- Bitcoin lately registered a significant interval of value stabilization after an prolonged interval of consolidation

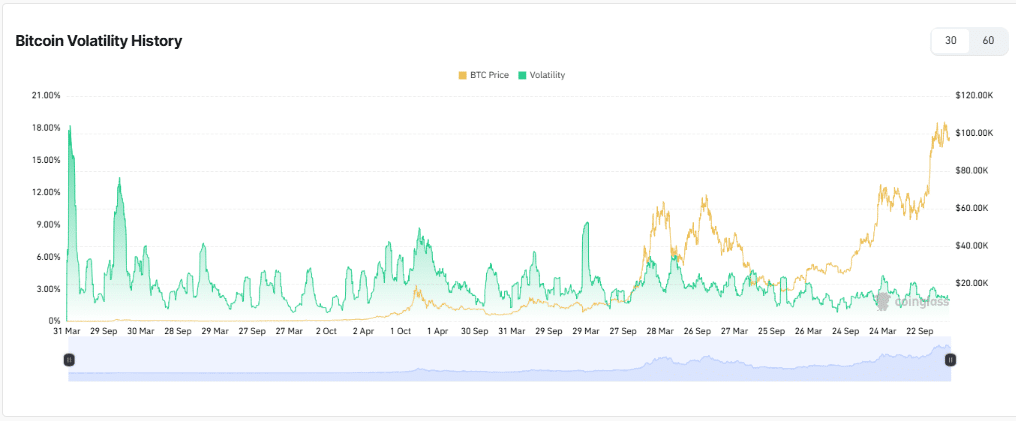

- Its volatility has fallen in current weeks, alongside its value motion on the charts

Bitcoin [BTC] lately underwent a interval of value stabilization, sometimes called sideways motion – A part that has traditionally preceded a surge in retail investor curiosity. After an prolonged interval of consolidation although, Bitcoin could also be on the point of a constructive shift now, with rising retail demand poised to drive its value increased.

A shift in the direction of development and market optimism

During the last 30 days, retail investor exercise for Bitcoin has declined by roughly 2% – A notable lower in comparison with the 20% drop in January.

Such a moderation in retail demand signifies that the market has reached a degree of stabilization, setting the stage for potential development. Additionally, at press time, evaluation highlighted the 30-day change in retail demand, revealing how earlier durations of development in demand have been linked with value hikes.

The smaller decline in retail exercise over the previous month might point out that the consolidation part is nearing its finish. As retail demand begins to develop once more, it might create a constructive shift in market sentiment, favoring Bitcoin’s value within the brief time period.

Bitcoin’s robust foundations for future development

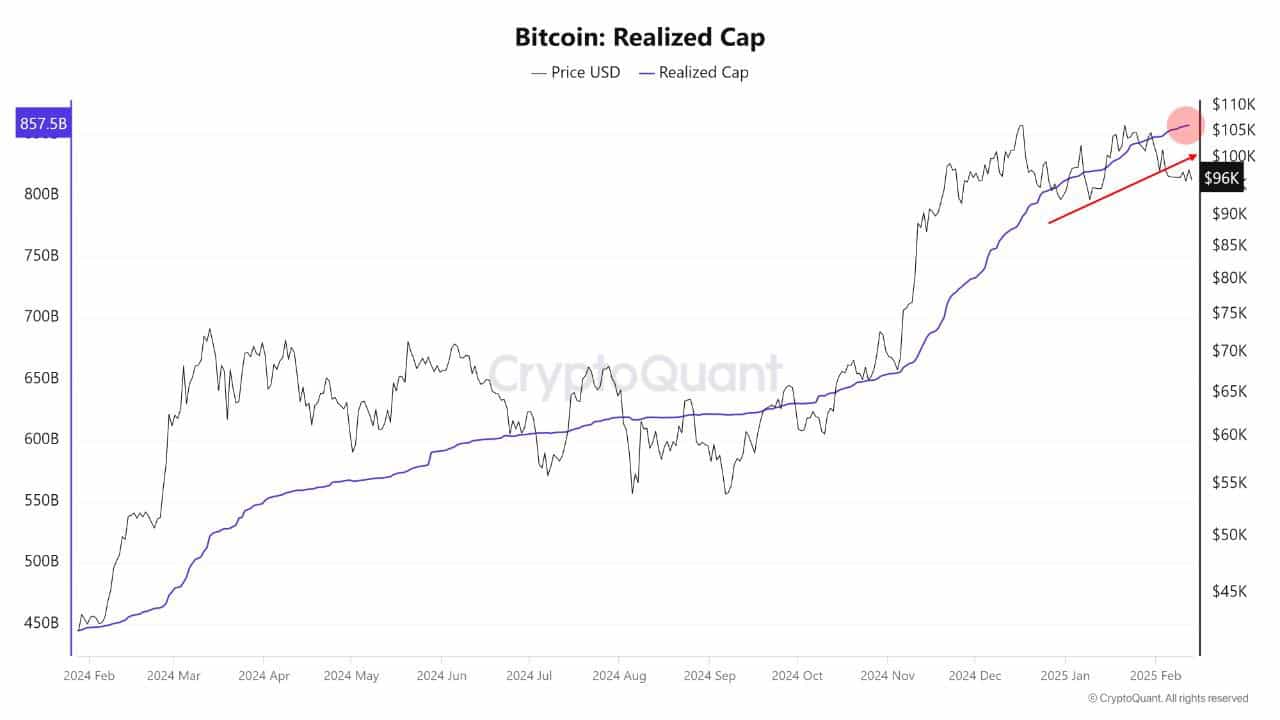

Bitcoin’s realized market cap lately hit an all-time excessive of $857 billion. This achievement merely reinforces the continuing energy of Bitcoin’s bull cycle – An indication of sturdy market well being regardless of occasional value corrections.

Actually, long-term holders are capitalizing on increased costs, signaling confidence within the asset’s long-term worth. Concurrently, new traders are getting into the market and absorbing promote strain, whereas sustaining upward momentum.

This interaction between long-term holders and new traders signifies that bullish sentiment for Bitcoin has remained robust. This additionally helps the probability of sustained value development within the close to time period.

Affect of worthwhile positions on value

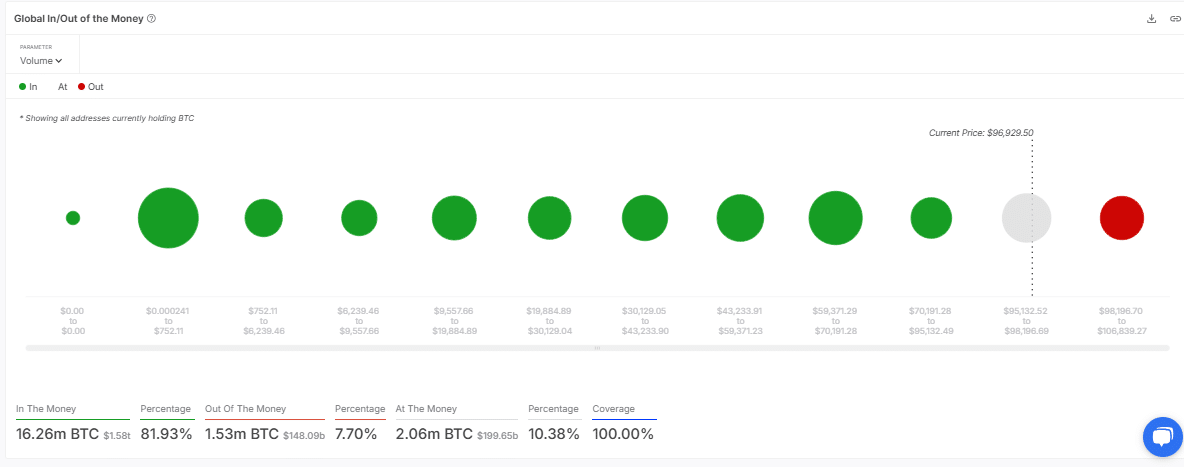

In line with an evaluation of Bitcoin’s International In/Out of the Cash metric, the crypto’s value of roughly $96,929.50 has positioned a good portion of addresses ‘Within the Cash.’ Such a discovering additionally hinted that many traders are in worthwhile positions proper now.

This usually triggers a worry of lacking out (FOMO) sentiment, with potential patrons in search of to enter the market earlier than additional positive factors happen.

Fewer ‘Out of the Cash’ addresses scale back promoting strain, doubtlessly permitting for a extra steady and constant value hike. The prevailing scenario appeared to point out {that a} favorable ratio of worthwhile positions might additional contribute to momentum in Bitcoin’s value.

A precursor to potential to extra upside?

Lastly, Bitcoin’s volatility has fallen in current weeks, alongside its value motion. Since durations of decrease volatility usually precede vital value actions, it may be assumed that the market could also be consolidating earlier than a breakout.

This mixture of low volatility, excessive market cap, and constructive retail demand is essential for BTC’s price action. A fall in volatility, mixed with different bullish indicators, could be a precursor to a bullish development, with Bitcoin doubtlessly breaking out of its consolidation part.