- Promoting sentiment has been dominant amongst U.S buyers

- Market indicators hinted at a sustained value drop within the quick time period

Bitcoin [BTC] has been on a rollercoaster trip for a few weeks now. This was finest evidenced by BTC efficiently crossing $64k, earlier than dropping underneath $60k inside only a few days.

Whereas the coin’s volatility has remained excessive, institutional buyers are contemplating stockpiling the cryptocurrency. Will this assist BTC flip bullish in September?

Are institutional buyers accumulating Bitcoin?

Bitcoin witnessed a +9% value correction final month. On the time of writing, it was trading at $58,184.19 with a market capitalization of over $1.13 trillion.

Within the meantime, Vivek, a preferred crypto influencer, not too long ago shared a tweet highlighting an attention-grabbing growth. In response to his evaluation, the variety of BTC balances on new addresses with greater than 1k BTC elevated sharply during the last a number of months. This clearly steered that institutional buyers have been displaying confidence in BTC. It additionally means they count on the king coin’s value to surge within the coming weeks or months.

Since a brand new month is already upon us, AMBCrypto took a more in-depth have a look at Bitcoin’s state. This, in an try to see whether or not institutional buyers’ confidence in BTC would repay this month.

How BTC’s September may appear to be

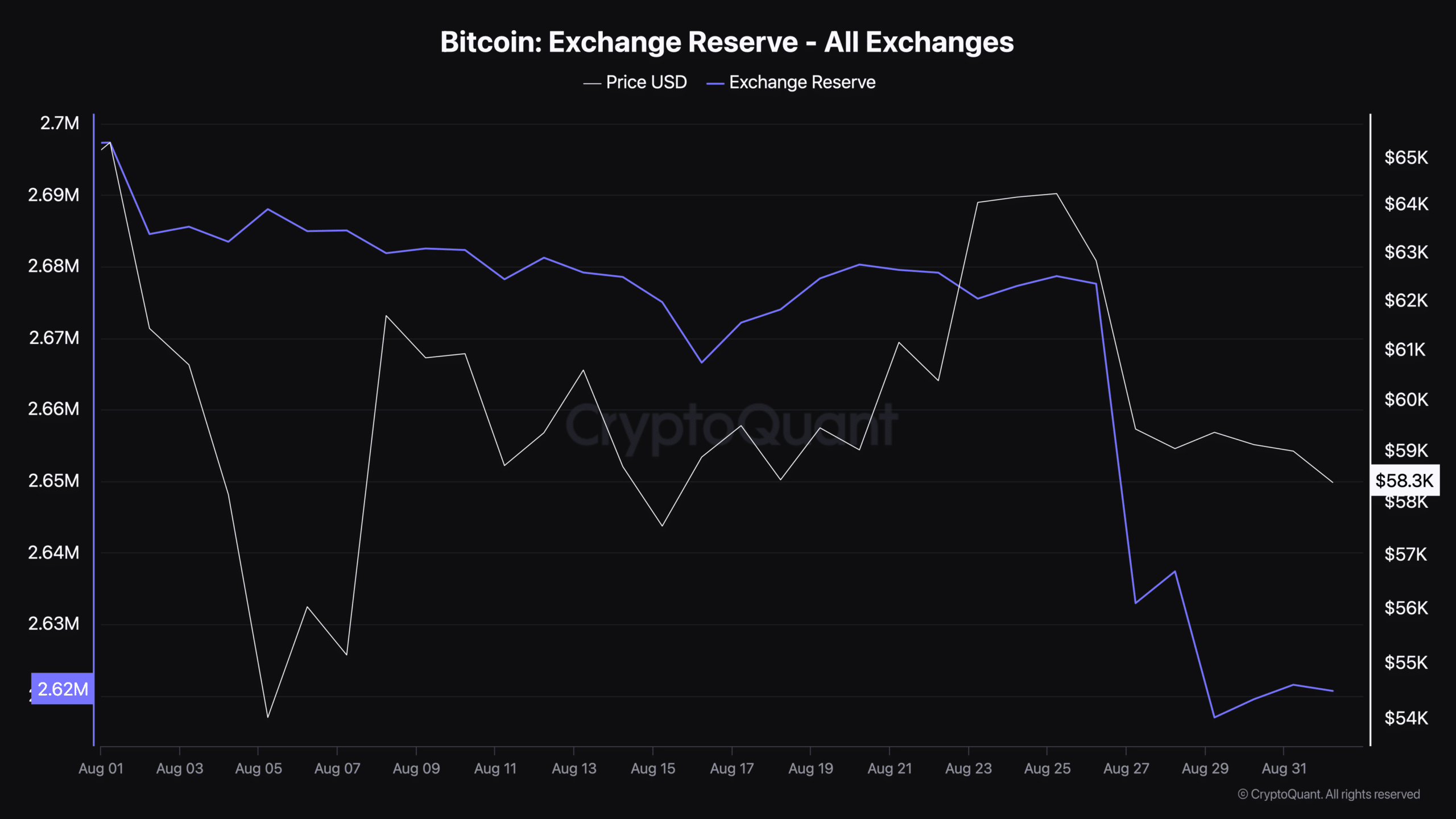

AMBCrypto’s evaluation of CryptoQuant’s data revealed that BTC’s alternate reserves dropped sharply on 27 August. This clearly steered that purchasing strain on the coin was excessive, which frequently leads to value hikes.

Nevertheless, not all the pieces gave the impression to be within the coin’s favor. For instance, the Coinbase premium turned inexperienced, that means that promoting sentiment was robust amongst U.S buyers. On high of that, the Funds premium was additionally crimson. This indicated that buyers in funds and trusts, together with Grayscale, have comparatively weak shopping for sentiment.

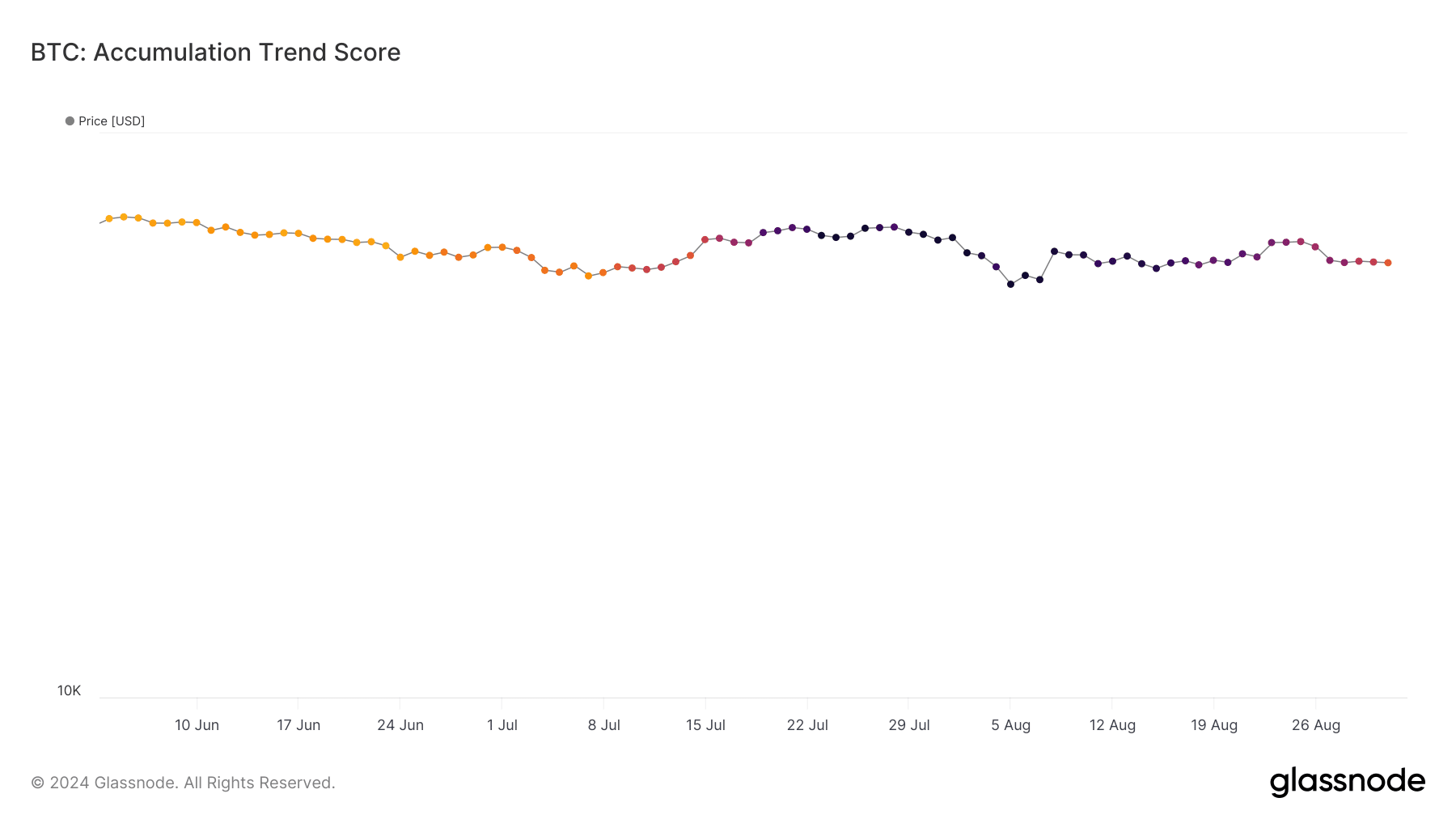

Aside from this, AMBCrypto’s evaluation of Glassnode’s knowledge revealed that at press time, Bitcoin’s accumulation pattern rating had a worth of 0.35. For starters, the buildup pattern rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain by way of their BTC holdings.

A quantity nearer to 0 signifies the reluctance of buyers to build up. Then again, a worth nearer to 1 hints at a hike in shopping for strain. Since at press time the worth was near 0, it appeared that purchasing strain was diminishing.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

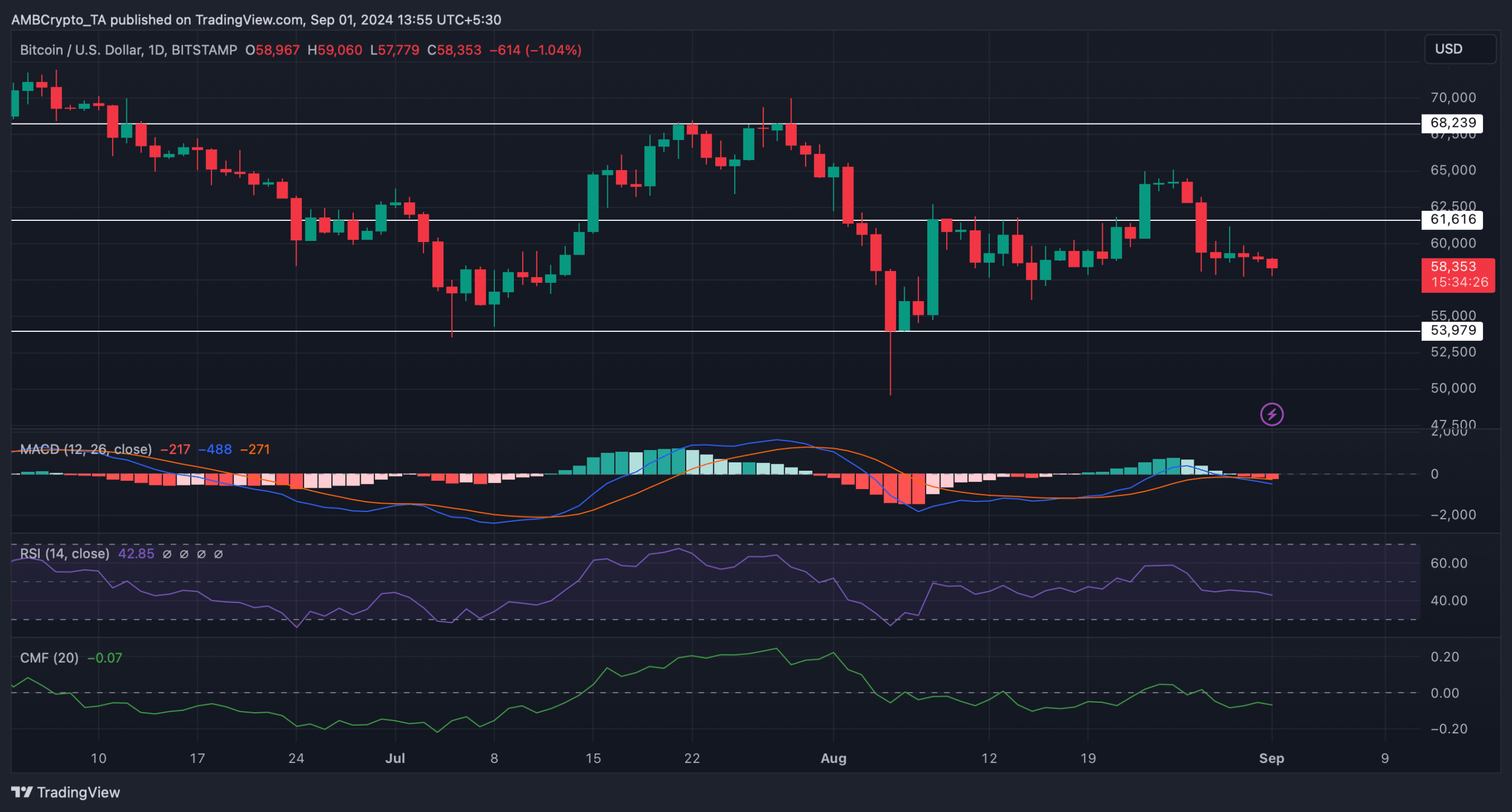

Lastly, AMBCrypto analyzed BTC’s every day chart to higher perceive what to anticipate from it in September.

The technical indicator MACD displayed a bearish crossover. Each its Chaikin Cash Circulation (CMF) and Relative Energy Index (RSI) registered downticks too. Collectively, these indicators steered that buyers might need to attend longer in September to see Bitcoin flip bullish.