Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

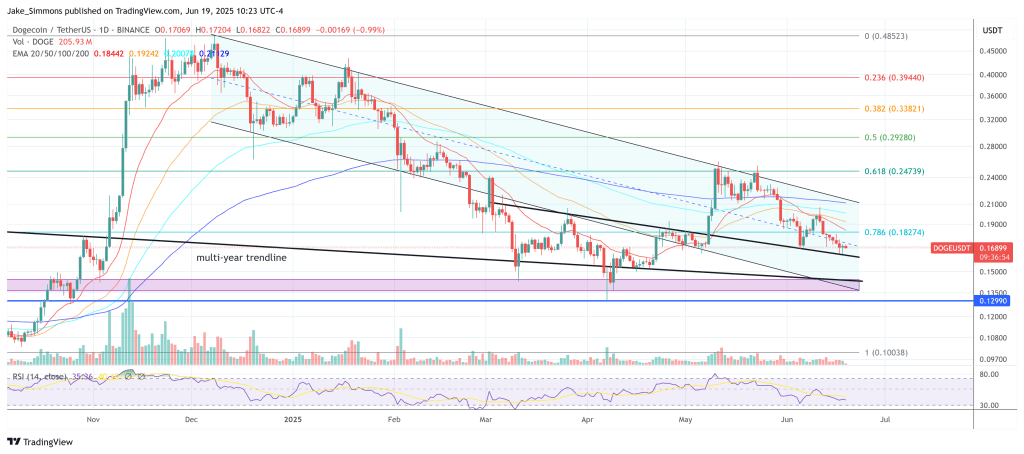

Dogecoin’s day by day chart, revealed by the pseudonymous dealer Cantonese Cat on X Wednesday, hints that the meme-coin could also be stirring after a months-long down-draft. At 02:26 UTC the TradingView snapshot captured DOGE altering fingers at $0.16979, fractionally decrease on the session, whereas the 14-period relative-strength index sat at 35.72, simply north of classical oversold territory.

Dogecoin Prints Bullish Divergence

Essentially the most hanging characteristic of the graphic is a sequence of standard bullish divergences—worth units progressively decrease lows even because the RSI traces increased troughs. Cantonese Cat illustrates three such inflection factors: the primary in August 2024, the second in March and April 2025 and the newest in mid-June.

Traditionally, the primary sign preceded the parabolic autumn rally that vaulted DOGE from the high-$0.05 space to an intraday peak simply shy of $0.23, a virtually 300% advance. The March divergence ushered in a one hundred pc rebound again to the $0.26 zone, a former assist now performing as overhead resistance.

Associated Studying

“DOGE day by day – Bullish divergence with RSI,” Cantonese Cat wrote in his publish, letting the annotated arrows communicate louder than prose. A schematic inserted on the right-hand facet of the chart underlines the textbook definition: within the highlighted quadrant, worth slopes downward whereas momentum slopes upward, a configuration typically interpreted as consumers quietly absorbing provide.

Descending Channel And Key Assist Line

The present structural context lends weight to the sign. Since topping out in November above $0.48, worth is retracing inside a descending channel. Inside that broader channel, Dogecoin is now retesting a former down-sloping resistance line—which supplied stiff resistance all through March and April this yr—that it lastly broke in early Could and is now performing as essential assist close to $0.163.

Just under this back-test sits the multi-year ascending trendline which now sits near $0.142. Ought to each of these ranges falter, the true decrease boundary of the descending channel waits a fraction decrease round $0.139, giving bulls solely a slender buffer of roughly three cents to defend.

Associated Studying

From a Fibonacci perspective, the 0.786 retracement at $0.1826—coupled with the 20- and 50-day exponential transferring averages in addition to the channel midline at $0.172—types the primary ceiling that should be cleared to shift near-term momentum. A breakout above that space would expose the 0.618 degree at $0.247 and the 100-day EMA. Successive hurdles then stack on the 0.5 retracement ($0.292), the 0.382 ($0.338), and the 0.236 ($0.3939), every similar to prior congestion zones through the winter advance.

Quantity has begun to taper as worth approaches assist, whereas the 14-period RSI stays anchored within the mid-30s—nonetheless technically oversold, however displaying a slight uptick that mirrors the bullish divergence Cantonese Cat flagged. For bears, a decisive day by day shut beneath the multi-year trendline would invalidate that divergence setup and sure drive DOGE towards the horizontal liquidity band between $0.135 and $0.13, with a final capitulation goal round $0.10—website of final October’s base.

Featured picture created with DALL.E, chart from TradingView.com