Dogecoin (DOGE) could possibly be on the cusp of a major worth transfer which may ignite a robust quick squeeze, in accordance with analyst Ali Martinez (@ali_charts). He pointed out on January 27, by way of X, that “$766.45 million in brief positions shall be liquidated if Dogecoin DOGE rebounds to $0.35,” implying that bearish merchants stand on precariously skinny ice.

Huge Dogecoin Brief Squeeze Incoming?

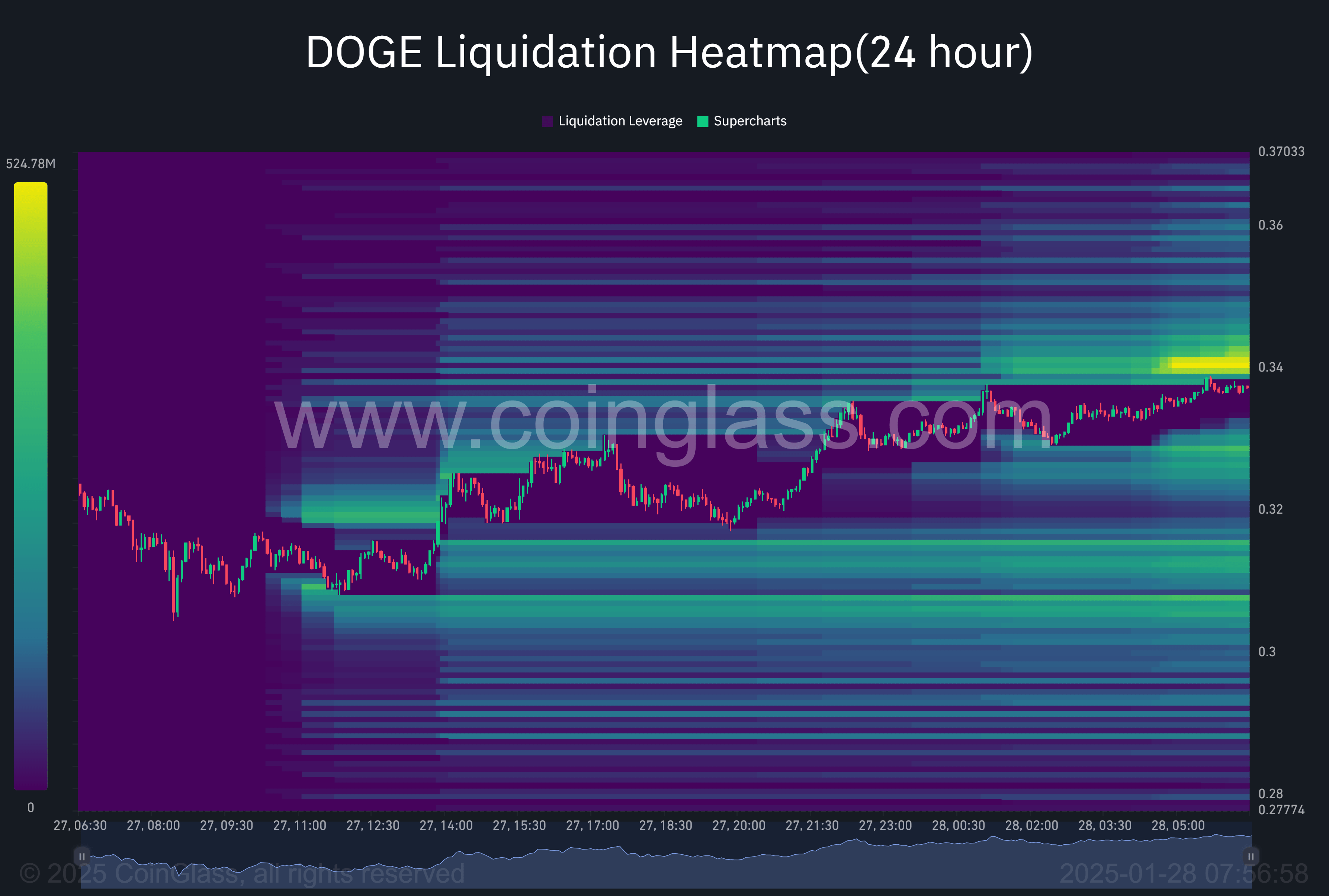

A have a look at the up-to-date liquidation heatmap from Coinglass reveals hefty quick positions clustered between roughly $0.339755 and $0.34368. Coinglass knowledge reveals $464.8 million at $0.339755, $534.79 million at $0.34054, $503.97 million at $0.341325, $433.04 million at $0.34211, and $325.29 million at $0.34368, bringing the whole to round $2.26 billion in potential pressured liquidations.

That determine underscores the magnitude of a attainable short squeeze ought to DOGE climb above that tight vary. Coinglass describes its heatmap as a method “to foretell the place liquidation ranges are more likely to provoke,” and has additionally underscored that “liquidations play a vital function within the cryptocurrency market” as a result of they will affect fast worth swings when merchants with massive leveraged positions are pressured to shut out.

Associated Studying

Coinglass emphasizes the worth of understanding “excessive liquidity areas,” since they will function magnet zones the place large gamers, generally known as whales, seize the chance to execute sizable trades. Merchants usually bounce on liquidation clusters at advantageous costs, which then paves the best way for sharp reversals. Within the case of Dogecoin, that magnet zone is now sitting slightly below $0.35.

Martinez’s evaluation of DOGE aligns with the broader technical image, which suggests the token could also be at a make-or-break juncture. Since December 8, when Dogecoin briefly surged to $0.4834, the value motion has been outlined by a descending trendline. Though DOGE broke above this line on January 15, 2025—indicating a possible bullish shift—broader market volatility on January 26 rapidly dragged it again under.

The result’s a situation during which the descending line, now round $0.335 to $0.34, stands as a formidable barrier. A profitable breach of that zone could possibly be pivotal, particularly given the sheer focus of shorts that Coinglass has recognized simply above it. Ought to DOGE rally sufficient to pierce that stage, merchants holding quick positions could also be pressured to cowl rapidly, and that wave of shopping for strain can quickly speed up an upward transfer.

Associated Studying

In the meantime, DOGE stays above the essential 0.382 Fibonacci retracement close to $0.313, a help stage that prevented additional draw back through the newest market sell-off. The following technical help lies deeper on the chart, close to $0.212 (0.236 Fibonacci retracement), the place merchants shall be watching intently for any signal of weakening momentum.

On the upside, the 0.5 retracement at $0.394 stays a key pivot. A sustained restoration above that threshold may spark larger bullish confidence, with potential resistance rising once more across the 0.476 to 0.592 area if Dogecoin can regain sufficient power.

Featured picture created with DALL.E, chart from TradingView.com