- Crypto merchants are cautious forward of Trump’s tariff announcement, unsure of market influence.

- Regardless of the Q1 downturn, consultants predict Bitcoin might take a look at $100,000 if tariffs and insurance policies stabilize.

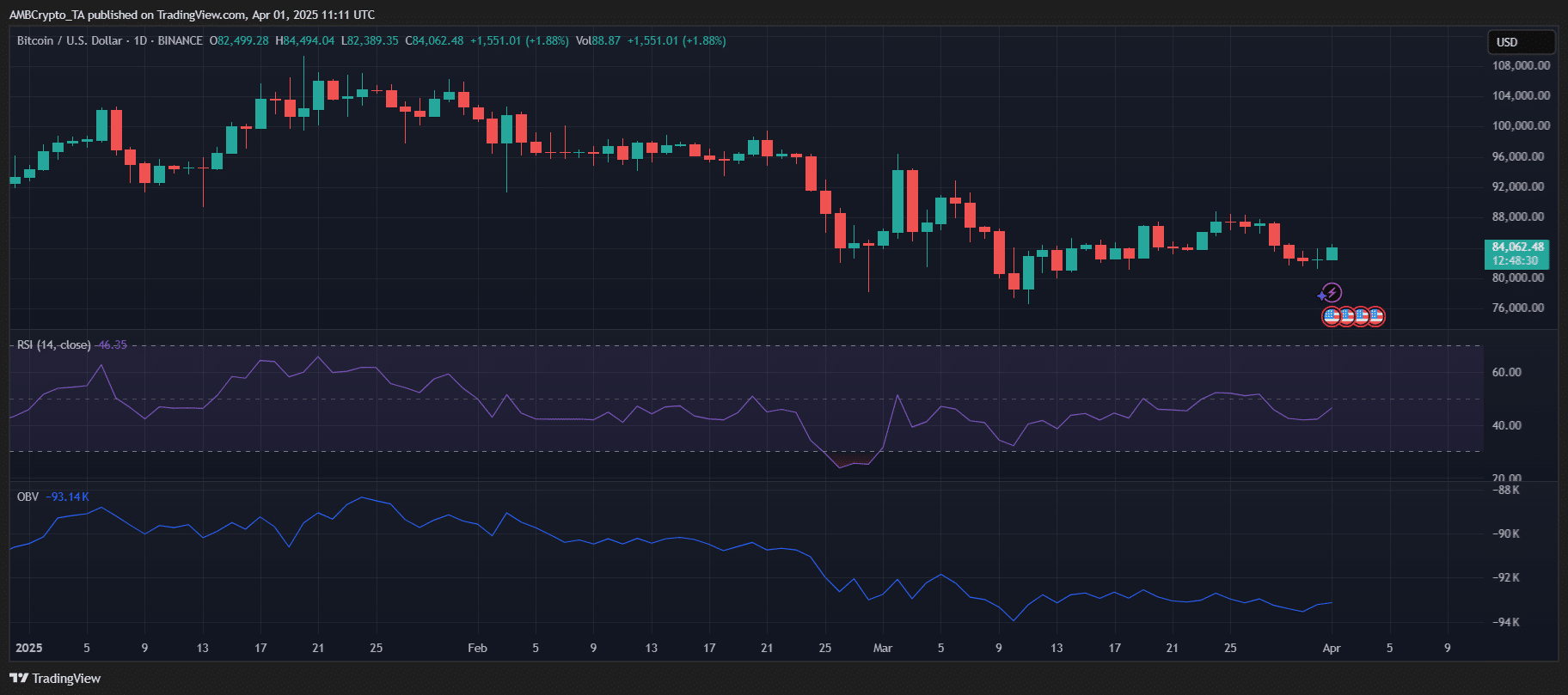

Bitcoin [BTC] is holding agency above $84K as merchants undertake a cautious “wait-and-see” stance forward of President Trump’s much-anticipated Liberation D tariff announcement.

With international markets bracing for potential turbulence, crypto buyers are left grappling with uncertainty. Will the brand new tariffs ignite recent volatility, or will they open the door to new alternatives?

Crypto merchants in ‘wait-and-see’ mode

Presto Analysis Analyst Min Jung mentioned,

“Proper now, the market is in a wait-and-see mode, as the small print of the tariffs have but to be disclosed.”

The announcement of latest tariffs on April 2, dubbed “Liberation Day,” is anticipated to convey vital modifications to U.S. commerce relations. Nevertheless, the precise influence on the crypto market stays unclear.

Merchants are weighing the potential fallout from these tariffs, which can set off a sequence response in international commerce.

“Some buyers imagine the influence could also be much less extreme than initially feared, viewing the current dip as a possible ‘purchase the dip’ alternative…”

Jung went on so as to add,

“Nevertheless, many merchants are nonetheless opting to stay on the sidelines till there’s larger readability.”

Worst Q1 for Bitcoin since 2018

The primary quarter of 2025 has been a turbulent one for Bitcoin. After peaking above $108,000 in January, BTC skilled a pointy drop to beneath $80,000 final month.

This decline was in step with the broader market’s response to Trump’s tariff bulletins and international financial uncertainty.

Put up-November, the market adopted a traditional “purchase the rumor, promote the information” sample. Traders had initially anticipated Trump’s pro-crypto stance to drive a bull market in early 2025.

Nevertheless, the implementation of tariffs has launched sudden volatility, shifting the market’s trajectory and dampening the anticipated bullish momentum.

Bitcoin’s Q1 2025 efficiency marked the worst since 2018, with a drop of 11.82%.

Trying forward

Regardless of the current downturn, consultants stay optimistic about Bitcoin’s long-term outlook.

Whereas coverage modifications take time to totally unfold, the anticipated momentum from institutional adoption is seen as a key driver, with pro-crypto insurance policies from the present administration set to play a pivotal position.

Nevertheless, the results of those insurance policies are prone to be gradual.

Bitcoin’s worth is anticipated to check the $100,000 mark within the coming months, with a possible restoration within the second quarter of the yr.

If the Federal Reserve cuts charges and the administration supplies readability on its tariff stance, Bitcoin might see one other rally, presumably breaking by way of resistance at $88K.

That mentioned, dangers stay, and the market’s response will hinge on the specifics of the tariff announcement, leaving buyers ready for additional readability on the financial panorama.