Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s six-month consolidation is a coil, not a coffin, in keeping with the pseudonymous technician Cantonese Cat, whose 19 June video marshals a number of time frame proof to argue that the meme-coin’s subsequent directional break shall be up—doubtlessly so far as $4.13 earlier than the present cycle tops out.

Dogecoin Breakout Is Solely A Matter Of Time

The analyst begins by addressing sentiment. Retail remark threads have turned caustic, he notes, as a result of worth has slipped from final autumn’s spike after which “achieved nothing for months.” But such fatigue is exactly what bull-market retracements are supposed to produce: “Lots of people are getting actually bitter about Doge … that’s precisely how larger highs and better low sort conditions are alleged to get you all annoyed. That is nonetheless a bull development till confirmed in any other case.”

Associated Studying

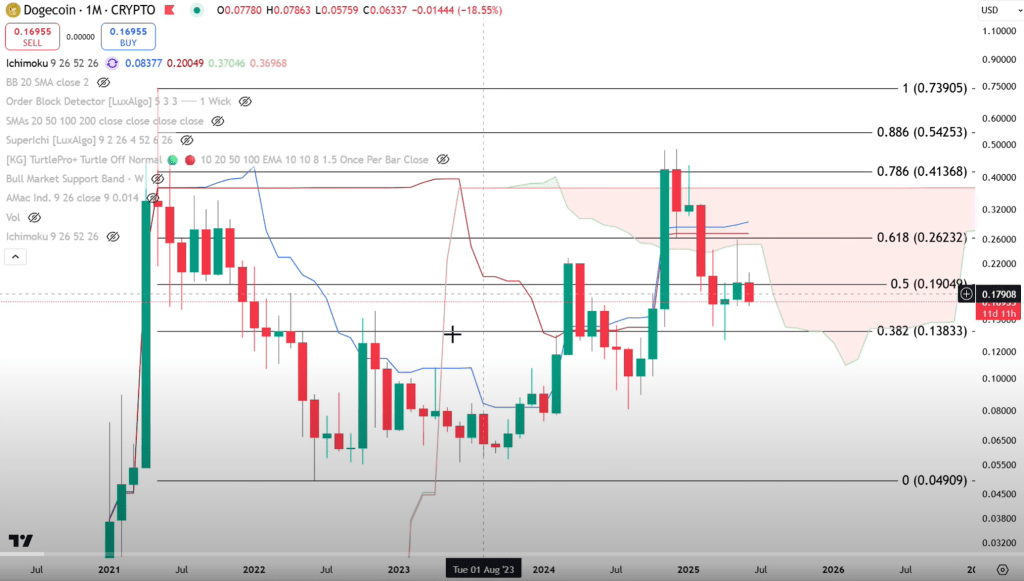

On the highest zoom degree, Dogecoin is tracing what he calls “nonetheless a cup and … nonetheless a deal with till confirmed in any other case.” The primary thrust of that deal with halted nearly precisely on the 0.786 Fibonacci retracement of the 2022–24 bear vary—“a vital fib degree right here.” As a result of preliminary makes an attempt hardly ever pierce that resistance, he anticipated rejection. What issues is the place the pullback discovered assist: “Within the case of Dogecoin, it determined to go all the best way right down to 0.382, which is nothing uncommon … that is truly a fairly necessary zone of this good Adam-and-Eve double backside.” The market is due to this fact testing, not violating, an traditionally highly effective neckline.

Zooming to the month-to-month chart, Dogecoin sits beneath what the analyst calls “a fairly thick Ichimoku cloud.” Two breakout makes an attempt have failed, producing a pair of wicks that look ominous to informal chart watchers. Cantonese Cat disagrees: “We had somewhat little bit of a false breakout right here on the month-to-month … I feel a 3rd time goes to be the attraction.” Beneath the cloud, six consecutive month-to-month candles have nested solely contained in the tall inexperienced bar printed final November. He interprets the formation—six inside bars—as latency constructing for a violent transfer: “You’re speaking about consolidation with six inside candles forming numerous vitality right here.”

That compression is mirrored on the weekly time-frame: “For those who additionally take a look at the weekly right here, you can even see that you’ve got six inside candles over right here too … that tells me that there’s not a lot bearish vitality essentially left anymore. I feel we’re nearer to the underside than the highest.”

Key structural assist is provided by a rising 20-month easy transferring common, now at $0.1737. Value at the moment ticks under it, however the slope remains to be optimistic. Traditionally, such mixtures resolve in favour of the development: “When you have a 20-month transferring common that’s up-sloping, more than likely that is simply going to be a wick.” He cites an earlier cycle when Dogecoin depraved beneath the identical metric earlier than staging a dramatic reversal.

Value motion, he argues, is meaningless with out context. “If I find yourself taking a look at Doge right here on Coinbase and I pull up the amount right here, you can even see that there isn’t a promoting quantity right here in any respect.” Binance, the world’s deepest Dogecoin market, exhibits equivalent inertia. “The promoting quantity is basically non-existent,” he says, concluding that offer overhang has vaporised and solely demand is required to propel a reversal. Twice earlier than—in July 2023 and February 2024—equivalent quantity droughts preceded V-shaped rallies: “Low promoting quantity over right here, reversal as soon as quantity is available in … low promoting quantity over right here, reversal as soon as quantity is available in.”

Associated Studying

Day by day-chart oscillators are starting to corroborate the structural learn. Dogecoin has simply registered what Cantonese Cat labels a “treasure backside”—his time period for a localised capitulation whose candle physique is way smaller than its wick. Extra formally, the relative-strength index has exhibited bullish divergence: worth has etched decrease lows whereas RSI turns larger. “Final time when you might have some bullish diversions was proper right here … that was the native backside proper there,” he says, pointing to the October 2023 reversal. The sample repeated in March 2024 and seems once more at present: “I feel that we may be experiencing a development change right here comparatively quickly.”

DOGE Value Targets

Ought to quantity arrive and worth claw again via the 0.5 and 0.618 retracements, Cantonese Cat’s Fibonacci ladders flag successive targets. From the Binance dataset, “$1.60, $2.26 and $4.13, all of those are chance for Dogecoin.” A composite feed of a number of exchanges tweaks the numbers to $1.50, $2.27 and $3.94. What he doesn’t foresee is a reprise of 2021’s parabolic blow-off, when Dogecoin tagged the two.272 extension and briefly urged a trajectory in the direction of $23. “I feel that $23 doge is insane … I don’t assume that doge goes to finish up changing into, you already know, like something like $3 trillion market cap.” 1 / 4- to half-trillion-dollar capitalisation, nonetheless—roughly the value zone between three and 4 {dollars}—stays “one thing to consider” given present financial growth.

Cantonese Cat interprets the group’s malaise as a contrarian reward: “The market makers are giving us extra time to purchase whereas the sentiment is extraordinarily, extraordinarily poor.” Inside-bar ranges function a easy set off. An in depth above the six-month vary excessive would, in his studying, unlock the first up-trend’s subsequent leg. Conversely, an in depth under the 20-month average would possibly delay—however not essentially invalidate—the thesis, supplied the transferring common itself retains rising.

Throughout each lens—the macro cup-and-handle, the Adam-and-Eve neckline check, Ichimoku resistance, 20-month transferring common assist, quantity exhaustion, every day bullish divergence—the burden of proof converges on a bullish end result. Timing, he concedes, is unknowable: “When is that going to be? I don’t know.” But not one of the knowledge justify capitulation. He closes with the maxim he repeats thrice within the broadcast: “The development is your pal, and the development is up.” If that view holds, Dogecoin’s dormant coil could finally unwind towards the analyst’s most formidable extension at $4.13—a degree unthinkable to at present’s demoralised sellers, and exactly for that purpose, he argues, nonetheless inside attain.

At press time, DOGE traded at $0.171.

Featured picture created with DALL.E, chart from TradingView.com