nonetheless, the development has been weakening currently.

Actually, the web distinction between long-term earnings and short-term losses has been narrowing too, as proven within the second chart.

This “profit-loss equilibrium” displays a impartial zone the place inflows cool, market demand slows down, and value momentum stalls.

Traditionally, such situations have preceded consolidation phases or minor corrections on the charts.

Worth motion displays sentiment shift in Bitcoin

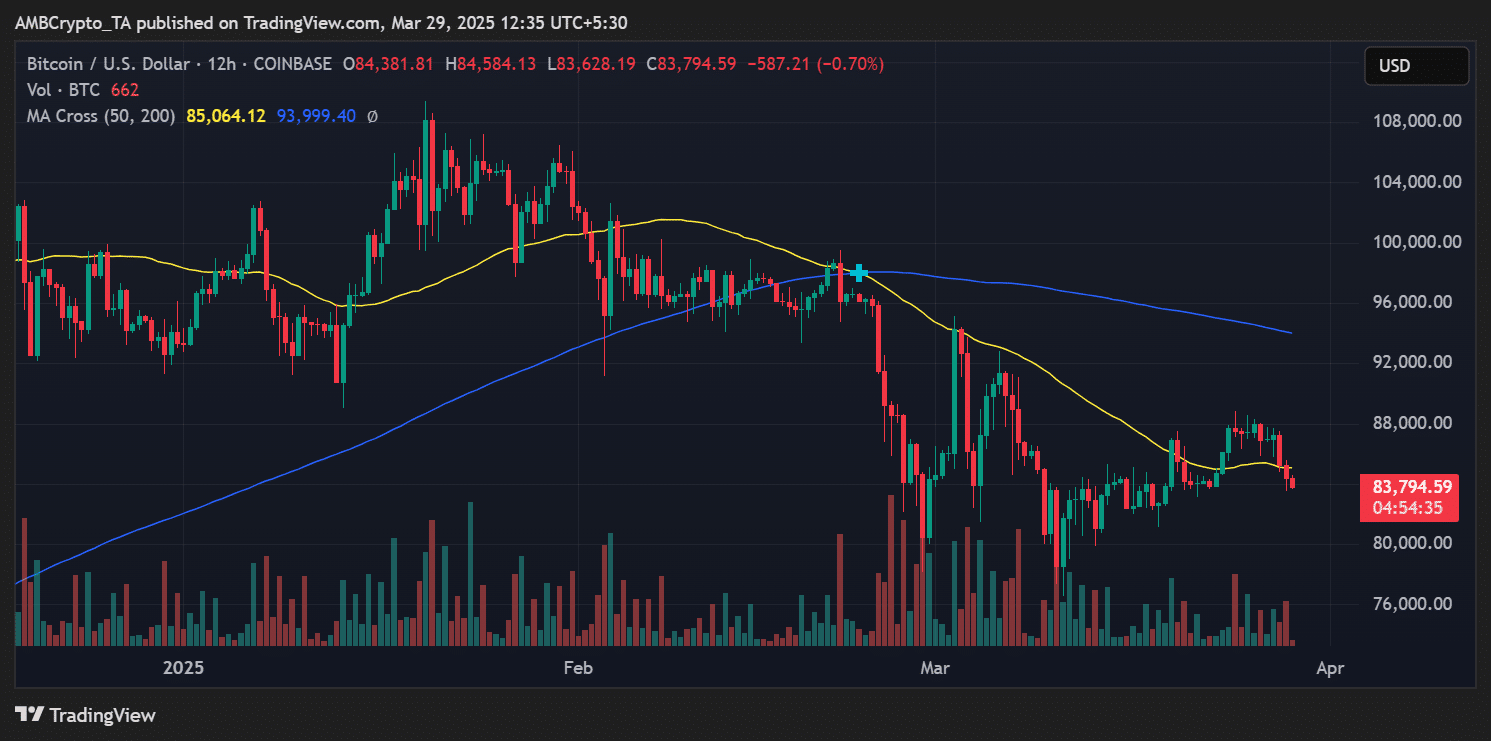

On the 12-hour chart, Bitcoin slipped beneath the 50-day MA of $85,064, buying and selling at $83,794 at press time.

The technical breach and weakening quantity supported the on-chain story of waning bullish power throughout the board.

If the market continues to digest earlier features with declining capital inflows, BTC could revisit the $80k assist zone. Nonetheless, if LTH profit-taking stays regular with out sparking extreme promoting, Bitcoin may stabilize earlier than making an attempt a contemporary transfer larger.

Conclusion

The prevailing dominance of short-term losses and the declining depth of long-term profit-taking are indicators of a transitional market section for Bitcoin. Whereas no sharp breakdown has occurred to this point, the info alluded to a cooling cycle.

Therefore, the market contributors ought to exhibit some extent of warning and endurance proper now.