- Bitcoin’s surge again to $101K is fueled by massive HODLers capitalizing on the dip.

- A brand new all-time excessive may very well be inside attain, setting the stage for an thrilling rally.

Bitcoin [BTC] is again on the vital $100K degree, igniting intense hypothesis about its subsequent huge transfer. The market is split: some see the latest surge as an indication of cautious optimism, fueled extra by hype than stable fundamentals.

On the flip aspect, the rising variety of massive HODLers suggests a robust accumulation part, with many contemplating the present value as a possible backside.

This units the stage for a big breakout as the brand new 12 months pleasure ramps up.

So, with the stakes greater than ever, can Bitcoin ship on its promise of hitting a brand new all-time excessive by the tip of This fall?

Bitcoin is displaying indicators of undervaluation

A number of key elements are in play proper now. On the interior entrance, quantity knowledge suggests Bitcoin is reasonably undervalued, whereas the RSI stays impartial.

The MACD traces are near a bullish crossover, and the CMF stays constructive.

Externally, each financial and psychological dynamics are lining up, hinting {that a} backside formation is underway.

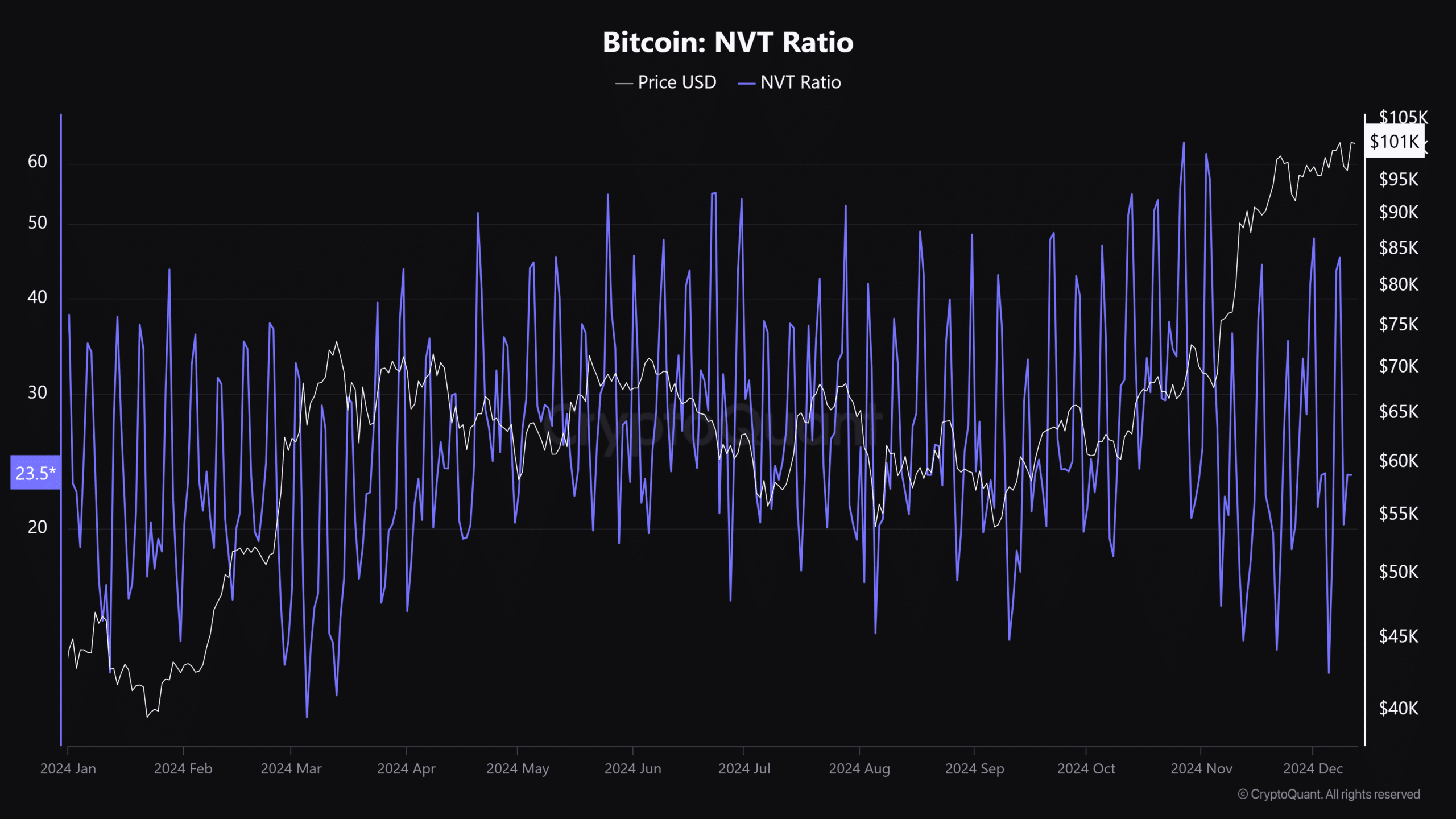

Traditionally, breakouts are likely to observe when the community is undervalued—and proper now, the NVT ratio is confirming this sentiment.

With the NVT hitting a two-month low, Bitcoin’s value appears to be outpacing its community exercise. This alerts a possible shopping for alternative, particularly for giant HODLers capitalizing on the dip.

However right here’s the catch: whales have been actively scooping up each dip for the previous two weeks, successfully stopping any main pullbacks.

Nonetheless, regardless of their efforts, value motion has remained lackluster because of the overwhelming affect of excessive leverage within the derivatives market.

A confirmed backside may set the stage to squeeze quick positions – however this may solely occur if whales and enormous HODLers proceed to drive the shopping for momentum.

A method bulls should observe for Bitcoin’s surge

Previously 24 hours, Bitcoin surged again to the $101K mark after every week of sell-side strain, triggering an enormous quick squeeze.

Over $170 million briefly positions had been liquidated, with the largest order coming from Binance—a whopping $5.31M BTC/USDT.

What’s extra, Open Curiosity (OI) has climbed almost 6%, reaching $64 billion, as dominant holders wager on Bitcoin’s rise. This surge may very well be a great second for traders to think about leaping in for a possible rebound.

Why? A latest correction pressured lengthy positions to shut, however whales managed to maintain the worth from falling beneath $90K, neutralizing the strain.

Learn Bitcoin [BTC] Price Prediction 2024-2025

Now, with massive HODLers and institutional gamers recognizing Bitcoin’s undervaluation, the stage is about for a wave of shorts to get squeezed out.

If the massive gamers hold scooping up the dips, a brand new all-time excessive may very well be simply across the nook, able to shatter expectations.