The DeFi house is clearly at an fascinating level.

On the one hand, DeFi tokens misplaced as much as 95% of their worth in the course of the present market cooldown, NFTs and Metaverse have taken the highlight and DeFi 2.0 misplaced its preliminary momentum. There have been additionally quite a lot of exploits, regulatory uncertainties, an unprecedented cult of people and a few questionable hires.

Alternatively, established protocols have been working like a allure supporting quite a lot of day after day operations. DeFi on Layer 2 is simply getting began. Multichain DeFi and DeFi on different chains are additionally going by way of a fast progress part.

With all of those, is it doable that the worst is behind us and we're on the brink of a DeFi Renaissance? You’ll discover solutions to this query and extra on this article.

Previous

Because the starting of 2021, the market hasn’t been sort to DeFi.

Regardless of the wonderful improvements and rising complete worth locked throughout DeFi protocols the costs of DeFi tokens didn’t mirror this.

Even when the DeFi tokens appreciated in worth, along with the general market, most often they nonetheless underperformed ETH.

The eye was targeted on different issues: NFTs, memecoins, Metaverse, various L1s – and NFTs once more.

DeFi 2.0 introduced a little bit of hope however finally resulted in a market overexuberance and a painful worth correction.

Ethereum Layer 2 scaling didn’t arrive as rapidly as most individuals anticipated which created a terrific alternative for different chains. The benefit of deploying to different EVM-compatible layer 1s resulted within the creation of a large number of forks of well-known DeFi protocols reminiscent of Uniswap or Aave.

Olympus turned most likely probably the most forked protocol of all of them, fuelling seemingly endless ponzi-games throughout all doable EVM-compatible chains.

The unprecedented cult of people didn’t assist both. Possibly, simply possibly, within the house the place anonymously written items of code can course of billions of {dollars} price of transactions, we shouldn’t pay a lot consideration to people and give attention to what is absolutely necessary: code and communities.

It’s been proven time and time once more {that a} cult of a person can disperse as rapidly as it may possibly rise.

There have been additionally quite a lot of discussions round morality in DeFi. Ought to a convicted felony concerned in fraud be allowed to anonymously work on a protocol with out different individuals figuring out about it?

This query may not be as simple to reply as we might imagine. For some individuals, particularly these coming from conventional finance that will be one thing unacceptable. For others, being a superb contributor to the ecosystem is what issues they usually consider that individuals needs to be allowed to recuperate.

One factor is evident, nobody engaged on a DeFi protocol ought to be capable to single-handedly entry individuals’s cash – regardless of who they're.

The previous hasn’t been nice on the hacks and exploits aspect both. Poly Community, Compound, Cream Finance, Badger to call just some.

Rug pulls haven’t slowed down both with a whole lot of forks created for the only real objective of stealing cash from the customers.

The Wormhole bug alone resulted in a $326m loss that was fortuitously lined by one of many largest contributors within the Solana ecosystem – Soar.

The general hacks and exploits from the start of 2021 complete at roughly $2b.

There have been additionally fairly a couple of very shut calls.

A bug in Sushi found by DeFi researcher and white hacker Sam Solar may’ve doubtlessly resulted in a humongous lack of as much as $350m. Kudos to Sam Solar for disclosing the bug in an expert and well timed method.

Unclear laws round DeFi and crypto as a complete was one other extensively mentioned matter that resulted in quite a lot of uncertainty for customers, traders and founders.

Nations banning and unbanning crypto, powerful legal guidelines making an attempt to suit DeFi into the present monetary guidelines being voted on and rather more.

Though regulatory uncertainty continues to be not completely behind us, different beforehand talked about issues could be thought-about as relics of the previous and positively one thing to be taught from.

Now, let’s discuss in regards to the present state of DeFi.

Current

Based on DeFi Llama, the whole worth locked in DeFi is hovering at round $215b. That is barely down from $255b on the finish of 2021 however nonetheless stays excessive.

With regards to decentralized exchanges, the month-to-month buying and selling quantity has been at round $50-60b. That is down from over $100b on the finish of 2021.

Regardless of a couple of new entrants into the AMM house, Uniswap market share stays extraordinarily excessive at round 75% of the general quantity.

With regards to lending, liquidity on Aave throughout 7 completely different networks is hovering at round $20b on the time of writing this text. That is down from $31b on the finish of 2021 over fewer networks.

Though, on the floor, it could seem like DeFi has stagnated for some time. In actuality, this will’t be farther from the reality.

Main DeFi metrics like complete worth locked throughout all DeFi protocols or quantity on decentralized exchanges don’t present us the entire image as they're at all times correlated to the present market situations.

We now have to look a bit nearer beneath the hood to know what's being constructed when nobody is watching. And how much impression it may possibly have sooner or later.

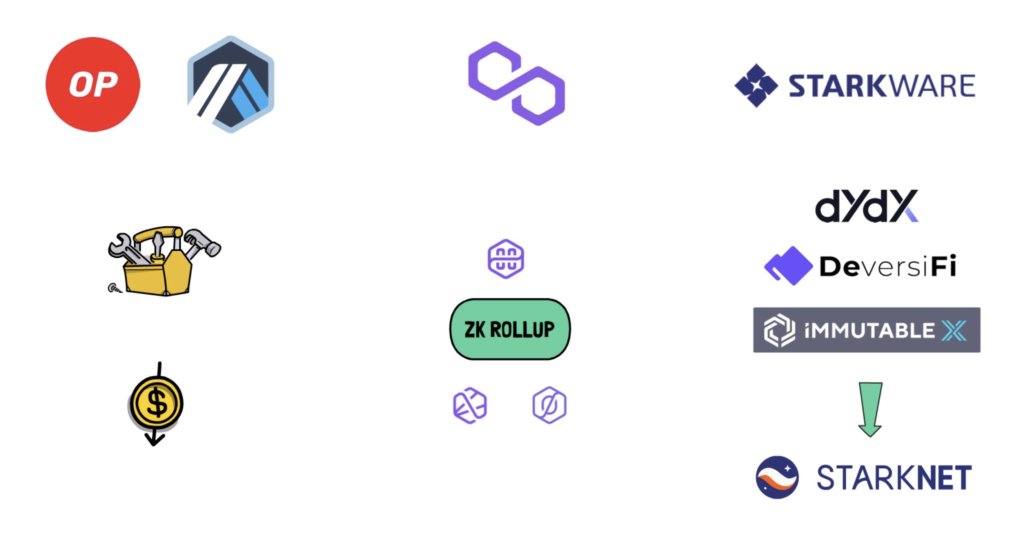

Layer 2 scaling is clearly one of many huge developments and may dramatically enhance the adoption of DeFi by decreasing the fee and growing the pace of transactions.

Optimism and Arbitrum are bettering their code making them cheaper and cheaper to make use of.

Polygon has acquired quite a lot of scaling options together with ZK rollup tech like Hermez, Dusk and Maiden.

StarkWare, after efficiently scaling single-purpose protocols like DyDx, DeversiFi and Immutable X, is engaged on a extra generalised ZK rollup known as StarkNet.

Within the meantime, different chains should not slowing down both.

DeFi on Avalanche, Fantom, Solana, Terra and others can also be going by way of a fast progress part.

Though for the time being, DeFi protocols on these chains, particularly the EVM-compatible ones, are largely forks of protocols constructed initially on Ethereum, there are additionally quite a lot of new issues being tried and constructed.

Regardless of some preliminary criticism, we are able to see the multichain thesis enjoying out and coming to fruition.

Within the seek for yield in DeFi, customers are eager to bridge their property into different chains.

All of it seems fairly thrilling, however we have to do not forget that bridges are inherently problematic. Transaction on 2 completely different chains guarded by completely different consensus mechanisms can't be simply executed as 1 atomic operation, so it requires both trusting extra centralized bridges or counting on networks of relayers as a substitute of the particular consensus of the two chains we're bridging in between.

Bridging to Layer 2 scaling options like Optimistic or ZK rollups is a little more safe as most L2s have escape hatch mechanisms that permit withdrawing funds straight from L1 Ethereum if one thing goes mistaken.

Tasks specializing in multichain, like Cosmos and Polkadot, is also fascinating options because the bridging transactions are normally secured by 1 consensus mechanism, however it doesn’t resolve the issue when leaping between 2 completely different L1s.

With regards to DeFi 2.0, regardless of the market overexuberance, sure mechanisms of this paradigm shift, largely round incentivising liquidity, might prevail.

Protocols like Tokemak are sustaining a robust TVL of over $1b and introducing new helpful options to the general DeFi ecosystem.

It stays to be seen if different DeFi 2.0 protocols like Olympus will be capable to shine once more and are available again to their unique energy.

In the meanwhile, the market cap of the Olympus token OHM is basically backstopped by its underlying protocol-controlled worth of the treasury, so to a sure extent, it really works as anticipated within the worst-case situation.

The extra established protocols haven’t rested on their laurels both.

Aave has not too long ago launched model 3 of their protocol that introduces higher capital effectivity and improves threat administration.

Bancor has additionally introduced model 3 of their protocol that reduces the price of buying and selling, permits for limitless deposits and supplies on the spot impermanent loss safety.

Thorchain has recovered from its hack and not too long ago launched artificial property aiming at growing community utilization, community TVL and pool depth. It additionally permits for cheaper swaps and better earnings for liquidity suppliers.

MakerDAO is discussing a brand new, aggressive progress technique that would come with issues like increasing into extra real-world property.

Sushi is engaged on Trident – a framework for creating AMMs and Shoyu 2.0 – an NFT market.

Curve, which is fuelling most of secure asset swaps in DeFi, just isn't slowing down both. Its tokenomics mannequin incentivises quite a lot of different gamers to compete for the CRV yield. The method, because of its competitiveness, has been known as “Curve Wars”.

The CRV mannequin turned so widespread that it's being copied by quite a lot of different protocols within the ecosystem.

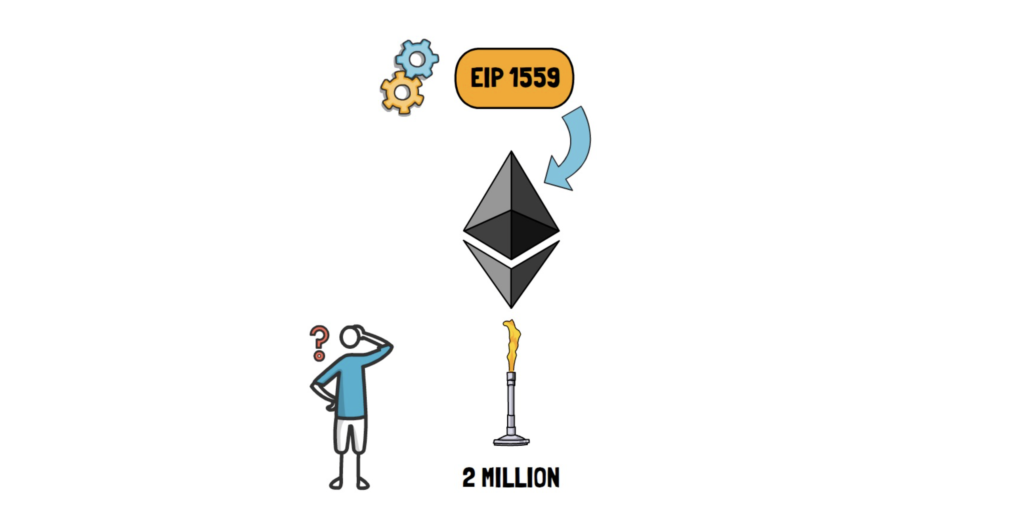

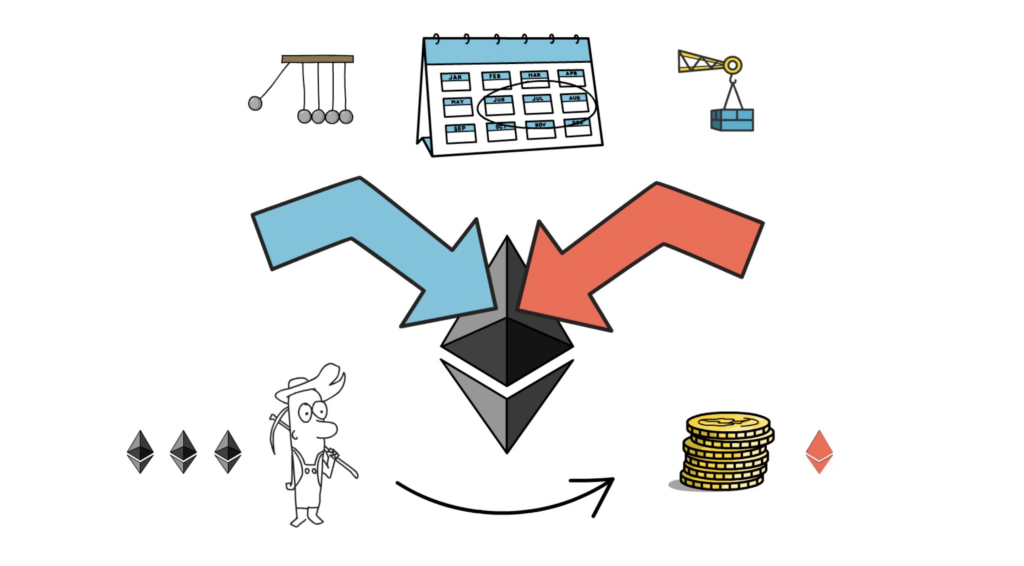

With regards to Ethereum itself, EIP1559, regardless of the preliminary worries, has been working like a allure and burning ETH each day. We now have not too long ago crossed 2m of ETH burnt because the change was deployed.

There has additionally been a giant rise in liquid staking. Lido, the dominant participant on this class, has over $8.5b of ETH staked. Additionally they assist staking on different chains and their Luna staking grew to an astonishing $7.5b.

Rocket Pool, which selected a more durable path and determined to begin in a extra decentralized state, can also be displaying wonderful progress with virtually $0.5b of ETH staked.

Though not precisely DeFi per se, NFTs, Metaverse and crypto social media, together with the Lens protocol launched by the Aave group, have been a sizzling matter of dialogue.

This could carry extra individuals into the crypto house and permit them to additionally uncover DeFi.

On high of all of this, it’s price mentioning that even throughout a market cooldown when customers are much less vulnerable to spend money on new tasks, enterprise capital doesn't sleep and pours billions of {dollars} into the DeFi ecosystem and crypto as a complete.

This supplies early tasks with sufficient capital to give attention to constructing as a substitute of desirous about learn how to survive till the subsequent bull market.

As we are able to see, regardless of the market downturn, the DeFi ecosystem is flourishing and this gained’t cease right here – let’s have a fast look into the longer term.

Future

One of many extensively mentioned occasions that's coming nearer and nearer is the Ethereum Merge.

The Merge will transition Ethereum from Proof-Of-Work to Proof-Of-Stake and dramatically cut back the ETH issuance fee which can probably trigger ETH to grow to be deflationary.

The Merge is at present estimated to reach between June and August this 12 months, however this, in fact, will depend on additional testing. That is one among, if not the most important adjustments to the Ethereum protocol, so it can't be rushed.

The Merge drives one of many present narratives for Ethereum and should consequence within the subsequent bull marketplace for ETH and DeFi.

There are additionally quite a lot of different enhancements in Ethereum’s pipeline.

EIP 4488, for instance, can drive down transaction prices for rollups by decreasing the fuel price of calldata.

L2s are one other catalyst that may end up in customers rediscovering DeFi.

Not solely will DeFi be cheaper and sooner than ever, it can additionally allow new DeFi protocols that have been beforehand not doable to implement on Ethereum itself.

Most L2s even have a secret weapon. They will at all times launch a token and rapidly incentivise progress. I wouldn’t be stunned to see some inflection factors that may trigger all main L2s to launch tokens one after the other in a really quick time period.

There are quite a lot of groups engaged on L2 scaling, however one of many extremely anticipated occasions is the complete launch of StarkNet which can present a general-purpose ZK rollup.

NFTs, Metaverse and DAOs also can gas DeFi, which may grow to be the spine of those nascent ecosystems.

Tokenising NFTs and buying and selling them on an AMM – That is DeFi.

Creating escrow contracts to trade tokens between DAOs – DeFi.

Buying and selling parcels of land within the Metaverse? – Additionally, DeFi.

Even NFT marketplaces could be thought-about as decentralized finance.

One other phase of the DeFi market which will expertise fast progress are indexes.

In conventional finance, indexes, reminiscent of S&P500 and FTSE100, went by way of an enormous cycle of progress and have become an enormous a part of the general market. This hasn’t been absolutely leveraged in DeFi but.

I wouldn’t be stunned to see increasingly more give attention to indexes in DeFi, particularly because the nature of sensible contracts permits for simply creating a variety of indexes, from DeFi blue chips to Metaverse, to NFTs. It additionally permits for automating rebalances of those indexes.

Index Coop with its DeFi, Metaverse and different indexes is without doubt one of the outstanding tasks on this class.

One factor that we'd like sooner fairly than later is clarification round legal guidelines and taxes in DeFi. The present unclear guidelines stifle innovation and create an adversarial atmosphere for DeFi founders and customers.

We can't permit this house to grow to be a bedrock for monetary surveillance and unfair remedy so frequent in conventional finance.

Ultimately, I consider that the majority liquidity will transfer on-chain and DeFi will entice most banks, hedge funds, different monetary corporations and possibly even entire nations.

Though there shall be a protracted tail of chains every with a functioning DeFi ecosystem, naturally, the liquidity will focus round a handful of chains.

With regards to the market, it’s laborious to say what's going to occur to the worth quick to medium time period, however I wouldn’t be stunned to see DeFi tokens having one other resurgence when the world wakes up to what's being constructed right here.

Abstract

The Decentralized Finance house, regardless of the present market cooldown, retains evolving with astonishing pace. When the eye strikes away from costs, the long-term builders preserve delivering worth and preserve arising with recent concepts that later fertilise the subsequent market cycle.

Throughout these seemingly quiet durations, it’s extraordinarily necessary to remain updated with the most recent tendencies to profit probably the most when the eye finally comes again to DeFi.

Luckily, whether or not it’s MEV, Bridges or one thing we haven’t but found, Finematics shall be right here, overlaying all of those fascinating matters in future movies and articles.

So what do you consider the present state of DeFi? What are a few of your predictions for 2022 and past?

For those who loved studying this text you too can try Finematics on Youtube and Twitter.