- Bitcoin confronted a important resistance at $102,350, with sturdy help round $96,147.

- Market sentiment remained balanced as transaction quantity declined, indicating attainable short-term volatility.

Bitcoin [BTC] has not too long ago reclaimed a important help zone between $96,475 and $99,360, signaling potential bullish momentum.

At press time, Bitcoin’s worth was at $98,079.85, reflecting a 0.91% drop over the previous 24 hours.

Regardless of this minor decline, Bitcoin’s general momentum remained sturdy, particularly with the $102,350–$103,900 provide wall in sight. If Bitcoin breaks by this degree, we might see the subsequent section of its bullish cycle.

What does Bitcoin’s chart reveal?

The king coin’s worth chart confirmed an incoming inverted head and shoulder sample, which is commonly seen as a bullish sign. The worth has consolidated between $96,147 and $102,806, forming a important resistance zone.

Bitcoin is testing this zone, and if it holds above $96,147, it might break by the $102,350–$103,900 area, pushing in the direction of $104,000.

Moreover, the Relative Energy Index (RSI) was at 44.45 at press time, indicating that BTC was approaching oversold situations.

Thus, Bitcoin might expertise a short-term pullback or consolidation earlier than gaining sufficient power to interrupt the $102,350 provide wall.

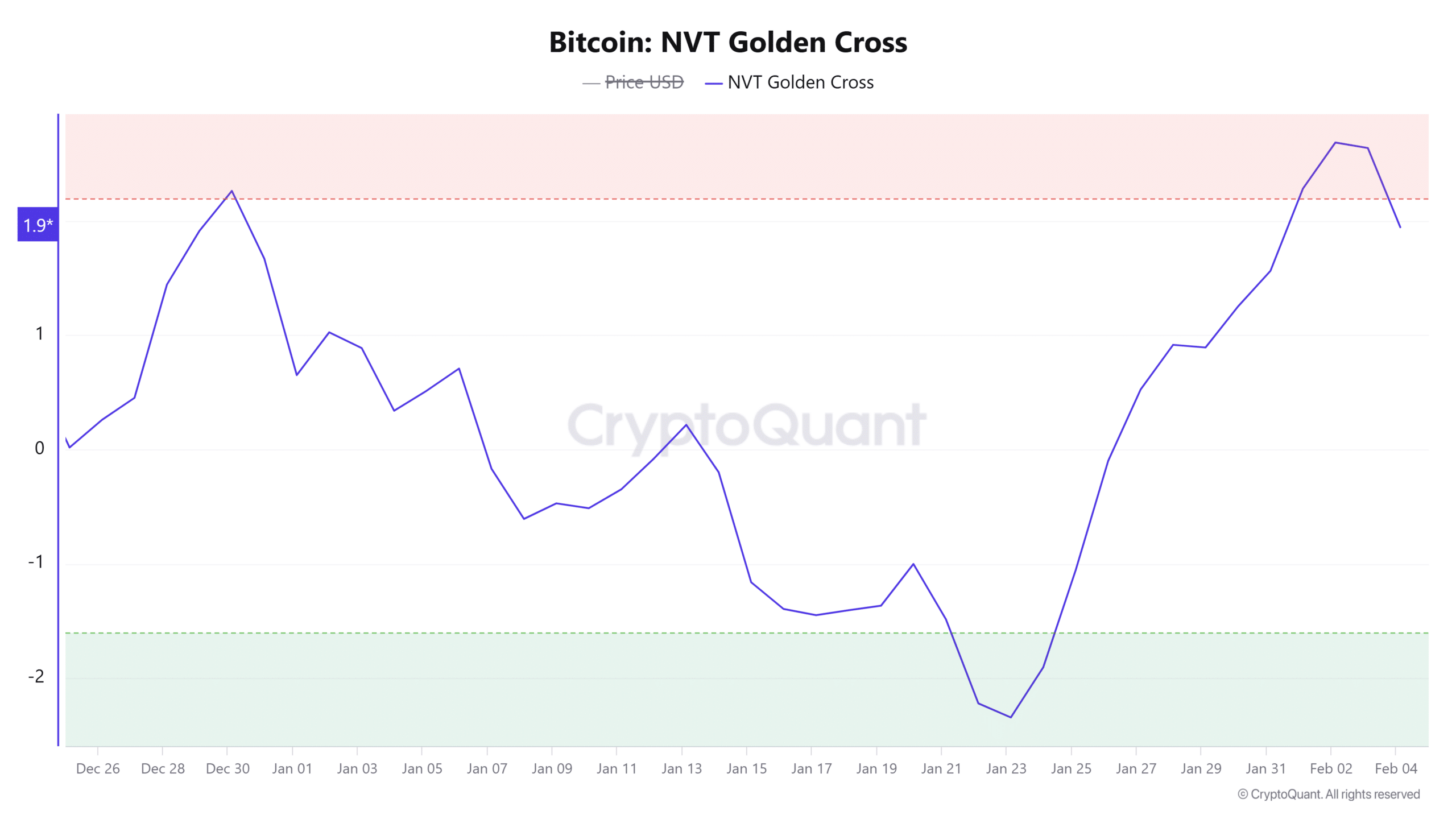

What’s the NVT Golden Cross telling us?

The NVT Golden Cross indicator, which measures Bitcoin’s community worth to transaction quantity, confirmed a 24-hour proportion change of -23.09%.

This indicated a decline in transaction quantity relative to BTC’s worth enhance, suggesting that the rally might not be absolutely supported by community exercise.

Though BTC remained bullish, the dearth of adequate transaction quantity might sign that the rally might lose steam.

Due to this fact, if transaction quantity doesn’t choose up quickly, Bitcoin might expertise a short pullback earlier than resuming its upward pattern.

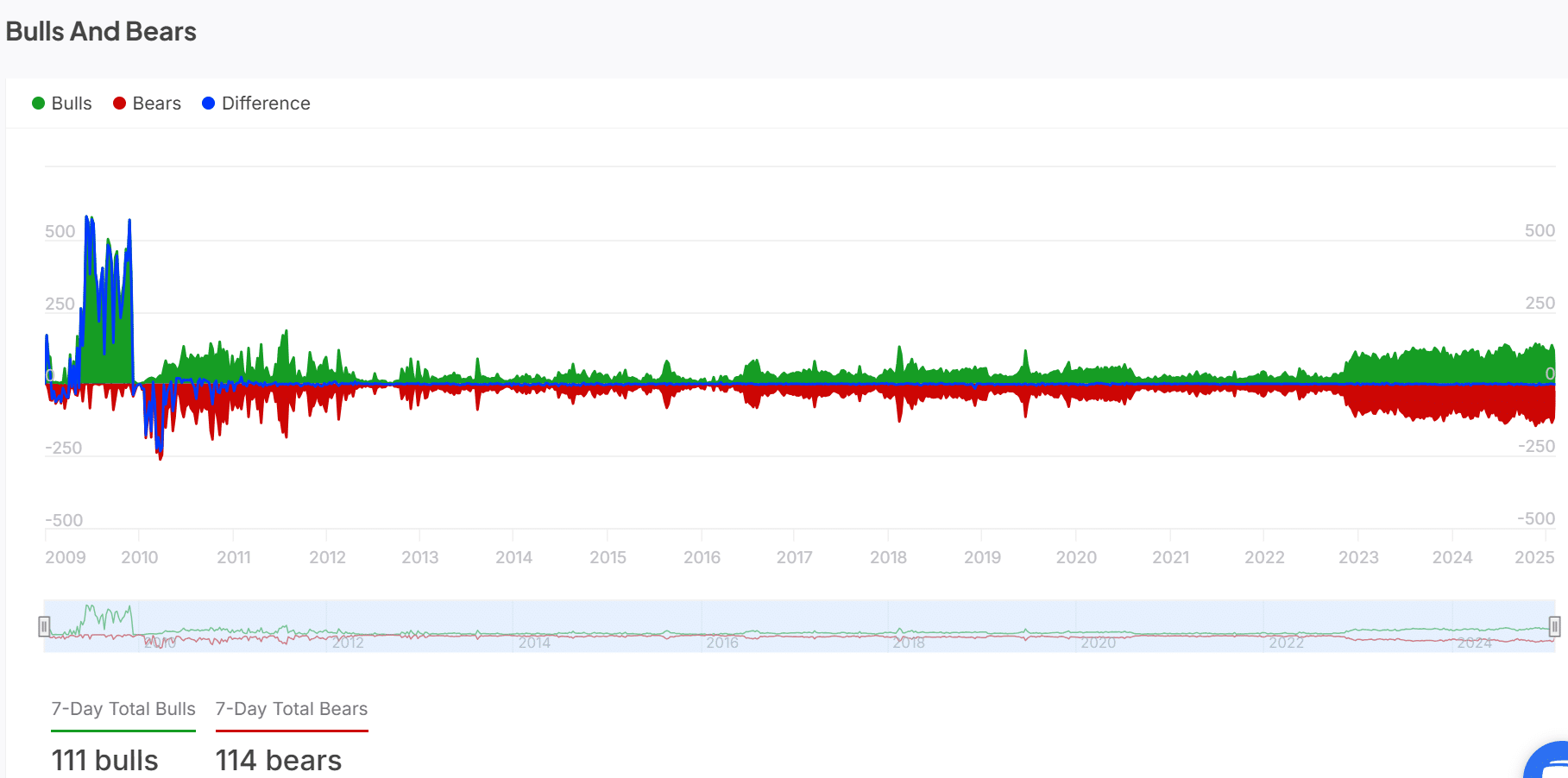

Bulls vs. bears: Who has the higher hand?

Market sentiment confirmed that bulls and bears had been in a good contest. With 111 bulls versus 114 bears up to now week, the market sentiment stays comparatively balanced.

Regardless of some bullish outlooks, bear strain endured, signaling that BTC might face resistance because it approaches the $102,350 provide wall.

The result of this tug-of-war between the bulls and bears will doubtless decide whether or not Bitcoin can break by this resistance and proceed climbing.

Lengthy vs. quick positions: What are merchants anticipating?

Bitcoin’s Lengthy/Brief Ratio revealed that extra merchants had been betting towards additional worth will increase. At press time, 45.16% of positions had been lengthy, whereas 54.84% had been quick.

This instructed {that a} majority of merchants had been anticipating a worth pullback within the quick time period.

BTC’s volatility performs a job on this cautious stance, as many merchants are unsure in regards to the sustainability of the current worth motion.

Merchants will probably be watching carefully to see if the bullish momentum can overpower the quick positions.

BTC can break the $102,350 wall, however…

BTC’s current restoration, mixed with its important help ranges and potential bullish patterns, means that the cryptocurrency will doubtless break by the $102,350–$103,900 provide wall.

Whereas some bearish sentiment stays out there, the general technical setup is promising.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Nevertheless, the present lack of sturdy transaction quantity and continued resistance from the bears might lead to some volatility.

Consequently, whereas Bitcoin is poised to interrupt the availability wall, the journey might contain some fluctuations earlier than a transparent breakout.