- Bitcoin ETFs IBIT and FBTC excelled with over $10 billion in property amid the market downturn.

- Ethereum ETFs struggled, going through cumulative outflows as Bitcoin and Ethereum costs declined.

Because the cryptocurrency market grapples with a broader downturn, Bitcoin [BTC] ETFs aren’t resistant to the prevailing traits.

Latest reviews from Farside Investors reveal that BTC ETFs skilled vital outflows, amounting to $52.9 million on 2nd October.

Balchunas highlights high performers

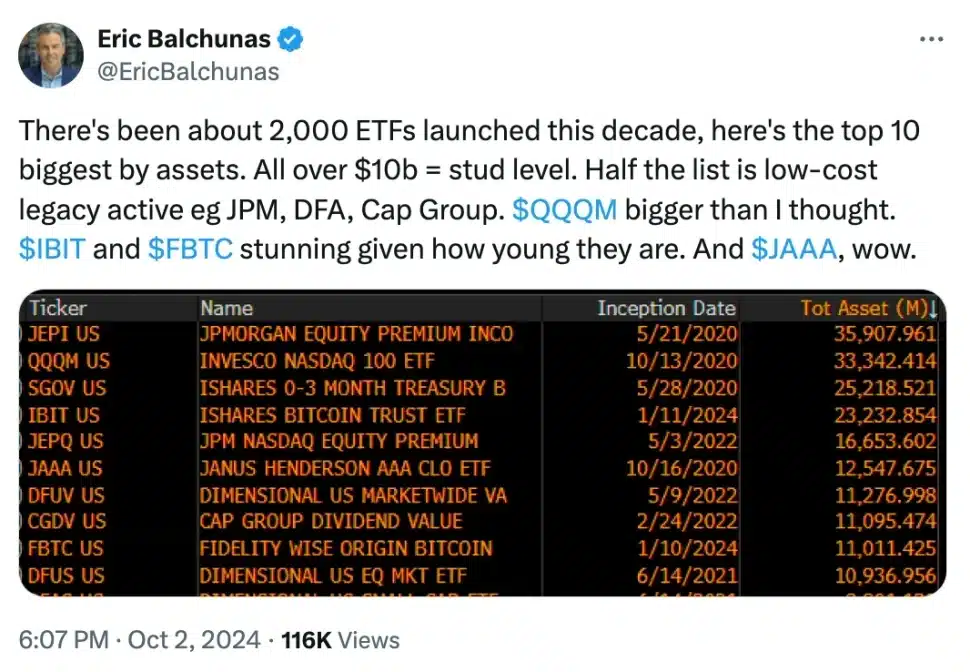

Nonetheless, amidst this difficult panorama, Eric Balchunas, a senior ETF analyst at Bloomberg, has recognized two standout Bitcoin ETFs—BlackRock’s IBIT and Constancy’s FBTC—as high performers of the 2020s.

Each funds have achieved “stud degree” standing, boasting over $10 billion in Belongings Underneath Administration (AUM), highlighting their resilience and attraction to buyers even in turbulent instances.

In his X (previously Twitter) put up, Balchunas famous,

Echoing Balchunas’ sentiment, an X person added,

Blackrock’s and Constancy’s Bitcoin ETFs analyzed

This pattern was additional confirmed by knowledge from Farside Investors, revealing that since its launch, BlackRock’s IBIT has amassed a staggering $21.5 billion in complete inflows, whereas Constancy’s FBTC has attracted $9.9 billion.

These two ETFs have set the tempo, leaving different funds trailing.

Nonetheless, October, historically considered as an “Uptober” month following a declining September, has introduced blended outcomes.

On the first of October, IBIT skilled an influx of $40.8 million, contrasting sharply with FBTC, which confronted outflows of $144.7 million.

IBIT recorded outflows of $13.7 million on the 2nd of October, whereas FBTC rebounded with inflows of $21.1 million, illustrating the volatility and shifting dynamics inside the ETF panorama.

Ethereum ETF efficiency

Conversely, the efficiency of Ethereum [ETH] ETFs has additionally been underwhelming.

On the first of October, cumulative outflows for ETH ETFs reached $48.6 million, with BlackRock’s ETHA experiencing no inflows or outflows, whereas Constancy’s FETH noticed outflows of $25 million.

ETHA continued to wrestle, posting outflows of $18 million on the next day.

Whereas FETH maintained a gradual place with no flows recorded.

This pattern highlights the challenges going through Ethereum ETFs within the present market atmosphere.

Rising considerations round Grayscale’s GBTC

Amidst there was one other X user who requested a really regarding query,

“Would this not then make #GBTC one of many worst performing ETFs of this decade?”

This statement is additional substantiated by the newest replace from Farside Buyers, revealing that Grayscale’s GBTC has skilled a staggering complete outflow of $20.1 billion since its launch.

Equally, Grayscale’s Ethereum ETF, ETHE, had confronted vital outflows totaling $2.93 billion, which surpassed the mixed outflows of all different ETH ETFs.

BTC and ETH worth motion

On the value entrance, each cryptocurrencies have been experiencing a downward pattern, with Bitcoin trading at $60,480.03, reflecting a decline of 0.98% prior to now 24 hours.

In the meantime, Ethereum was trading at $2,347.81, displaying a extra substantial dip of 4.35% over the identical interval.