- A symmetrical triangle and ascending trendline trace at an upcoming bullish rebound for Ethereum.

- Ethereum’s leverage ratio and open curiosity present key tendencies that might affect worth actions quickly.

Ethereum [ETH] has been mirroring the general market dynamics carefully, experiencing a notable bounce in worth lately.

Following Bitcoin’s [BTC] actions, Ethereum is steadily recovering from a week-long dip that noticed the asset decline by 7.2%, bringing its worth under the $2,400 mark.

On the time of writing, ETH has managed to reclaim some floor, buying and selling at $2,451 with a modest achieve of 1.1% over the previous 24 hours.

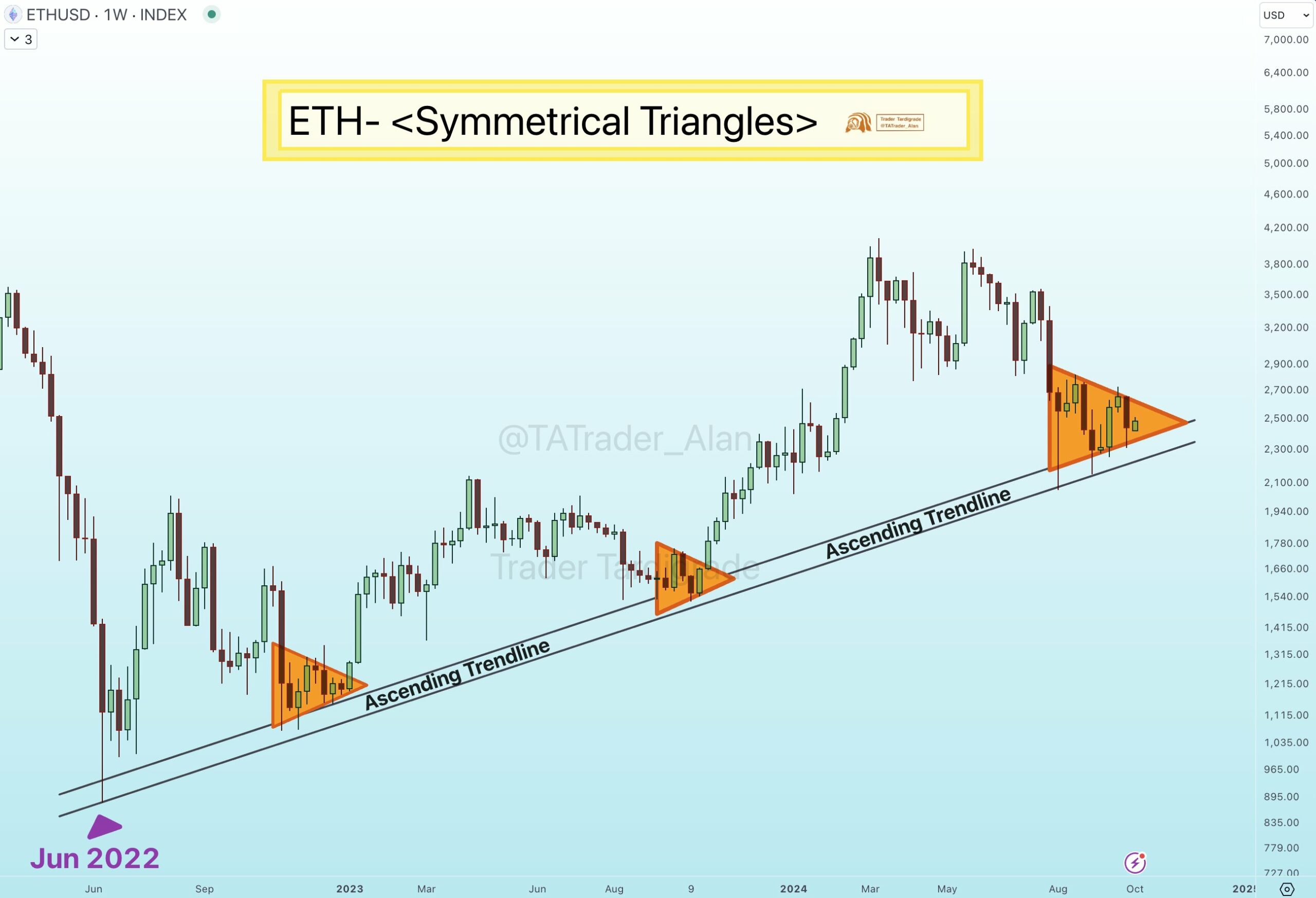

Amidst this worth restoration, a well known crypto analyst going by the title Dealer Tardigrade lately shared insights on Ethereum’s worth chart.

The analyst identified that ETH has been tracing an ascending trendline since June 2022, exhibiting a constant sample.

Ethereum to rebound quickly?

Based on the analyst, each time Ethereum neared this trendline, the value motion fashioned what’s often known as a Symmetrical Triangle sample earlier than bouncing upwards.

The present market exercise reveals the formation of one other Symmetrical Triangle simply above this trendline, hinting at the opportunity of an imminent rebound for Ethereum.

Tardigrade’s evaluation means that ETH is approaching a vital assist zone, with this triangle formation doubtlessly offering the momentum wanted for an upward breakout within the coming days.

In technical evaluation, an Ascending Trendline is a straight line drawn to attach not less than two or extra worth lows.

It signifies an upward motion, the place every low is increased than the earlier one, suggesting bullish market momentum over time.

A Symmetrical Triangle, alternatively, is a chart sample characterised by converging trendlines, indicating a interval of consolidation earlier than a breakout.

This sample sometimes kinds when the market is indecisive, however a breakout in both path usually follows as soon as the consolidation section ends.

The repeated look of those symmetrical triangles in Ethereum’s worth chart, coupled with its positioning above the ascending trendline, implies a possible bullish breakout is on the horizon.

ETH’s basic outlook

Past the technical indicators, Ethereum’s basic metrics additionally supply worthwhile insights into its potential trajectory.

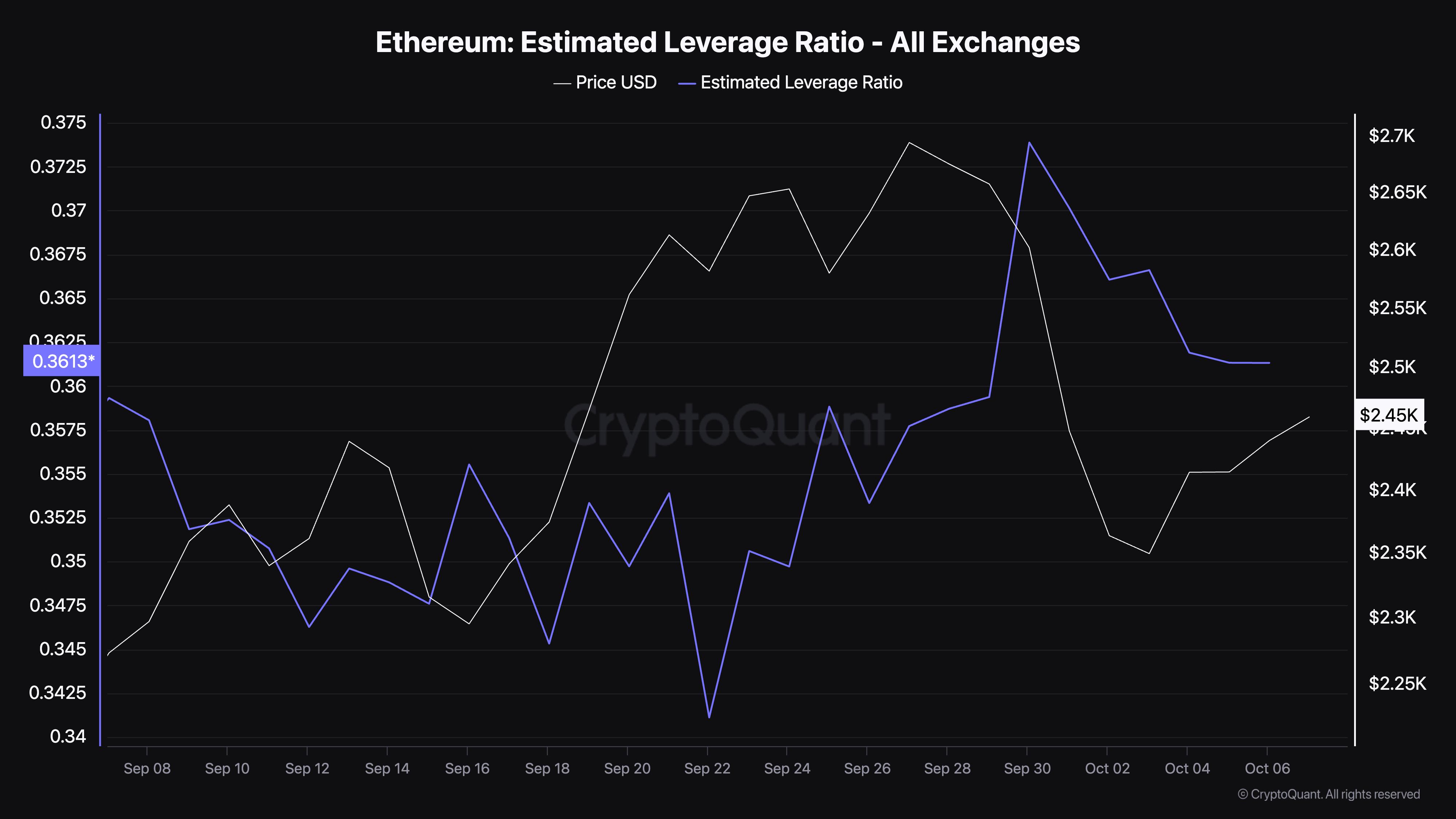

Based on data from CryptoQuant, the estimated leverage ratio of Ethereum has been on the rise over the previous month, with the determine at the moment standing at 0.361.

This ratio represented the quantity of leverage merchants are utilizing, calculated as Open Curiosity divided by change reserves.

A rise on this ratio implies that extra leverage is being utilized, usually signifying increased expectations for worth volatility.

Whereas this may result in increased beneficial properties if the value strikes within the anticipated path, it additionally will increase the danger of liquidation if the value shifts unfavorably.

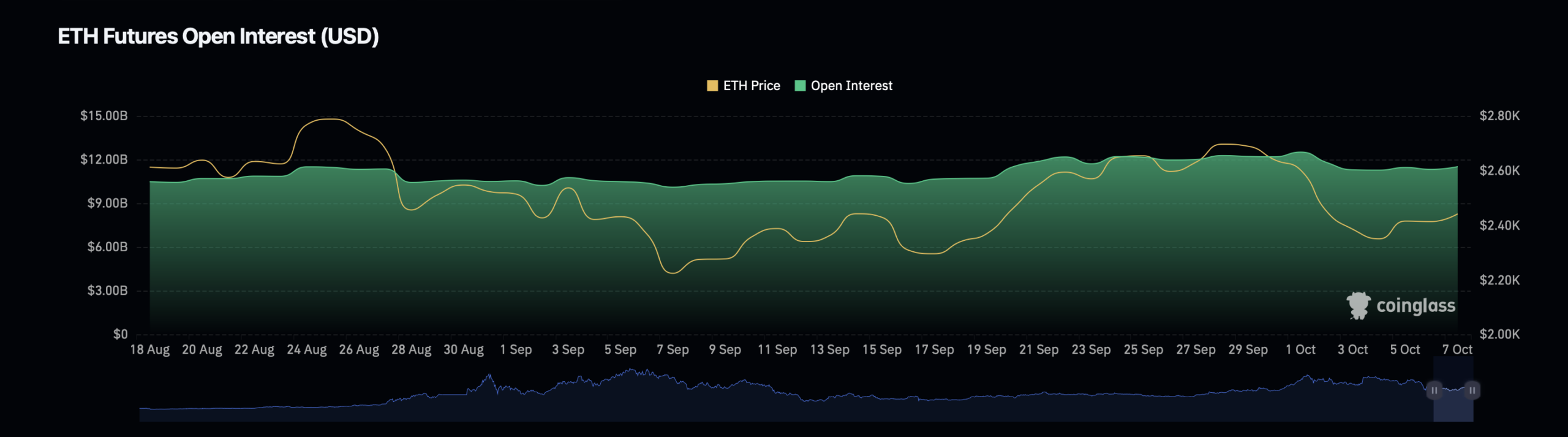

To additional assess Ethereum’s market well being, a glance into its open curiosity reveals combined indicators.

Open Curiosity, which represents the overall variety of lively by-product contracts, has skilled a slight decline of 0.21%, standing at a valuation of $11.38 billion based on Coinglass.

Nevertheless, Ethereum’s Open Curiosity quantity has surged by a powerful 120%, now valued at $18.38 billion.

This divergence means that whereas the variety of open contracts has decreased, the buying and selling quantity and exercise surrounding these contracts have intensified considerably.

The decline in Open Curiosity might level to a section of lowered speculative exercise, usually occurring when merchants shut their positions to keep away from elevated market uncertainty.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Conversely, the surge in quantity could point out that merchants are actively partaking out there, doubtlessly positioning themselves for Ethereum’s subsequent main worth motion.

This mixture of lowered speculative positions however heightened quantity exercise implies that market contributors are consolidating their positions, seemingly in anticipation of a extra decisive worth motion within the close to future.