- Endaoment bought 3690 Ethereum tokens price $12.47 million.

- ETH continues to consolidate whereas market indicators recommend a possible breakout.

Since hitting $4,109, two weeks in the past, Ethereum [ETH] has struggled to keep up an uptrend. Over this era, the altcoin has traded inside a consolidation vary.

These market situations have been largely related to elevated promoting stress from varied entities and people.

Endaoment sells 3,690 ETH for $12.47M

In keeping with SpotOnChain, Ethereum’s giant holders have been actively promoting. One of many newest entities to promote its holdings is Endaoment a charity fund on Ethereum.

Primarily based on Spotonchain’s statement, Endaoment has bought 3,690 ETH tokens price $12.47 million. That is the primary transaction from this entity in 10 months and its largest ever.

Notably, a big sale by a big holder like Endaoment might elevate considerations about promoting stress and doubtlessly bearish sentiment within the quick time period. Nonetheless, the truth that the sale is for a charitable trigger would possibly mitigate unfavorable perceptions, because it’s not speculative promoting from a dealer.

Affect on ETH value charts

Regardless of elevated promoting from giant holders, Ethereum has continued to carry sturdy inside the consolidation vary between $3,500 and $3,300.

On the time of writing, ETH was buying and selling at $3,429, marking a average enhance of 0.21% on each day charts and an extension of this bullish development by 2.45% on weekly charts.

These good points point out that Ethereum bulls try to retake the market and push costs increased, whereas bears are nonetheless making an attempt to decrease costs.

In keeping with AMBCrypto’s evaluation, the Ethereum market stays optimistic, and buyers are nonetheless hoping for a value restoration.

This market sentiment is evidenced by a rising RSI and MACD. The Relative Power Index (RSI) made a bullish crossover 2 days in the past, signaling a surge in shopping for stress as consumers begin to dominate. The RSI has risen to 47 at press time, up from 42.

Equally, the MACD line is nearing a bullish crossover, additional confirming the strengthening momentum to the upside.

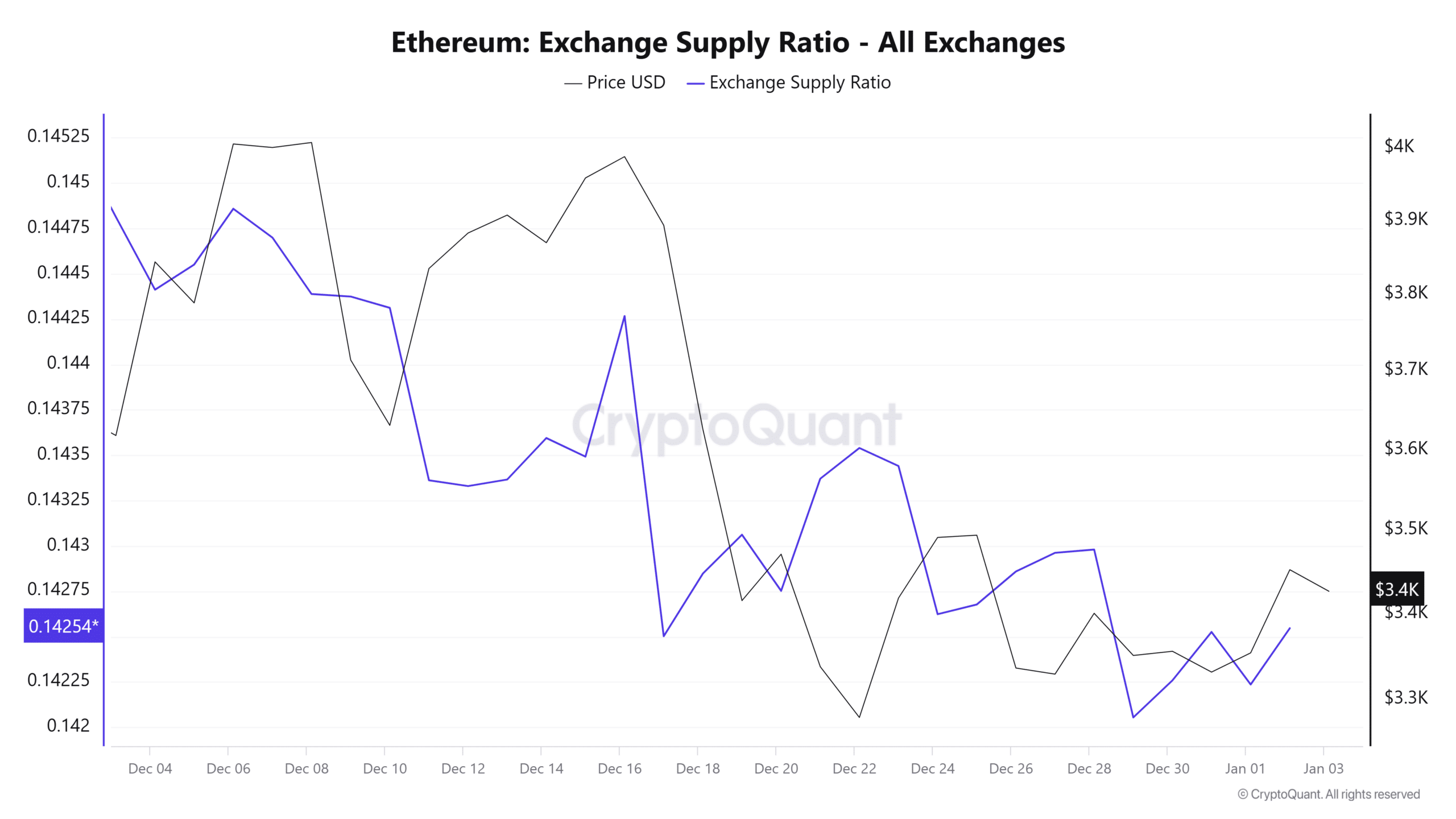

Wanting additional, Ethereum’s Change Provide Ratio has been declining over the previous month. This means that ETH outflow from exchanges has outweighed influx.

Thus reflecting optimism as extra buyers are accumulating than these promoting.

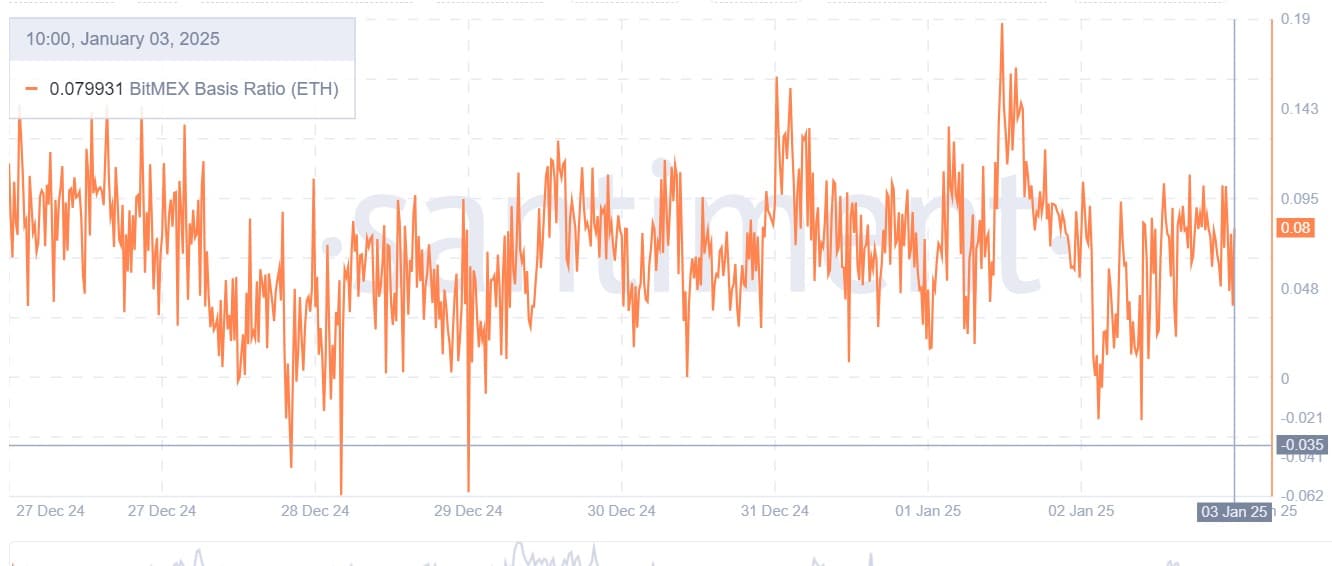

Lastly, Ethereum’s Bitmex Foundation Ratio has remained constructive because the begin of the 12 months.

A constructive foundation ratio means that merchants within the futures market are keen to pay a premium for his or her contracts. This displays market optimism as they anticipate costs to extend.

What subsequent for Ethereum?

In conclusion, Ethereum appears caught inside a consolidation vary as bulls and bears battle for market management. Subsequently, whereas sellers like Endaoment are lively, consumers too are actively accumulating.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

If these market situations proceed, Ethereum will proceed buying and selling between $3300 and $3500.

Nonetheless, if bulls regain management, ETH will get away of $3500 and discover the subsequent important resistance round $3700. Consequently, if sellers dominate, the altcoin will drop to $3305.